The La-La-Land Fairy Tale Of A "Soft Landing"

The reason why a "soft landing" is a fairy tale straight out of La-La-Land is all bubbles pop, and a "soft landing" is based on bubbles remaining unpopped. In the "soft landing" scenarios, mind-boggling bubbles remain at "permanently high plateaus" as gamblers rotate out of one soaring sector into another soaring sector, in an endless rotation that keeps the entire speculative bubble fully inflated forever--or close to forever, which in today's world is a few years.

In the fairy tale, the economy is "strong" for all the right reasons: people are investing in new companies, spending lots of money, hiring more employees, and so on. In this fairy tale version of economics, the occasional spot of bother-- a "weakening economy"--is deftly resolved by the central bank lowering interest rates, which magically encourages everyone to return to their happy speculative, consumerist ways.

In La-La-Land, there are no bubbles, just enthusiasm for new technologies with limitless potential to reap billions in new profits. It's not a bubble, we're assured, it's simply strong fundamentals: sales are soaring, profit margins are fattening, and there's no end in sight.

In March, 2002, two years after the dot-com bubble had topped out, Scott McNealy, co-founder and CEO of dot-com darling Sun Microsystems, wrote a now-famous encapsulation of the difference between strong fundamentals and a bubble:

"At 10 times revenues, to give you a 10-year payback, I have to pay you 100% of revenues for 10 straight years in dividends. That assumes I can get that by my shareholders. That assumes I have zero cost of goods sold, which is very hard for a computer company. That assumes zero expenses, which is really hard with 39,000 employees. That assumes I pay no taxes which is very hard. And that assumes you pay no taxes on your dividends which is kind of illegal. And that assumes with zero R&D for the next 10 years, I can maintain the current revenue run rate. Now, having done that, would any of you like to buy my stock at $64? Do you realize how ridiculous those basic assumptions are? You don't need any transparency. You don't need any footnotes. What were you thinking?"

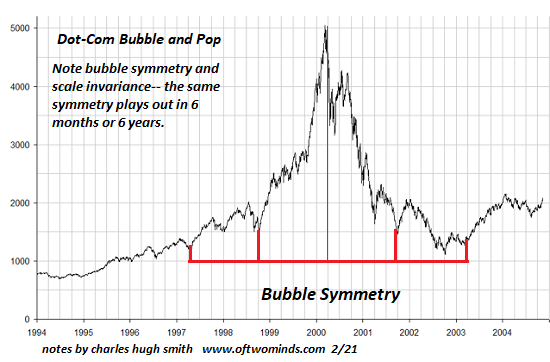

The chart of the dot-com bubble's euphoric ascent and eventual collapse is instructive: note how strong fundamentals eventually returned to the pre-La-La-Land level, wiping out all the wealth created by the bubble.

In response to the "weakening economy," a.k.a. the bubble popping, the Federal Reserve duly slashed rates, and talked up the "soft landing" fairy tale. Nothing stopped the bubble popping, something the leadership in China is discovering the hard way as their decades-long real estate bubble is popping despite a slew of subsidies, incentives, rate cuts and other forms of stimulus: even a Command Economy can't stop a bubble from deflating.

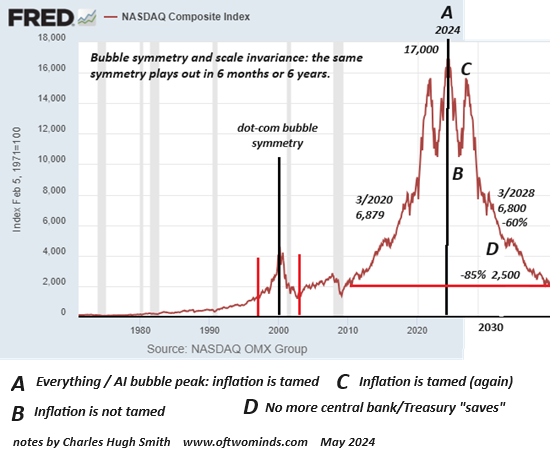

Which leads to this question: if the "soft landing" fairy tale is, well, a fairy tale, then what happens to the current Everything Bubble? If history is any guide, this chart of bubble symmetry will play out in the years ahead: strong fundamentals eventually return to the pre-La-La-Land level, wiping out all the wealth created by the bubble.

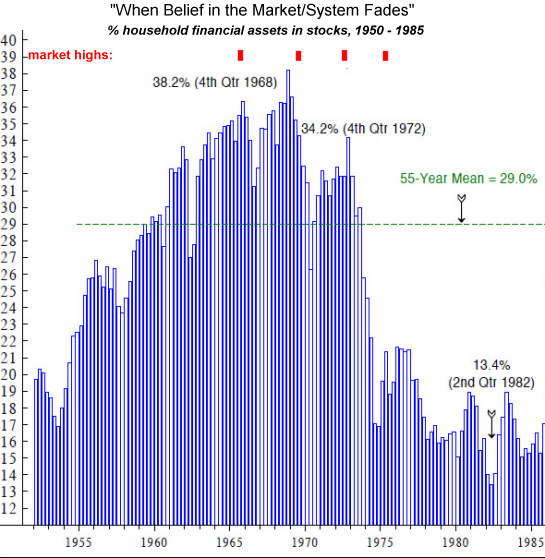

In the La-La-Land fairy tale, the solution is to play one's hot hand in speculation in a new sector, rotating seamlessly from one hot sector to the next, continuing to build wealth at each turn of the wheel. History tells a different story: all the punters and players keep playing until they run out of money or enthusiasm, and they exit the casino. This is reflected in this chart of household wealth held in stocks in the choppy stagflationary era of the 1970s:

When everyone finally leaves the La-La-Land casino and abandons the fairy tale, household wealth held in stocks is a fraction of what it was in the heady days of hot hands rotating into the next hot sector. It's OK to love fairy tales, for they appeal to our deepest emotions, our desires and our fears. But it's problematic when we let the fairy tale seep into reality.

More By This Author:

The Social Recession Is Accelerating

Who Wins And Who Loses When The Housing Bubble Pops?

The Anxiety Economy

Disclosures: None.