The Jobs Boom Is Clearly Behind Us, So What’s Ahead?

(Click on image to enlarge)

ADP and BLS data via the St. Louis Fed. Chart by Mish

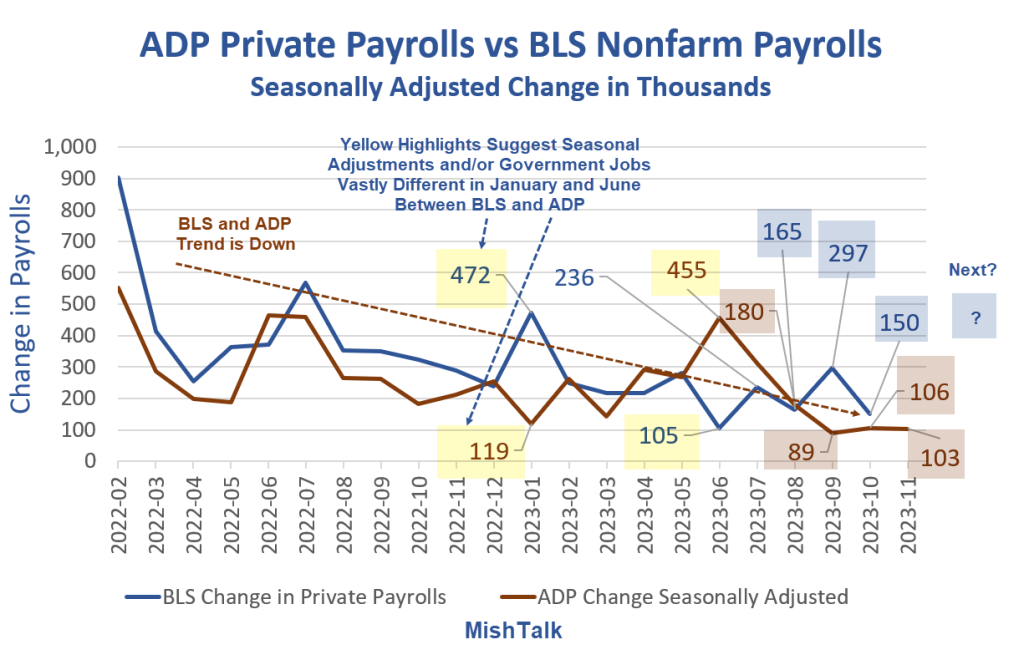

Today, ADP released its National Employment Report for November. The BLS reports Nonfarm Payrolls and employment levels on Friday.

The Job Boom is Behind Us

“Restaurants and hotels were the biggest job creators during the post-pandemic recovery. But that boost is behind us, and the return to trend in leisure and hospitality suggests the economy as a whole will see more moderate hiring and wage growth in 2024,” says Nela Richardson, ADP Chief Economist.

ADP Month-Over-Month Change

Leisure and hospitality, a big driver in employment for years, took a dive in November according to ADP.

Are people eating out less? I would suspect so with costs soaring along with minimum wages.

And Manufacturing is down 15,000 despite a UAW strike settlement.

Pay Growth Continued its Slowdown in November

- Job-stayers saw a 5.6 percent pay increase in November, the slowest pace of gains since September.

- Job-changers, too, saw slowing pay growth, posting pay gains of 8.3 percent, the smallest year-over-year increase since June 2021.

Job Switching Premium

ADP notes “The premium for switching jobs is at its smallest in three years of

data.“

The switching premium is down and the risk of a slowdown is rising. So, more people are staying put. This shows up in quits reports.

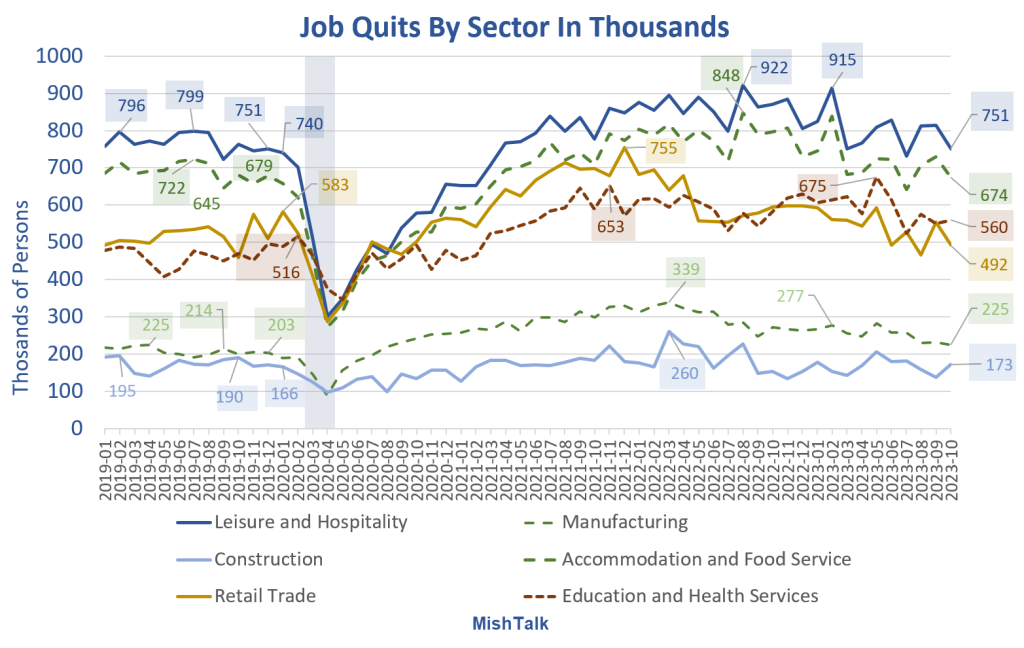

A Big Decline in Quits Suggests the Labor Market is Back to Normal

Quits are hard data and provide a better measure of the labor market than openings. But what’s next?

