The S&P 500 Continues On Expected Trajectory

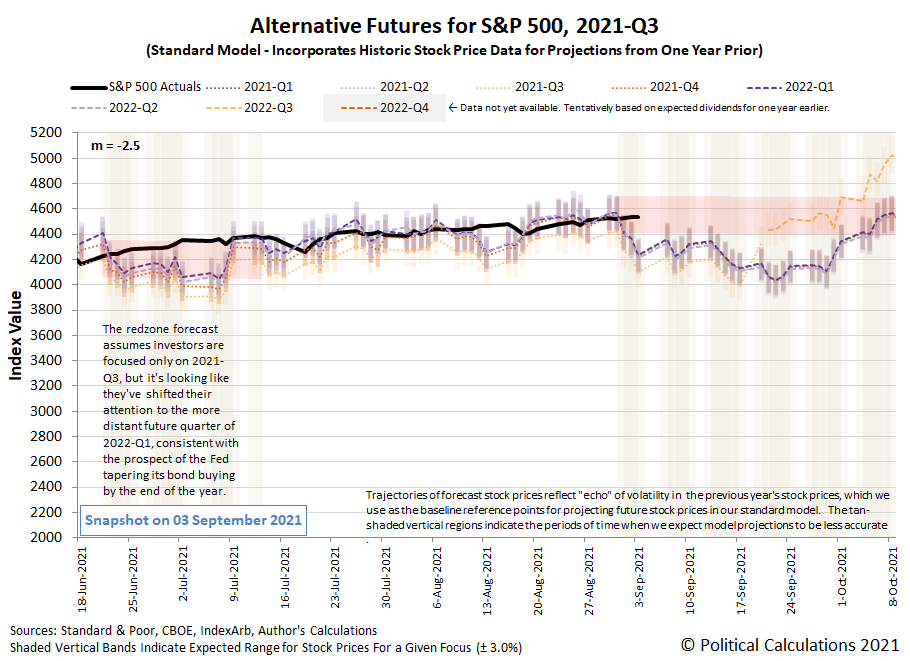

The S&P 500 (Index: SPX) is following its expected trajectory following the Federal Reserve's annual Jackson Hole event. Investors remain focused on the upcoming future quarter of 2021-Q4, which for as long as that holds, suggests a relatively flat, range-bound trajectory for the index.

At least, that's what we're already seeing in the alternative futures spaghetti forecast chart, where we've added a redzone forecast range to project the likely trajectory of the S&P 500 based on that assumption.

(Click on image to enlarge)

We've had to add the latest redzone forecast because of the dividend futures-based model's use of historic stock prices as the base reference points from which its future projections are made. Here, the past volatility of stock prices can skew the model's projections of the future, which we've found we can generally compensate for by bridging across the period we know will be impacted by the echoes of the index' historic volatility.

For the latest redzone forecast, we're bridging a period that continues into early December, making it the longest we've attempted since early early 2019.

Looking backward at the past week, we find little to motivate investors to shift their forward-looking focus to other points of time in the future as the market headed into the long Labor Day holiday weekend.

Disclaimer: Materials that are published by Political Calculations can provide visitors with free information and insights regarding the incentives created by the laws and policies described. ...

more