The Inflationary Bubble

As I’ve been outlining for the last few weeks, the Fed and other central banks have finally succeeded in unleashing inflation.

The Fed is trying to downplay this by saying the inflation is “transitory,” but who are you going to believe… your own eyes or the words of a Fed official who is literally paid to say things that downplay systemic risks?

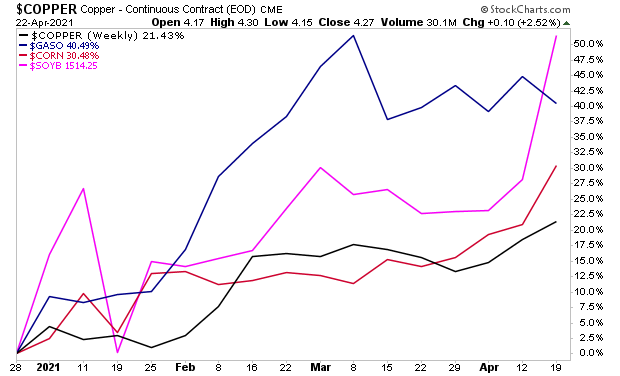

Year to date, the price of copper, gasoline, corn and soybeans are all up double digits.

The last two (corn and soybeans) are the most concerning as the Fed’s own research shows that food inflation is the single best predictor of future inflation.

And unfortunately, things are about to get a whole lot worse.

You see, inflation arrives in stages. It’s not as though it enters the financial system and POOF suddenly the cost of everything rises.

Instead, inflation slowly works its way into the financial system in phases.

The first stage occurs in the manufacturing/ production segment of the economy when you see producers suddenly paying more for the raw goods and commodities they use to manufacture/ produce finished goods.

You can see this development in the chart above. The prices of things like copper, gasoline and corn are all spiking higher.

Now, one or two months of higher commodities or raw goods is no big deal, but once you’re talking 6-8 months of steadily rising prices it’s significant. At that point manufacturers/ producers have to start raising the prices of finished goods or face shrinking profit margins

At that point, you move into the second stage of inflation: when the prices of ordinary objects begin to increase.

We are now entering that phase as the below headlines show.

- Coca-Cola CEO says company will raise prices to offset higher commodity costs

- Procter & Gamble to raises prices on baby care, feminine care and adult incontinence products

- Kimberly-Clark raises prices on Scott toilet paper, diapers in U.S. and Canada

- Another furniture maker raises prices to cope with rising costs

This is where things start to get nasty. Once you start seeing price hikes appear in the broader economy, inflation has become systemic. At that point, the only thing that will stop it is if the Fed begins to tighten monetary policy (raise rates, taper QE, etc.).

Bad news here too… the Fed has explicitly stated it has no interest in raising rates or tapering QE for another TWO YEARS.

Which means… inflation is going to rage and rage. And the damage done will be measured in trillions of dollars with a (trillions with a “t”).

Those who are properly prepared, however, will make literal fortunes.

For more market insights and investment ideas, swing by our FREE daily e-letter at www.gainspainscapital.com.