The Nerve

Kuroda, Draghi, and Yellen sure have a lot of nerve.

How dare these blinkered bureaucrats cause someone like me anxiety and stress? What business is it of theirs to threaten a normally-operating market and trouble a sweet soul like myself? I might as well be scared of a DMV clerk.

This morning was Exhibit A. Here I was, positioned with 125 shorts and 0 longs. I have said time again, we are in a bear market which started on December 26, 2014, and I have positioned myself to take advantage of it. And yet seven years of “training” the sheep have put the central bankers in a place of vomit-inducing power.

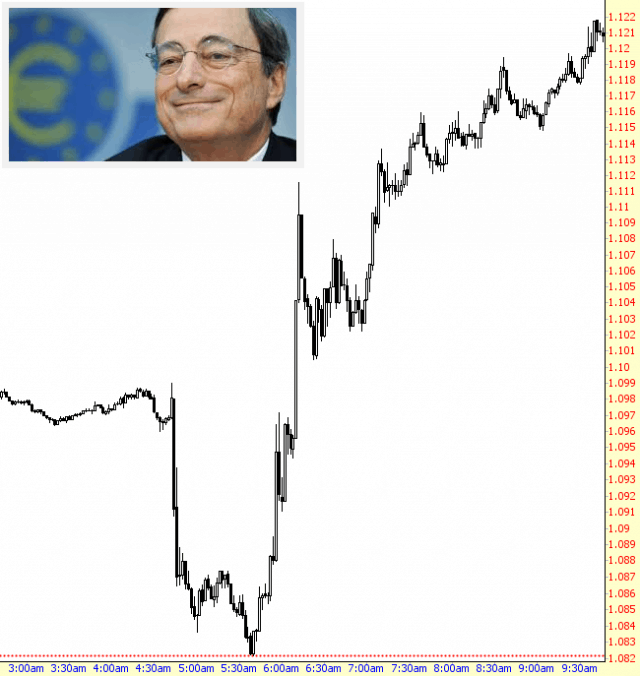

Draghi exercised that power this morning. The ES had been inching up all night long, and the moment ol’ saggy-eyes unleashed his latest plan to enslave the grandchildren of Europe so his buddies at Goldman Sachs could get even richer than they already are, the effect was immediate and precisely what he wanted: soaring equities and a collapsing Euro.

And then this happened……….

Yep. Saggy-Eyes enjoy about 45 minutes of swinging his tiny pencil around, and then the market decided to snatch it from his hand and ram it straight up his ass. Just as happened in exactly the same way with Kuroda back on January 28, once all the dust settled, Mario Draghi looked like a complete and total dillweed.

This is no fantasy; no careless product of wild imagination. No, my good friends. We are witnessing first-hand the timbers that make up the table of central banking power splinter and split. No one deserves mayhem, shaming, humiliation – – and, in a just world – – public execution – – more than these central banking clowns.

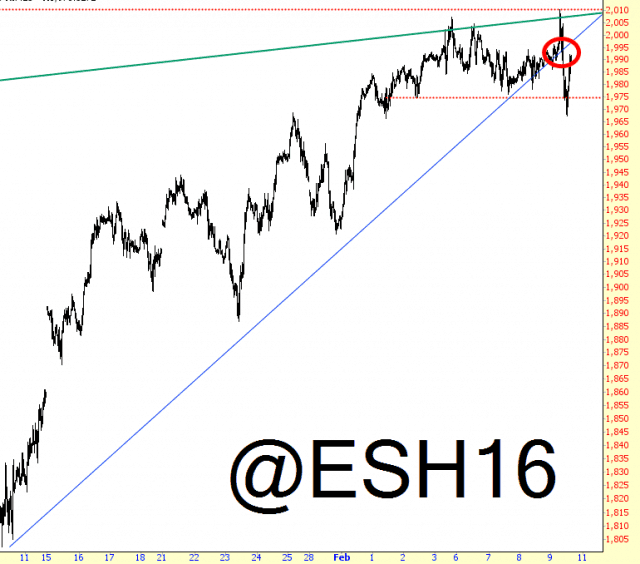

Our concern, of course, is to take advantage of their failure, and another important baby step took place today as the ES – – which roared about 20 points higher initially (much to the chagrin of your innocent host) fell all over itself and, crucially, broke the trendline which has been rigidly in place since February 11th. Take note that even the ridiculous end-of-day ramp that the bulls trot out every afternoon did nothing more than tag the underbelly of the now-broken trendline.

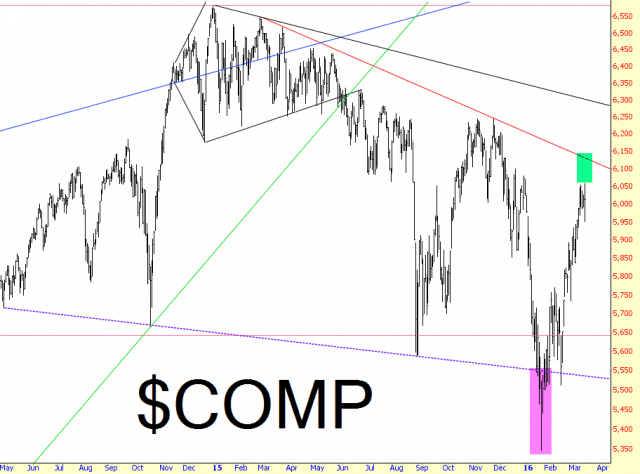

The big picture remains unchanged. We are at the very early stages of a bear market that will make the financial crisis of 2008 look like snack time at kindergarten. The Dow Jones Composite, shown below, is pushing lower than its pattern boundaries (tinted in magenta, illustrating core weakness) and isn’t able to muster a tag of its upper boundaries (tinted in green).

Precious metals. Bullish. Bonds. Bullish. Equities. Bearish. There will be blood.

This blog is not, and has never been, investment advice. It is a place that allows me to express my own views on the market and specific securities – as well as make whatever cultural ...

more

Thanks for your hard work and for being so stunningly candid - your posts are always the best. thanks.