The S&P 500 In The Week Russia Invaded Ukraine

Photo by Max Kukurudziak on Unsplash

When it comes to the U.S. stock market, a geopolitical event like Russia’s invasion of Ukraine isn’t much more than an additional source of noise in the market.

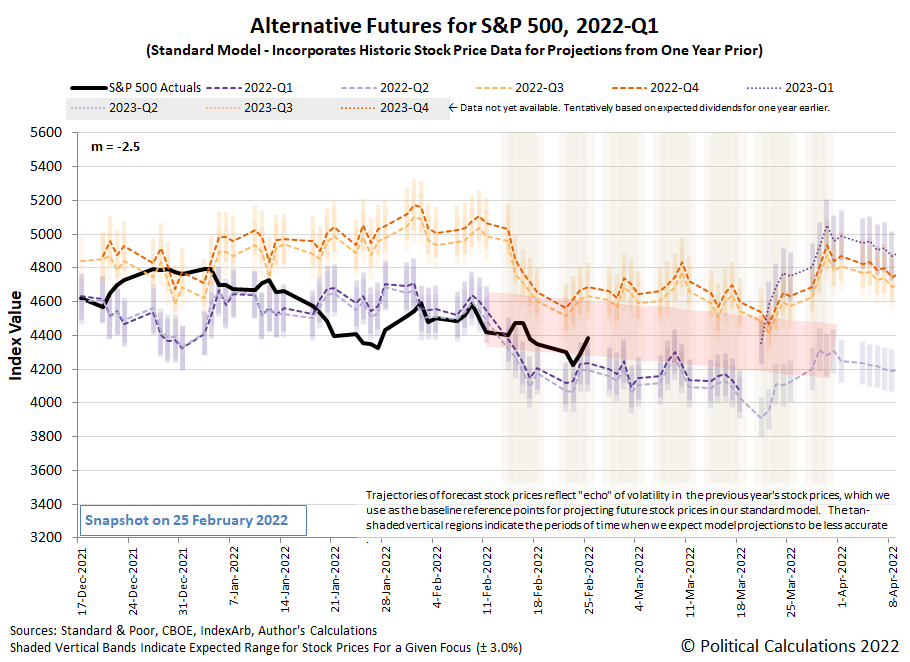

Evidence supporting that assessment can be seen in the latest update to the alternative futures spaghetti forecast chart for the S&P 500. Here, we find that after dipping outside the redzone forecast range we set up several weeks ago as investors initially responded to the Ukraine crisis, that reaction was short lived as the trajectory of the index has since jumped back up toward the middle of the forecast range. Where we would expect it to be in the absence of Russia's invasion of Ukraine.

(Click on image to enlarge)

Using the middle of that forecast range as a counterfactual for how investors would have set the value of the index in the absence of that geopolitical event, we estimate that at the peak of its impact on Wednesday, 23 February 2022, the invasion reduced the value of the index by 5.1% at the market's close.

In terms of its 31 December 2021 market cap, a 5.1% decline represents about $2.2 trillion, so that's a very noticeable amount of noise for a geopolitical event, but it's still noise. By Friday, 25 February 2022, much of that additional noise had dissipated, with the S&P 500 rising to be within 1.3% of its predicted no-invasion level.

Is that an unusual lack of impact for something that has dominated the news cycle since it happened? Not really. This latest example aligns with Barry Ritholtz found when he studied seventy years worth of geopolitical events for how they affected the U.S. stock market. Here's the key takeaway from his analysis:

Most of the time, markets are hardly affected by these sorts of terrible events.

How much noise Russia's invasion of Ukraine ultimately generates will depend on how its risk environment evolves, as events from this past weekend demonstrate. We would describe it as a highly fluid situation presenting a lot of risk, both potential and realized, for investors.

While Russia's invasion of Ukraine was the biggest news item of the trading week that was, other stuff happened too. Here's our summary of market moving headlines from the President Day holiday-shortened trading week. Spoiler alert: the most important news shaping future expectations for U.S. stock market investors during the week came on Thursday, 24 February 2022 and had to do with the Fed's plans for hiking short term interest rates:

Tuesday, 22 February 2022

- Signs and portents for the U.S. economy:

- Putin orders Russian forces to "perform peacekeeping functions" in eastern Ukraine's breakaway regions

- Ukraine war fears shake stocks and send oil soaring

- Full invasion of Ukraine? "Unlikely but who knows!"

- Explainer-How Western sanctions might target Russia

- Germany blocks opening of pipeline as West responds to Russian moves in Ukraine

- Oil hits highest since 2014 on Russia-Ukraine escalation

- OPEC+ compliance with oil output cuts near 130% in January, source says

- U.S. business activity accelerates in February - IHS Markit survey

- U.S. consumer confidence slips, migration to the South fuels house price inflation

- Putin orders Russian forces to "perform peacekeeping functions" in eastern Ukraine's breakaway regions

- Fed minions not sure if they will hike rates by 0.5% in March, plan to hike rates may be affected by Ukraine geopolitics:

- Fed's Bowman: too soon to tell if half percentage point rate hike needed in March

- Fed's Bowman keeping open mind on possible half percentage point rate hike in March

- Vladimir Putin muscles onto central banker agendas

- Three Fed banks voted to increase discount rate in January

- Fed's Bowman: too soon to tell if half percentage point rate hike needed in March

- Bigger trouble developing in the Eurozone:

- After ECB shock, European firms confront higher borrowing costs

- German economy likely to shrink again in Q1: Bundesbank

- German producer prices soar as Bundesbank, BDI warn on economy

- Faster economic growth signs in the Eurozone:

