The New Always Hedged Bond Rotation Investment Strategy Backtests

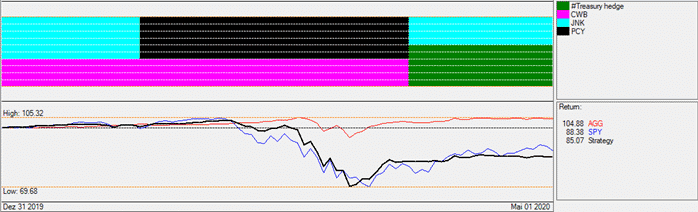

The old Bond Rotation Investment strategy behavior during the Corona crash:

You see that the crash happened in between two rebalancing’s. As we have been in a 100% bull market scenario in February, the March strategy allocation was 60% Emerging market bonds and 40% Convertible bonds. Both are equity like bonds. As the crash happened very fast, there was no time to switch into a more defensive allocation.

The max drawdown was -32% and the strategy was down -15% by May 1.

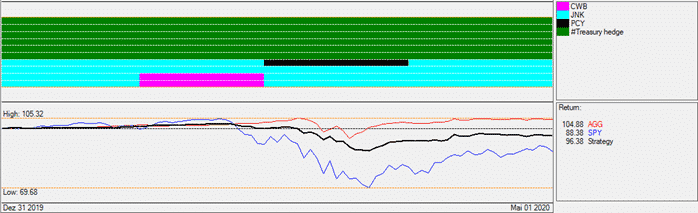

The new strategy is always hedged between 40%-60%. Since the beginning of the year the hedge was 60%. This helped to reduce the draw down significantly. The max drawdown was -13% and the new BRS strategy is now down -3.6% by May 1. The S&P500 had a max drawdown of 33% and is down 12% by May 1.

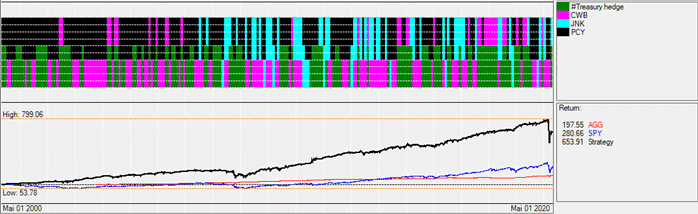

Here is a 20 year backtest of the old BRS strategy.

The strategy did quite well until the corona crash because all previous market corrections developed gradually over several months which gave the strategy plenty of time to reallocate to defensive bonds.

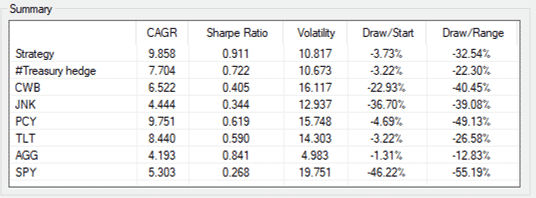

Here is the performance summary for the old BRS strategy for the last 20 years

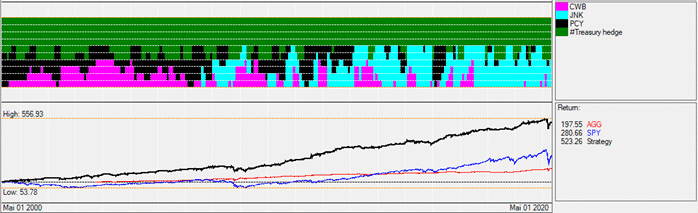

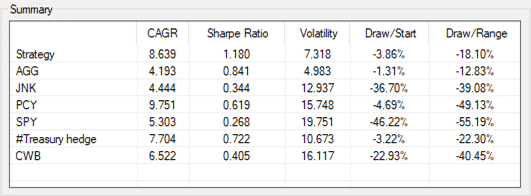

Here is a 20 year backtest of the new BRS strategy.

Here is the performance summary for the new BRS strategy for the last 20 years

Conclusion:

Looking at the two 20 year summaries, you see that the old strategy had a slightly higher performance, but a much higher volatility or risk due to the fact that during long bull market periods this strategy was not hedged. The Sharpe Ratio however which gives you the risk balanced return is much better for the new strategy.

Logical-Invest.com is not a registered investment advisor and does not provide professional financial investment advice specific to your life situation. Logical Invest is solely an ...

more