The Housing Bubble Has Officially Burst : Case-Shiller Records First Drop In Home Prices Since 2012

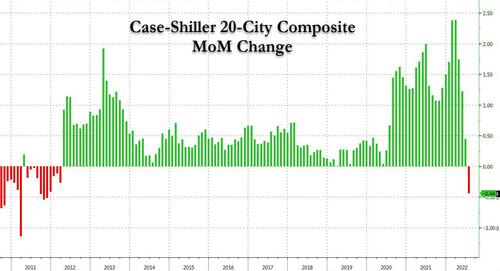

Analysts expected Case-Shiller Home Price growth to continue its modest deceleration in August (the latest available data in this heavily lagged and smoothed data set), but the result was a doozy: the 20-City Composite index tumbled 0.44% MoM, far below the 0.20% expected to increase, and a sharp decline from the downward revised 0.19% increase in July; more importantly, this was the first sequential drop in home prices tracked by Case-Shiller since March 2012, or ten and a half years.

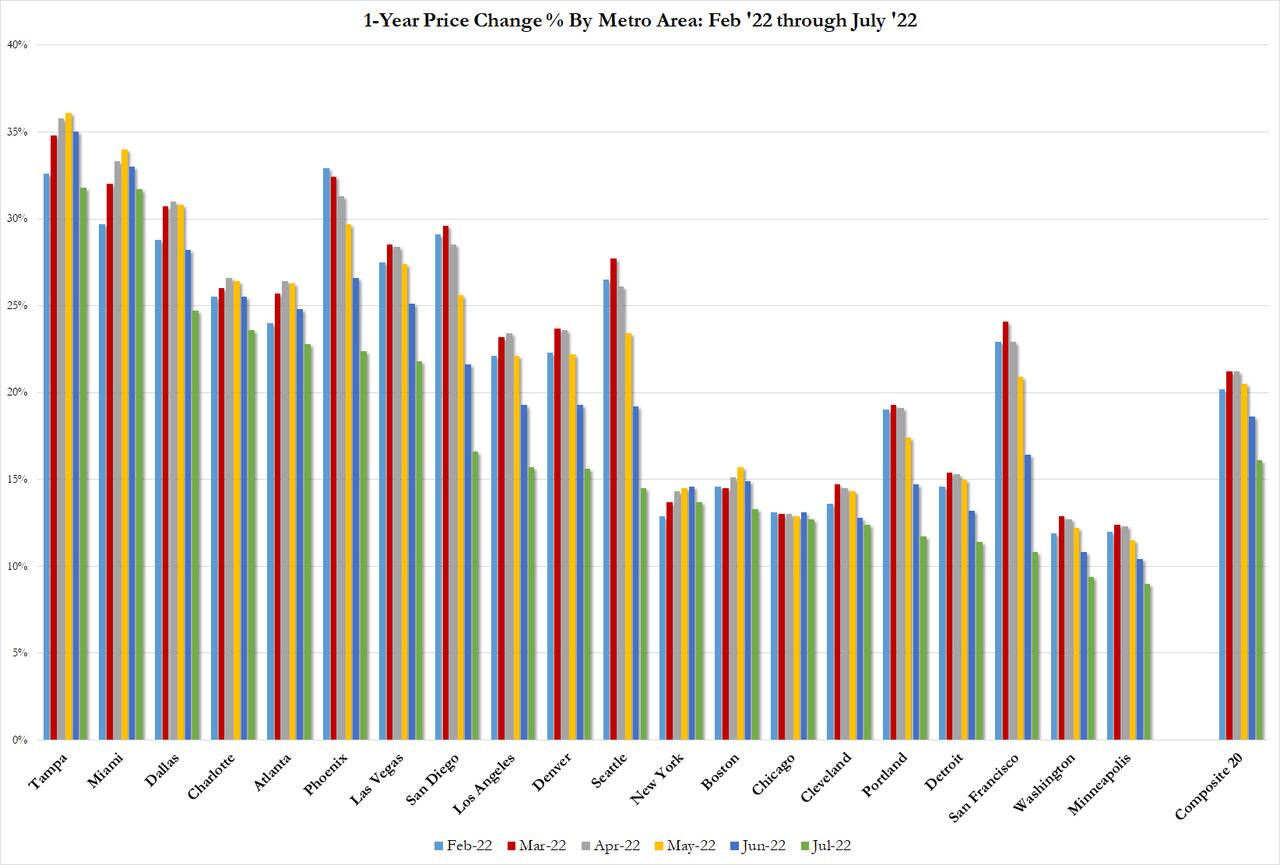

On a Y/Y basis, home prices rose just 16.06%, down from 18.66% YoY in July, and missing expectations of a 17.1% increase. The headline national average price index rose 15.77% YoY in August.

Comments confirmed that the mood is dismal and turning uglier by the day: “Although U.S. housing prices remain substantially above their year-ago levels, July’s report reflects a forceful deceleration,” says Craig J. Lazzara, Managing Director at S&P DJI.

“For example, while the National Composite Index rose by 15.8% in the 12 months ended July 2022, its year-over-year price rise in June was 18.1%. The -2.3% difference between those two monthly rates of gain is the largest deceleration in the history of the index. We saw similar patterns in our 10-City Composite (up 14.9% in July vs. 17.4% in June) and our 20-City Composite (up 16.1% in July vs. 18.7% in June). On a month-over-month basis, all three composites declined in July."

“The theme of strong but decelerating prices was reflected across all 20 cities. July’s year-over-year price change was positive for each one of the 20 cities, with a median gain of 15.0%, but in every case, July’s gain was less than June’s. Prices declined in 12 cities on a month-to-month basis. Tampa (+31.8%) narrowly edged Miami (+31.7%) to remain at the top of the league table for the fifth consecutive month, with Dallas (+24.7%) holding on to third place. As has been the case for the last several months, price growth was strongest in the Southeast (+27.5%) and South (+26.9%).

Lazzara concluded by noting that “as the Federal Reserve continues to move interest rates upward, mortgage financing has become more expensive, a process that continues to this day.Given the prospects for a more challenging macroeconomic environment, home prices may well continue to decelerate.”

Finally, we note that drops such as this are absolutely critical to avoid a total implosion in the housing sector, whose affordability just hit a record low last month, but managed to rebound modestly in July, as a result of dropping prices. That said, prices will have to drop by a lot more if housing is again to become affordable to ordinary Americans.

More By This Author:

Futures Jump, Yields And Dollar Slide After Gundlach Says He's A "Buyer" Of Treasuries"We're Living In Alice In Wonderland" - Dallas Fed Survey Slumps Amid "Irresponsibility Of Biden Admin"

Down $29 Trillion Since November

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more