The Mag 7 Is Now The Fab 5, TSLA 1Q Deliveries, PVH -20%

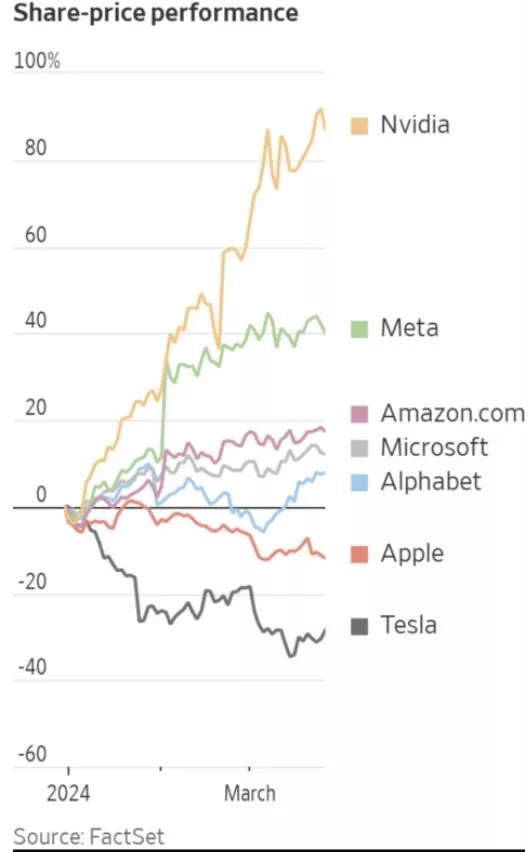

While the market held up last week despite underperformance from the Magnificent 7 (or Fab 5) because of strength in the rest of the S&P 500, it can’t go much higher without them leading.

That’s simply a function of math: The S&P is a market cap weighted index and their size means that they will continue to strongly influence the overall index’s performance. Nvidia (NVDA), Facebook (META), Microsoft (MSFT) and Amazon (AMZN) were themselves responsible for nearly half of the S&P’s first quarter advance, according to Howard Silverblatt, Senior Index Analyst S&P Dow Jones Indices (“The Stock Market’s Magnificent 7 Is Now The Fab 4”, Hardika Singh, WSJ A1, 4/1).

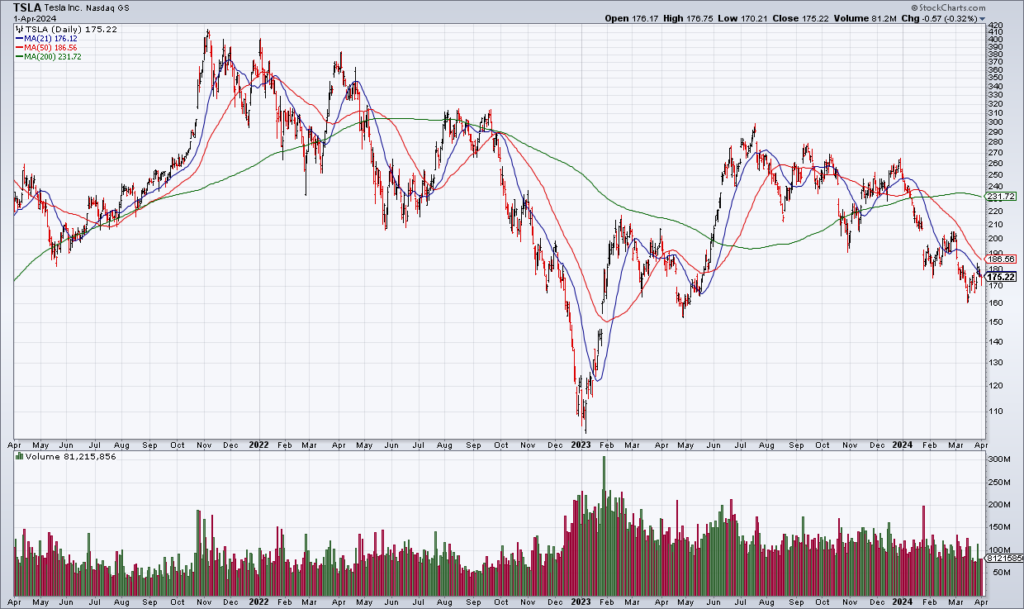

Tesla (TSLA) reports 1Q24 deliveries tomorrow morning before the open. Sentiment on TSLA has grown extremely negative. A selloff on the number would be a buying opportunity IMO. While sales may be under pressure in the short term, TSLA will continue to be a long term winner and sales will eventually come back and go even higher.

PVH – owner of the Tommy Hilfiger and Calvin Klein brands – is down 20% in the after hours after reporting disappointing 2024 guidance this afternoon in conjunction with its 4Q23 earnings report. The stock was +200% in the last 18 months. While it may be cheap on a forward P/E basis, there is no growth and I’d stay away for now. When momentum breaks like this, it usually marks at least an intermediate term top.

More By This Author:

Gold Hedges Against More Than Just InflationThe Market Will Soon Hit An Air Pocket And Drop 20% In A Matter Of Months

Lessons From The First 47 Years