The Oil Situation: The SPR Is Being Raided To Close US Production Deficit

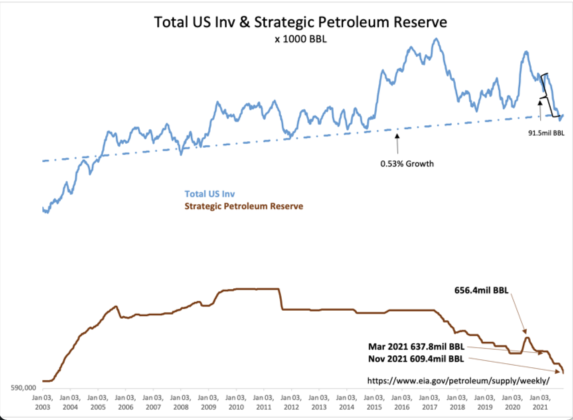

If the Total US Crude Inv., including the Strategic Petroleum Reserve (SPR) which is not routinely considered in the weekly commentary of crude inventory trends, is brought into consideration, the current deficit of US Crude Production suddenly looks very significant.

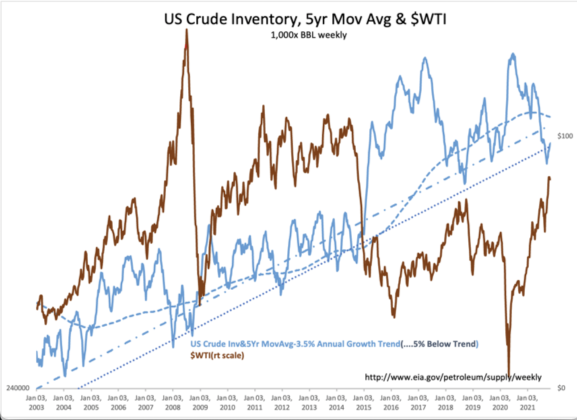

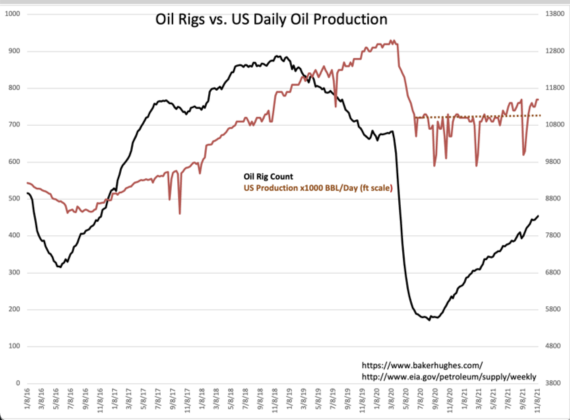

Everyone is aware of the crude inventory declines as the US slowly approaches a post-COVID-19 outlook. This decline and the current level of US crude production of 11.5 million BBL/Day both translate into a daily deficit vs. consumption of 0.503 million BBL/Day once the declines of Total US Crude Inv. (Total US Crude = weekly reported working US Crude Inv. + Strategic Petroleum Reserve) are considered.

The Total US Inv. has declined by 91.5 million BBL of crude oil since the end of Mar 2021. This is supply consumed, not supply provided by US Crude Production, which has varied around 11 million BBL/Day since June 2020 and has only recent risen to 11.5 million BBL/Day.

Bringing the working inventory down to levels that result in greater profitability for the E&P industry is a necessary act of rebalancing. The lowering of the SPR and the act of throwing more crude into the system slows the return to profitability, but this is viewed more as a political benefit to slow the rise in energy prices as a result of government restriction on fossil fuel production.

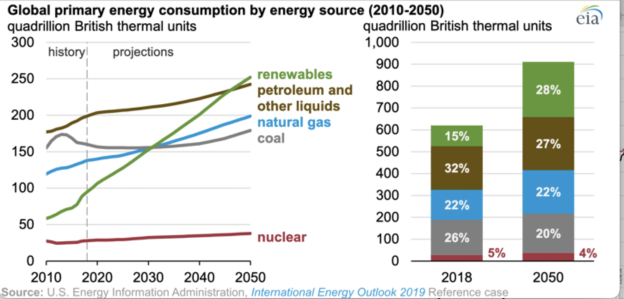

Wherever things go from here, the short-term outlook is dependent on government policy. The long-term outlook is dependent on global desires to maintain standards of living. Recent projections by the EIA expect a rise in the consumption of fossil fuels globally even as governments support alternative energy sources.

The experiences of Texas with alternative sources and sudden cold weather along with European policies that have already replaced fossil fuel with renewable sources have forced many to reconsider these efforts. Energy production from wind and solar have proven unreliable when they are most needed during severe weather. There has already been a run on fossil fuels globally to offset some renewables as populations and economies have suffered.

It is likely the transition away from fossil fuels will proceed more slowly than initially expected. The US EIA crude inventory data reveals that the US working inventory growth rate is 3.5% from a combination of domestic consumption and exports of refined products. The SPR is back to June 2003 levels with the recent decline.

Additional SPR releases will only slow the rebalancing of the fossil fuel markets. Sooner rather than later, global demand will return with growth in consumption. The current decline in production cannot continue as the US working inventory, which is currently at historic lows, will have to rise at some point. The SPR cannot be used indefinitely to reflate working inventories.

All indicators are signaling a global reopening post-COVID-19. Likewise, crude production indicators signal a cautious approach towards CAPEX-focused production increases due to uncertainty in government policies.

In my estimation, there will come a point when it is obvious that the current undersupply cannot be offset by letting inventories fall further. The current administration may be in the early stages of recognizing this fact, demonstrated by multiple requests to foreign producers to increase supply. It may prove a hard turning point considering the political agenda to eliminate the petroleum industry.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

moreComments

No Thumbs up yet!

No Thumbs up yet!