The Good, The Bad, And The Ugly: A Recap Of Post-Vote Winners & Losers

Image Source: Pexels

What’s promised on the campaign trail and what comes to reality are often different. But that didn’t stop investors and traders from speculating on the most prevalent and profitable themes under a new administration. So, let’s summarize what moved and why, explains Tom Bruni, head of market research at The Daily Rip by Stocktwits.

Small-Caps Soared

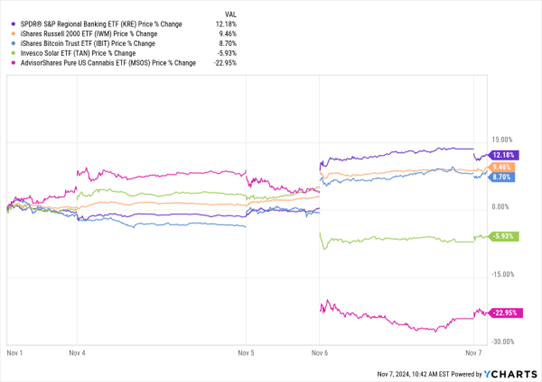

US stocks rocketed to the upside, led by the small-cap Russell 2000 index. Trump’s focus on “America first” put domestically focused companies in the spotlight. Plus, an overall positive backdrop for risk assets had investors and traders willing to venture out on the risk spectrum to make bullish bets.

KRE, IWM, IBIT, TAN, MSOS Chart (Five-Day Percentage Change)

Data by YCharts

Regional Banks Ramped Up

Remember how the regional banking sector was set to go down the tubes 18 months ago? Well, it’s been roaring back on hopes that deregulation and a focus on the domestic economy will be good for business. Reduced capital requirements could help fuel greater profit growth and free up capital for buybacks and dividends.

Bitcoin and Crypto-Linked Stocks Roared

An expectation for softer cryptocurrency regulations (and deregulation in general) drove the market higher. Bitcoin hit new all-time highs, while crypto-related stocks surged.

Solar Stocks Extinguished

The regulatory and overall fiscal support for renewable energy will likely be softer than it was under the Biden Administration, weighing on the sector. Additionally, tariffs could impact the China-linked industry.

Electric Vehicle (EV) Stocks Slumped

Regulatory support for EVs is likely to lessen under the Trump Administration. But many view this industry headwind as a positive for Tesla Inc. (TSLA) because of its massive head start in the space. Additionally, Elon Musk’s close relationship with Trump and Trump’s focus on "beating" China are seen as major tailwinds for the next several years.

Marijuana Stocks were Smoked

With Kamala Harris and the Democratic party seen as more pro-marijuana, much of the optimism around reclassification at the federal level was taken out of the market. Additionally, with states like Florida voting against recreational marijuana (albeit by a small margin), the regulatory environment will likely remain challenging for these companies.

Housing and Real Estate Stocks Slumped

Higher rates are the story here. Mortgage rates above 7% have already choked housing market activity and frozen commercial real estate transactions. But if Trump’s policies keep rates higher for longer, then the pain in these sectors could persist.

These were some of the biggest themes in markets throughout the past week. Some of these moves were knee-jerk reactions to what investors seem to think is ahead for US government policy and the economy. Eventually, the actual fundamentals will matter. But for now, the market has been trading on expectations, which have remained bullish.

About the Author

Tom Bruni is the head of market research at Stocktwits, where he publishes the brand’s flagship market recap newsletter, The Daily Rip, for one million subscribers and oversees the platform’s growing publishing efforts.

Mr. Bruni has been at the intersection of finance and media for the last decade, regularly featured in the Wall Street Journal, Bloomberg, Reuters, Barron’s, and more. He holds both CPA and CMT licenses and graduated with an accounting degree from Molloy University in 2016.

More By This Author:

RISR: A Unique Bond ETF With Interest Rate ProtectionSPY: What Now After The Big Post-Election Rally?

Cisco: A (Relatively) Cheap Way To Profit From AI, Chip Sector Growth

MoneyShow Editor’s Note: Tom Bruni is speaking at the 2025 MoneyShow Las Vegas, which runs Feb. 17-19. more