The Rally Off Of The November Lows Could Be A Buying Climax

SPX Monitoring purposes; Long SPX on 11/11/16 at 2164.45; sold 11/15/16 at 2080.39 = .74% gain. Monitoring purposes GOLD: Covered on 11/9/19 at 24.59 = gain .07%: Short GDX 11/2/16 at 24.78. Long Term Trend monitor purposes: Short SPX on 1/13/16 at 1890.28

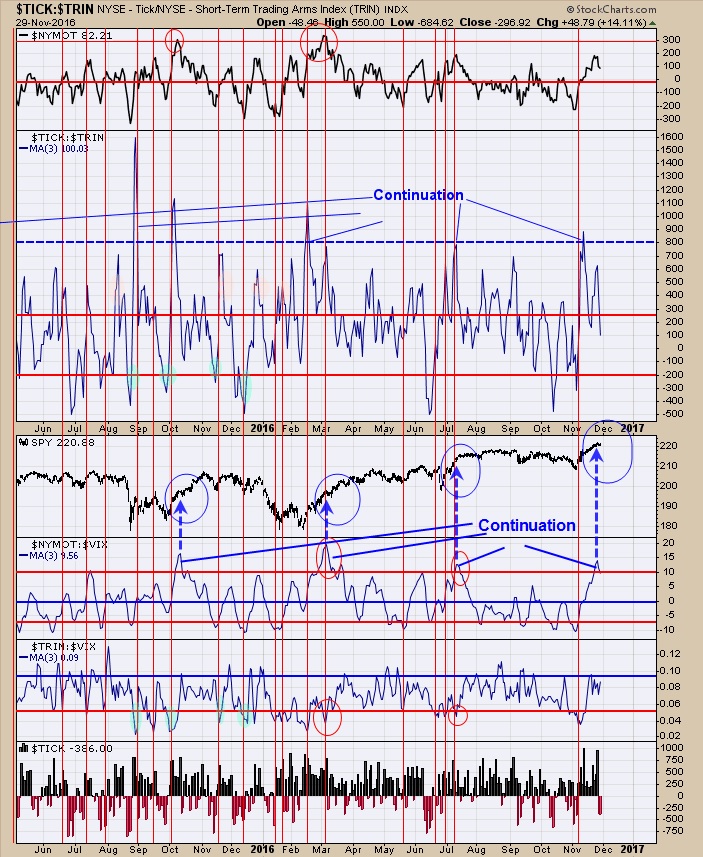

We said a couple of reports ago that the rally off of the November lows could be a buying climax. At the time we where looking at the Cumulative tick which was not supporting the SPY rally. As you can see from the chart above the Cumulative tick is still not supporting the SPY rally. Not all indicators work all the time and it could be one of those times where the Cumulative tick is not working. At the moment the upside seem limited but the downside looks also limited.

The middle window is the TICK/TRIN ratio. This ratio reached above +800 on November 10 suggesting the SPY rally should continue; which it did. The third window up from the bottom is the McClellan Oscillator/VIX ratio. This ratio reached above +10 on November 22 suggesting the rally still has legs. What is implied here of these two ratios is that downside at the moment is limited. At worst market could trade sideways (like in July). Staying neutral for now.

Above is the monthly ETF for Gold (GLD). The monthly 2014 highs near 130 on GLD was resistance. The monthly lows in 2013 near 115 is support along with the monthly mid Bollinger bands near 115. GLD did manage to push modestly lower to 112 range (which was a 61.8% retracement of the rally form the December low). all in all we are expecting GLD to start forming a low in this region. It may take another month or so before the next uptrend begins but we do expect this region to start forming support. Expect backing and filling to form the base in the coming weeks. Next rally may find the first resistance near the 130 range which was the last top. The daily charts have not turned up so patience is needed for now.

Disclaimer: Signals are provided as general information only and are not investment recommendations. You are responsible for your own investment decisions. Past performance does not guarantee future ...

more

thanks for sharing