- German economy grows at fastest rate for six months in February -PMI

- Euro zone recovery regained pace in Feb despite soaring prices -PMI

- Bigger stimulus developing in China:

- China plans bigger tax cuts in 2022 to prop up slowing growth

- Banks in nearly 90 Chinese cities cut mortgage rates

- S&P 500 confirms correction; Ukraine-Russia crisis keeps investors on edge

Wednesday, 23 February 2022

- Signs and portents for the U.S. economy:

- U.S. mortgage applications tumble last week - MBA

- With fertilizer costs high and seeds scarce, U.S. farmers turn to soy

- Biden Reverses Nord Stream 2 Pipeline Waiver, Reverts To Trump's Sanction Policy

- Biden's "Milquetoast" Russia Sanctions Defanged After Berlin Says Nord Stream 2 Halt Not Permanent

- Explainer: Western sanctions on banks only scratch surface of Fortress Russia

- Oil steadies as U.S. seen unlikely to sanction Russian exports

- Fed minion says they want at least four rate hikes in 2022:

- Fed's Daly prefers 'at least' four rate hikes in 2022

- NZ central bank hikes interest rates:

- New Zealand raises interest rates, signals more aggressive tightening

- ECB minions thinking about hiking rates to head off inflation:

- ECB could raise rates in summer before ending bond buys: Holzmann

- ECB has space to gradually normalize policy: Vasle

- ECB should keep steady hand in face of shocks

- ECB's de Guindos says asset purchases must end before raising rates

- Wall Street extends selloff on Ukraine worries

Thursday, 24 February 2022

- Signs and portents for the U.S. economy:

- Oil surpasses $100, stocks slump, dollar rises as Russia invades Ukraine

- U.S. crude stockpiles rise, fuel inventories fall -EIA

- U.S. labor market recovery gaining steam; unemployment rolls smallest in 52 years

- U.S. new home sales fall in January as prices march higher

- Biden unveils sanctions on Russian businesses after Ukraine attack

- Explainer-How Western sanctions will target Russia

- Oil surpasses $100, stocks slump, dollar rises as Russia invades Ukraine

- Fed minions working to set expectations of at least four rate hikes in 2022, Ukraine crisis may alter policy path:

- Fed's Bostic open to four or more hikes this year if high inflation persists

- Fed's Daly: balance sheet reduction should be gradual, predictable

- Ukraine crisis may slow, but not stop, Fed hiking

- Fed is closely watching situation in Ukraine, Bostic says

- Fed's Mester says situation in Ukraine will be considered for monetary policy

- Fed's Barkin: Ukraine events not likely to change case for U.S. rate hikes

- ECB minions may use Ukraine crisis to justify continuing policy of keeping stimulus going:

- Ukraine crisis complicates ECB's path to higher rates

- Exclusive-ECB must keep buying bonds to cushion Ukraine fallout, Stournaras says

- How a German state helped Moscow push a pipeline, weakening Ukraine

- Ukraine crisis complicates ECB's path to higher rates

- Nasdaq, S&P 500 gain, hit session highs after Biden comments on Russia

- Once a tail risk, now a real risk, Ukraine deals investors a 'gut check'

Friday, 25 February 2022

- Signs and portents for the U.S. economy:

- U.S. companies grapple with surging costs as supply chain problems persist

- U.S. trade relationship with China "getting more difficult" - USTR

- U.S. consumer spending beats expectations; core capital goods orders surge

- Fed minions starting to worry about wage-price inflation spiral taking hold:

- Fed says labor, wages could drive persistent inflation

- Bigger trouble developing in Russia:

- Analysis-Russia's economic defences likely to crumble over time under sanctions onslaught

- French Finance Minister Le Maire: we want to isolate Russia financially

- Cutting Russia off SWIFT is "very last resort" -France's Le Maire

- Cutting Russia off SWIFT technically difficult - German govt spokesperson

- Explainer-Russian banks face exclusion as EU joins new round of sanctions

- Russian oil exports continue despite payment issues - sources

- India setting up role for itself in geopolitics:

- Exclusive-India plans urea import deal with Iran using rupee payments-sources

- India explores setting up rupee trade accounts with Russia to soften sanctions blow - sources

- Bigger stimlus developing in China:

- China to step up policy support for economy, Xinhua cites politburo

- China urges banks, insurers to support affordable rental housing

- BOJ minions to workshop policy for inflation, start trimming stimulus buys of corporate bonds:

- Japan's central bank plans experts' workshop to scrutinise inflation

- Japan's central bank lowers limits on CP, corporate bond purchases

- ECB minions told Ukraine crisis will shrink Eurozone economy:

- Exclusive-ECB policymakers told Ukraine war may shave 0.3%-0.4% off GDP

- Dow posts biggest gain since Nov 2020 as Wall St rebounds second day

The onset of the Ukraine crisis had very little impact on investor expectations for future rate hikes. The CME Group's FedWatch Tool projects a total of six quarter point rate hikes in 2022, starting in March 2022 (2022-Q1), followed by additional hikes in May 2022 (2022-Q2), June 2022 (2022-Q2), July 2022 (2022-Q3), September 2022 (2022-Q3) and November (2022-Q4). That last rate hike represents the only change from the previous week, as investors had anticipated 2022's final rate hike would occur in December 2022.

Meanwhile, following the release of personal income and spending data, the Atlanta Fed's GDP Now tool reduced its projection of real GDP growth in 2022-Q1 down to 0.6%.

Disclosure: None.