The Next Big Move: September Fed Meeting

Image source: Wikipedia

Many experts anticipate the Fed will hold rates steady at 5.25%-5.50%, waiting for inflation to cool further toward its 2% target. Nevertheless, recent market turbulence has also sparked speculation of a rate cut in September, possibly between 25 and 50 basis points. According to the latest Reuters Poll, on Monday, August 19, fifty-five out of one hundred and one analysts surveyed expect the Fed to cut rates by 75bps this year.

Before diving into further discussions, it’s essential to understand what the FOMC does.

Understanding the FOMC

The FOMC is a component of the Federal Reserve, the central bank of the United States. The committee is responsible for setting the federal funds rate, which is the interest rate at which banks lend to each other overnight. This rate is crucial because it influences all other interest rates in the economy, including those for mortgages, car loans, and savings accounts.

The FOMC meets eight times a year, roughly every six weeks, to review economic conditions and decide whether to raise, lower, or maintain the federal funds rate. These meetings are keenly awaited, and the decisions made have far-reaching effects on the economy and financial markets.

The Power of Stats!

In this tense atmosphere, every data release and Fed statement is scrutinized.

But while most investors are looking intently at the central bank’s decision and what it signals, statistically, the relevant price movements occur in advance. And you can take advantage of them!

In a past Seasonal Insights, we highlighted the S&P 500’s average performance before and after the Fed’s meeting over the past 25 years.

That article concluded that in the two days leading up to the Fed’s second meeting day, the S&P 500 averaged a 0.36% rise. This may seem small at first glance. However, remember: calculated over the year, this corresponds to 66.55%! After all, the rise occurred in just two days.

As always information is power, and now you can access this powerful information with just a few clicks:

- Select an instrument, e.g. the S&P 500.

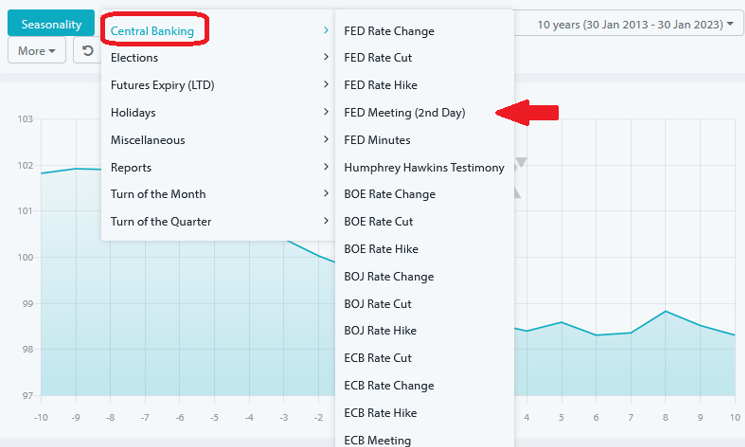

- Click on “Events” in the upper left corner of the chart.

Source: Seasonax

3. Select an event such as the Fed meeting from the drop-down menu.

Source: Seasonax

The event chart now shows you the average price trend of the instrument around the event. You can then select a start and end point to examine a pattern in more detail. This is analogous to the detailed pattern analysis you know from the seasonal chart. This includes various statistics, the cumulative profit curve and the distribution chart.

Of course, it is not only the Fed meeting that has an influence on prices; many other events do so too.

This gives you a wide range of events to choose from: ranging from reports (such as the CPI or labor market data), to futures expiration days (like triple witching days), to calendar events.

Seasonality and the Fed

One of the primary inputs into the FOMC’s decision-making process is economic data, including employment figures, inflation rates, and GDP growth. Significantly, many of these data points are subject to seasonal fluctuations. For example, retail sales often spike during the holiday season in November and December, while construction activity may slow down in the winter months due to harsh weather conditions.

To account for these fluctuations, economic data is often “seasonally adjusted.” This means that statistical techniques are used to remove the effects of seasonal patterns, allowing for a clearer comparison of data over time. However, even with these adjustments, the time of year can still influence the FOMC’s interpretation of the data. For instance, a weak jobs report in January might be viewed less critically if the FOMC considers the impact of post-holiday layoffs and winter weather.

Just as the FOMC’s decisions can be influenced by seasonality, so too can the market’s reactions. Investors are keenly aware of the potential for seasonal patterns in economic data and FOMC behavior. As a result, they may adjust their expectations and trading strategies based on the time of year.

For example, the stock market has historically shown a tendency to perform better in the final months of the year – a phenomenon known as the “Santa Claus rally.” This rally is often driven by investor optimism during the holiday season and the expectation that the FOMC will avoid making disruptive policy changes late in the year. Conversely, the summer months are sometimes marked by lower trading volumes and a greater focus on the FOMC’s mid-year meetings.

Is the Next Rates Cut on the Cards?

The latest data out of the US shows a ‘goldilocks scenario’. The economy is not too hot, not too cold, but just right. The latest CPI and PPI prints show a continued trend lower, the jobs market is weaker (but crucially not collapsing), and growth is remaining steady. This is a positive environment for US stocks and takes the pressure off the Fed to cut rates super quickly.

The latest NFP jobs print show the continued weakening of the labor market, but there is no need to panic like the markets did in early August. As long as inflation is cooling the Fed can cut rates and markets currently see a 77% chance of a 25bps September rate cut. Fed’s Powell should be cheering the latest falls in CPI at Jackson Hole this week and that could easily be a strong driver for stock gains into the end of this week.

Making the Most of Event Studies

As a trader, you can trade seasonal patterns directly. Alternatively, you can also use it as a filter: statistically speaking, as we saw in the Fed meeting example, it is better not to go short on these two days.

If you have a longer-term view, use it to optimize your entry time: buy shares on the day before the Fed meeting, and not immediately after the announcement of the meeting result.

Test it free for 30 days and explore patterns across various markets, including indices, (crypto)currencies, stocks, and commodities.

More By This Author:

Year-End Stock Market Rally: Myth Or Reality?October’s Stock Market Mojo

The Dog Days Of Summer: How August Affects The Stock Market