The Jobs Report Changed The Monetary Tides

Friday was one of those days when we saw a sea change in sentiment. Not necessarily for stocks – the mood was bullish both before the jobs number and after (and seemingly would be even if aliens landed tomorrow) – but for the fixed income markets and rate assumptions that underlie equity pricing.

During recent speeches, Powell got us to focus on the “maximum employment” portion of the Fed’s dual mandate, with the assumption that the “stable prices” portion was in control. The Payrolls report not only implied that the Fed doesn’t need to prop up employment right now – not with more than 100k jobs created than expected and a dip in the unemployment rate.Furthermore, the stable prices part might now be a given either after a 0.4% rise in monthly average hourly wages and a revision of the prior month to 0.5%.I’d say that my immediate take was the correct one:

Fed Funds traders agreed. According to the CME FedWatch, on Friday, expectations moved to 97.4% a 25bp and the other 2.6% for no cut.That compares to a roughly 35% expectation for 50bp and 65% for 25bp prior to the jobs report.This morning, the mood shifted even further towards “no cut” with a 20% chance of no action priced in currently.The IBKR ForecastTrader also saw shifting expectations, with the odds for the November Fed Funds rate being above 4.625% shifting from 15% to 63%.

I’ve been saying all along that despite the perception that monetary policy is restrictive, there is little evidence that it’s actually restricting anything.Stocks are at all time highs, bond yields are at multi-year lows, credit spreads are tight, and both real and nominal rates are at historically normal levels (but high relative to the ultra-low levels that prevailed in the post-Global Financial Crisis period – see graphs here).That said, we should keep Chairman Powell’s bias in mind: he made his money as a private equity investor using borrowed money to buy companies and sell them later.Of course he likes low interest rates and equity-friendly policies.

That said, the bond market is not a huge fan of the payrolls report.Rates on 2-year Treasuries have risen by nearly 30bp since Thursday.As I write this, that yield is currently 3.99% after a brief flirtation above 4%.The rise in 10-year rates is not quite as dramatic, though today’s 4.025% is considerably above Thursday’s 3.85%.That dispersion also means that the yield curve is close to re-inverting, with a spread of just 3.5bp.That seems to indicate that recessionary fears have been pushed off – remember that recessions tend to begin only after the yield curve normalizes after an inversion – and certainly we are not seeing a “flight to safety” bid even as oil prices rise on concerns about a potential widening of Israel-Iran hostilities.

We see VIX also trading higher, perhaps reflecting concerns about geopolitical events, but that could also be the recognition that the coming 30 days include PPI and CPI reports, another round of jobs data, earnings season, and, oh yes, the election.

Regarding the earnings season starts this week: remember, markets are pricing in double-digit earnings growth for SPX in 2025.If companies don’t reaffirm their guidance that will force investors to decide whether the current levels of valuation are correct (for reference, the current S&P 500 P/E is 26.2 – historically high, but below the 30-ish level that prevailed in 2021 and in ’99-2000).We’ve seen that EPS beats remain necessary for post-earnings advances, but they’re no longer sufficient when 75-80% of companies routinely beat estimates in any given quarter.Instead, investors are increasingly looking through EPS to other factors, with guidance being the key.Ask yourself whether companies can maintain lofty guidance in an economy sufficiently weak to require aggressive rate cuts.A strong economy is more important than rate cuts, and that’s why stocks did well on Friday and throughout this year.

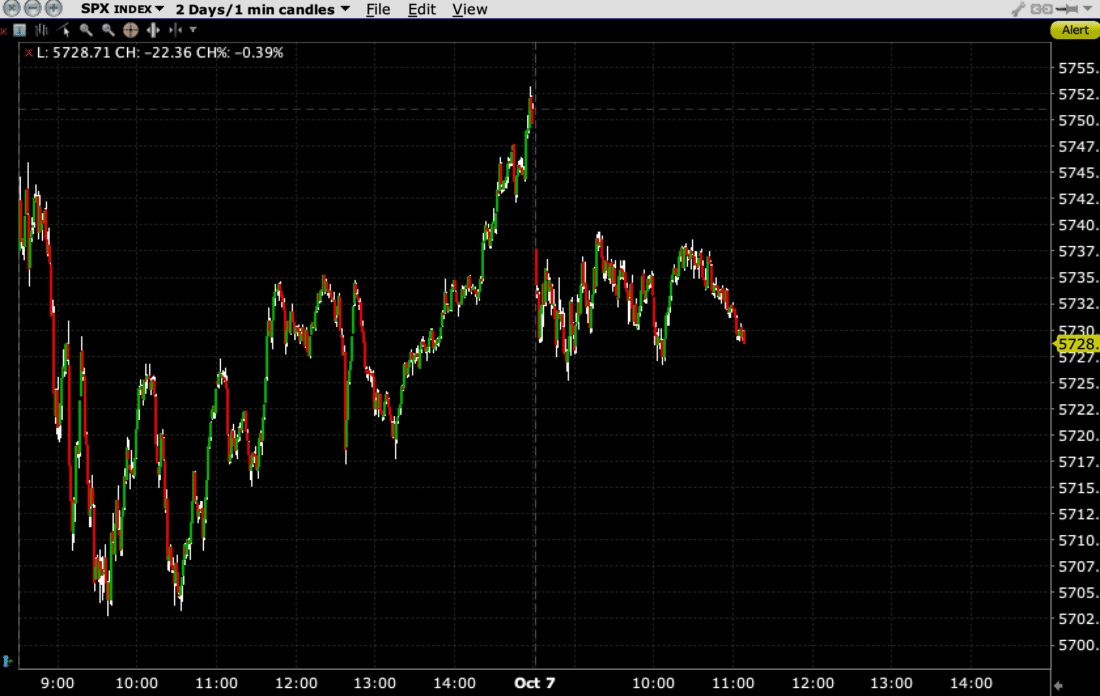

Finally, a question that I was asked more than once this morning was why we opened lower.Bearing in mind that this morning’s selloff only recouped the rally that occurred in the last hour of Friday’s trading, I offered a reminder about the concept of “socially acceptable volatility.”No one really minded that we had another in a series of mysterious rallies just before the close. Heck, markets are supposed to go up.Thus, we tend only to concern ourselves with volatility when it is to our detriment.

(Click on image to enlarge)

Source: Interactive Brokers

More By This Author:

Long End Yields Jump To 2-Month Highs On Blockbuster JobsA Quick One While He’s Away

Rotation Was The Key This Quarter

Disclosure: ForecastEx

Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ForecastEx ...

more