The Market Since Thursday: Rotation Or Exhaustion

(Click on image to enlarge)

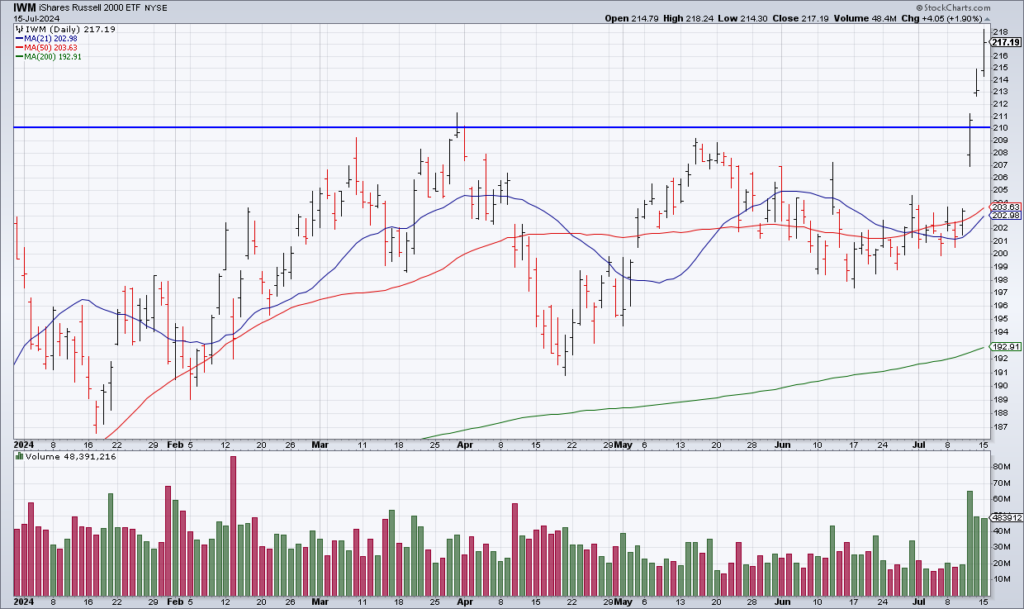

Since Thursday’s weaker-than-expected June CPI Report, the market has undergone quite the transformation. Megacap Tech – The Magnificent 7 – which have accounted for most of this bull market’s gains have taken a breather. On the other hand, the Russell 2000 (IWM) index of small-cap stocks has exploded higher along with the Equal Weight S&P (RSP) on the premise that coming rate cuts will help them most. Bulls interpret this as a healthy broadening of the rally. Bears wonder whether megacap tech might be exhausted. And without megacap tech, the market-cap-weighted indexes can’t go higher no matter how well the smaller stocks perform.

(Click on image to enlarge)

The first test of the appetite for mega-cap tech stocks comes on Thursday afternoon when Netflix (NFLX) reports 2Q24 earnings. NFLX has been on quite a tear for the last couple of years as you can see in the chart above. Analysts have NFLX earnings $18.34 EPS in 2024 for a 36x multiple on Monday’s closing price of $656.45. My personal bias is that this is too expensive for a stock that is maturing but I’m most interested in the reaction to Thursday afternoon’s report.

More By This Author:

The Global Economy Rests On 7 Stocks

Nibbling On Nike

The Stock Market Is In A Massive Bubble – And It’s Close To Popping