(Click on image to enlarge)

Job quits from the BLS Job Openings and Labor Turnover (JOLTS) report, chart by Mish.

Yesterday, ahead of this ADP report, I commented A Big Decline in Quits Suggests the Labor Market is Back to Normal

Quits Declines from Highs

- Leisure and Hospitality: 922 to 751, an 18.5% decline.

- Accommodation and Food Service: 848 to 674, a 20.5% decline.

- Education and Health Services : 675 (a recent high) to 560, a 17.0% decline, but still elevated. 516 is the highest pre-pandemic number in a set that is otherwise below 500.

- Retail Trade: 755 to 492 (well below pre-pandemic norms), a 34.8 percent decline. These people appear stuck with limited offers elsewhere.

- Manufacturing: 339 to 225 (slightly above pre-pandemic norms), a 33.6 percent decline.

- Construction: 260 to 173 (mostly below pre-pandemic norms), a 33.5 percent decline.

Nirvana?

If you believe in the soft landing theory, we will now live happily ever after.

I don’t. Portions of the economy are severely distressed including commercial real estate and manufacturing.

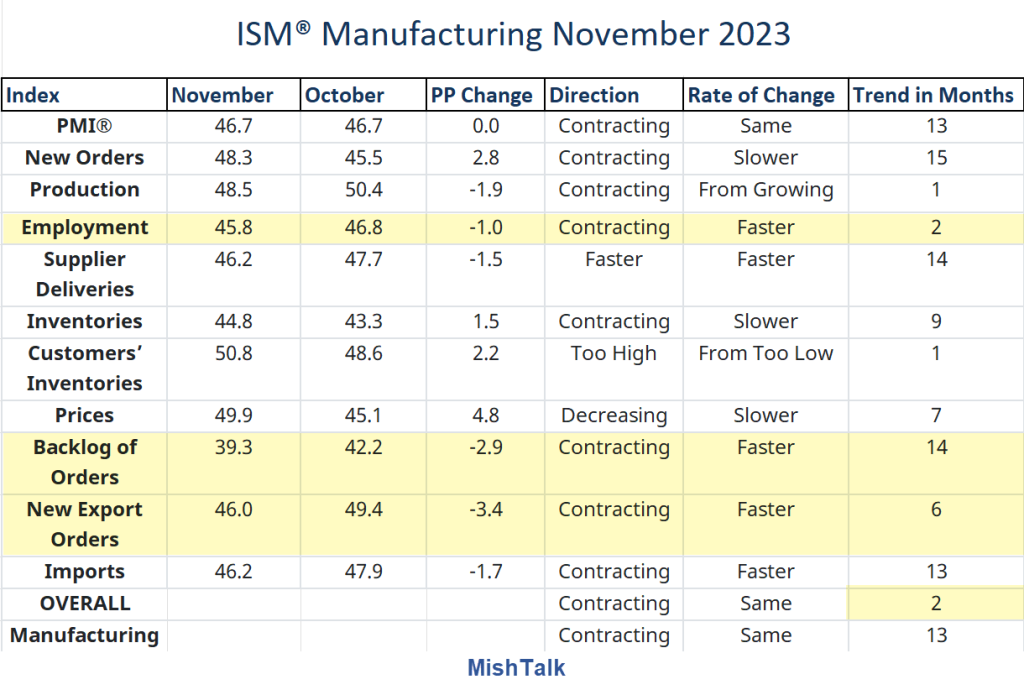

ISM Manufacturing Contracts for the 13th Consecutive Month, Order Backlogs Plunge

(Click on image to enlarge)

Image and excerpts by permission and courtesy of the Institute for Supply Management

The ISM manufacturing report for November is dismal. The headline number didn’t change but details look worse.

For discussion, please see ISM Manufacturing Contracts for the 13th Consecutive Month, Order Backlogs Plunge.

Manufacturing is a bigger portion of the economy that widely believed. It creates the goods that consumers buy.

And in the services sector, prices have risen 78 consecutive months according to the ISM.

For discussion, please see ISM Services in Positive Territory, Up Slightly, Much Better Than Manufacturing

Residential housing is stressed in a different way.

Home Prices Hit a New Record High According to Case-Shiller

Thanks to Fed policy, existing-home sales are in the gutter and likely to remain so. Yet, prices are in the stratosphere.

For housing discussion, please see Home Prices Hit a New Record High According to Case-Shiller, Thank the Fed

This is not a Nirvana setup. The Fed is walking a tightrope. The only questions are when and how the Fed makes another policy error and in which direction.

Everyone but the Nirvana believers are speculating on which way the Fed errs. I sure don’t know. And no one else does either.

But expect a mistake. The Fed has a long history of them.

More By This Author:

A Big Decline In Quits Suggests The Labor Market Is Back To NormalGermany’s Commitment To End Coal By 2030 Is A Never Ending Shell Game

Factory Orders Look Grim In October Down 3.6 Percent, What’s Going On?

Disclaimer: The content on Mish's Global Economic Trend Analysis site is provided as general information only and should not be taken as investment advice. All site content, including ...

more