The S&P 500 Casually Heads Higher

The first week of August 2022 lacked any real fireworks for the S&P 500 (SPX). The index rose 14.90 points (+0.4%) from the previous week to close the week at 4,145.19.

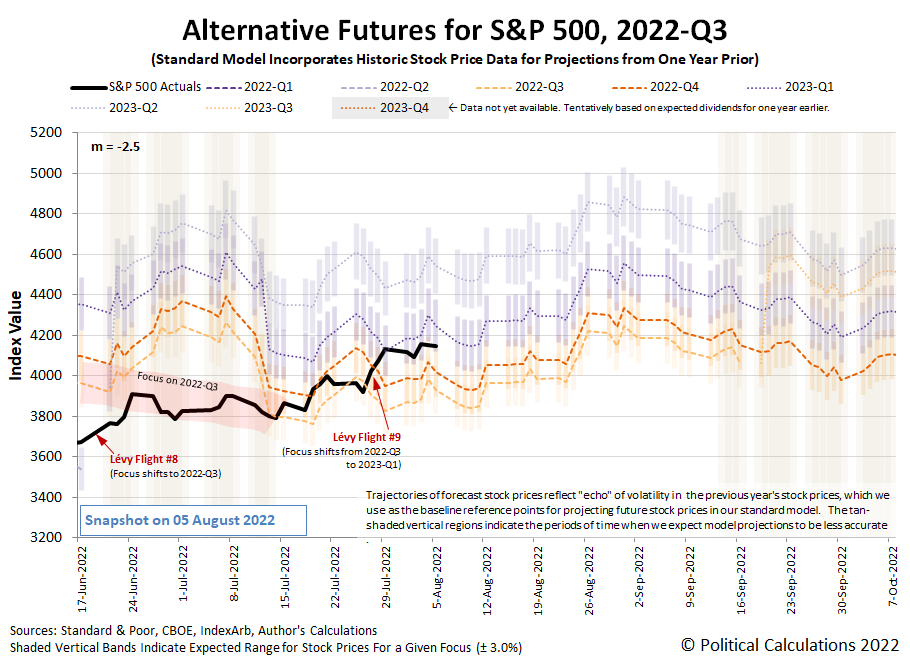

But when tracked against the latest update to the dividend futures-based model's alternative futures chart, we see that investors casually shifted a portion of their forward-looking attention back toward the nearer term future.

The actual trajectory of the index however remained within the range that is consistent with investors focusing most of their attention on 2023-Q1 in setting current day stock prices. Should investors decide to be less casual and more definitively shift their attention to the nearer term future, we would see that change as a significant decline in stock prices. On the plus side, if they shift their attention more fully toward 2023-Q1, stock prices will rise.

In the meantime, we have a split focus situation. What happens next will hinge on where investors set their future time horizon. And that will be driven by the random onset of new information.

The unexpectedly strong July 2022 jobs report reshaped the CME Group's FedWatch Tool projection for September 2022 (2022-Q3), now anticipating a three-quarter point rate hike instead of the half point hike investors expected beforehand. After that, the FedWatch tool foresees two quarter point rate hikes in November and December (2022-Q4), with the Federal Funds Rate topping out in a target range between 3.50% and 3.50%. In 2023, the tool now anticipates the Fed will be forced to begin cutting rates beginning in July (2023-Q3).

Meanwhile, the Atlanta Fed's GDPNow tool's scaled back its forecast for real GDP growth in 2022-Q3 down to 1.4% from last week's projection of 2.1%.

More By This Author:

Highest U.S. Mortgage Rates Since 2008 Sends Demand, New Home Prices PlungingMedian Household Income In June 2022

The Escalating Price Of Wheat

Disclosure: Materials that are published by Political Calculations can provide visitors with free information and insights regarding the incentives created by the laws and policies described. ...

more