The S&P 500 Rises As Index' Dividend Outlook Improves

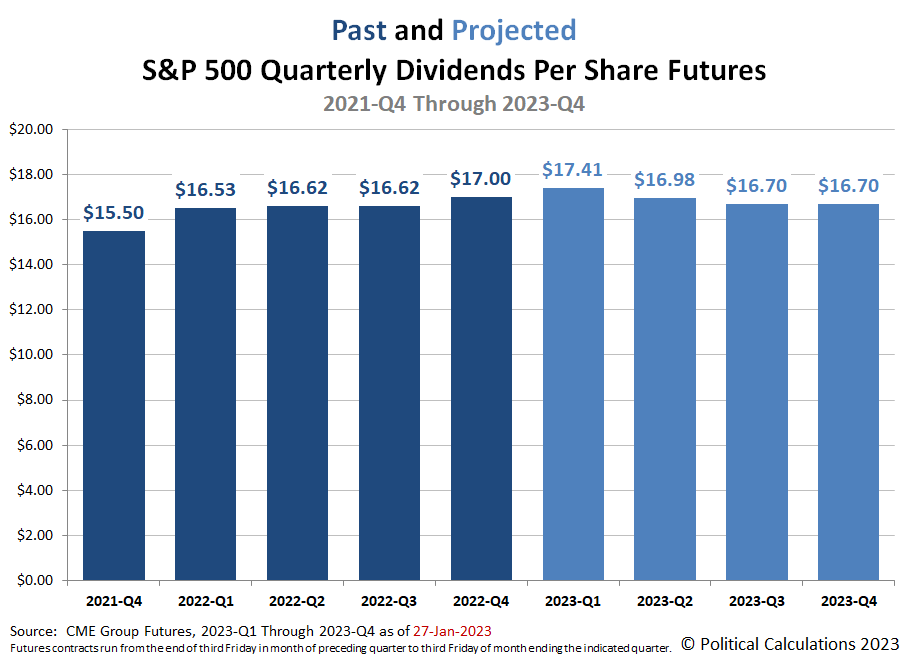

The dividend outlook for the S&P 500 (SPX) in 2023 continued to improve. Combined with recent upward momentum, the index closed at 4,070.56, some 13.5% above its October 12, 2022 bottom, but still 15.1% below its January 3, 2022 record high peak.

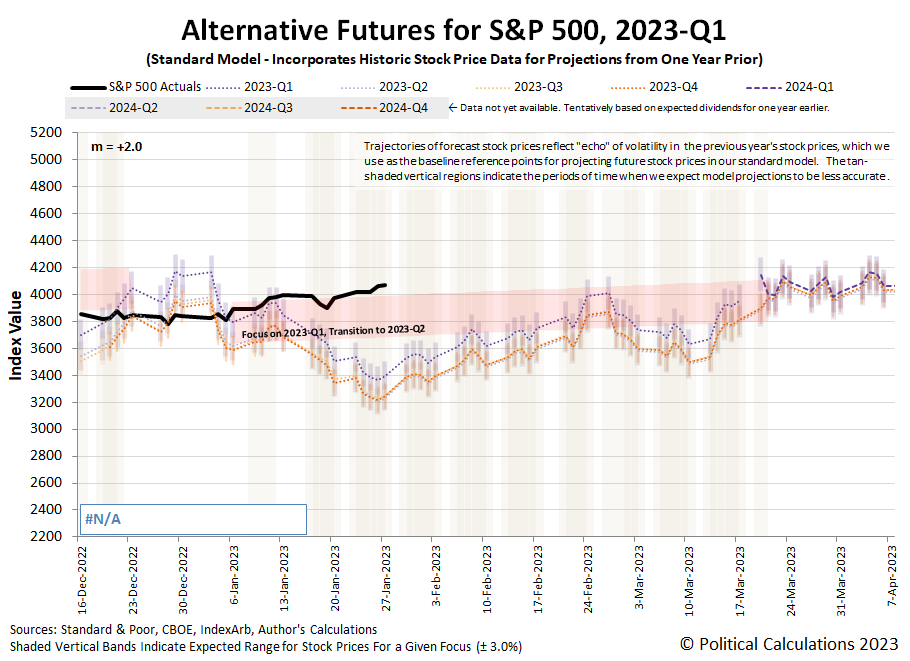

Here's the latest update for the alternative futures chart, which indicates stocks running to the high side of the redzone forecast range. That level is consistent with investors focusing on the current quarter of 2023-Q1 in setting stock prices.

The dividend outlook in 2023 has continued to improve over the last two weeks. Here's the latest from the CME Group's S&P 500's quarterly dividend futures:

Meanwhile, the upcoming Federal Reserve's Open Market Committee meeting this week helps account for why investors are so focused on the current quarter of 2023-Q1, where the market-moving headlines point to expectations of a quarter point rate hike. The Federal Funds Rate is also currently projected to top out on or by the conclusion of the Fed's March 2023 meeting.

The CME Group's FedWatch Tool still projects quarter point rate hikes at both the Fed's upcoming 1 February and 22 March (2023-Q1) meetings, with the latter representing the last for the Fed's series of rate hikes that started back in March 2022. The FedWatch tool then anticipates the Fed will hold the Federal Funds Rate at a target range of 4.75-5.00% through September 2023. After which, developing expectations for a U.S. recession in 2023 have the FedWatch tool projecting a quarter point rate cut in November (2023-Q4).

The Atlanta Fed's GDPNow tool's first projection for real GDP growth in the first quarter of 2023 is +0.7%, which would be a decline from the BEA's first estimate of 2.9% real GDP growth in the fourth quarter of 2022. GDPNow's final projection for real GDP growth in 2022-Q4 was 3.5%. We'll find out in a couple of months how close they got.

More By This Author:

New Home Market Capitalization Crash Continues

The Trillion Dollar Years Of The S&P 500

Are Americans Getting Real Value From Biden's Debt-Fueled Spending?

Disclosure: Materials that are published by Political Calculations can provide visitors with free information and insights regarding the incentives created by the laws and policies described. ...

more