The Global Stock Markets Are Highly Correlated

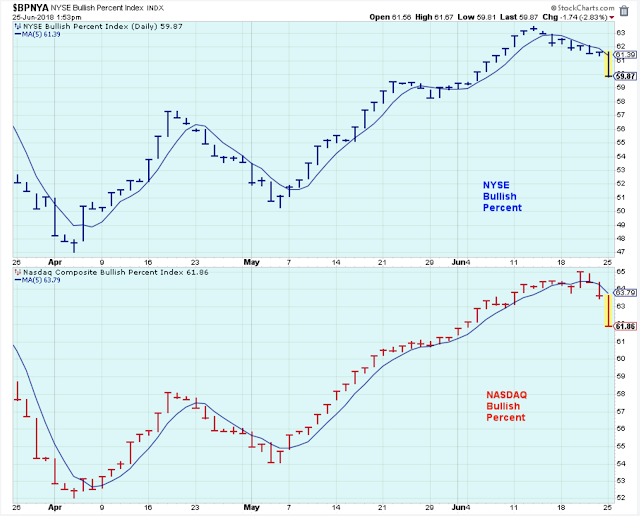

The short-term downtrend shifted into high gear selling today as confirmed by these Bullish Percents.

(Click on image to enlarge)

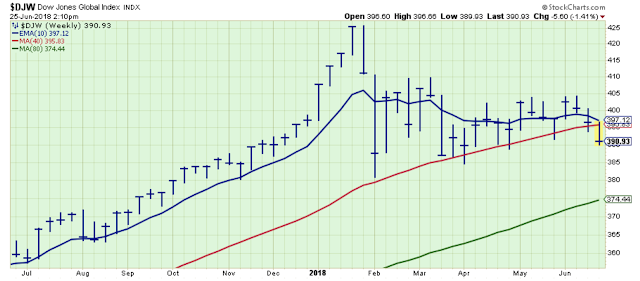

The Global Stock Index has led the way down for the large cap US stocks, and now it has broken decisively below the 200-day.

The global stock markets are highly correlated, so if you see weakness in the global index, then it is a warning for the US stock holders too. And it is more than just a short-term warning.

(Click on image to enlarge)

Here is another look at the Global Index, but this time it is a weekly chart. I don't like the looks of this.

I'm leaning negative on this market. I keep going back to what Investors.com said a few weeks ago. Their comment was basically saying that a strong market doesn't react much to negative headlines, but a weak market is susceptible to selling when there is bad news.

(Click on image to enlarge)

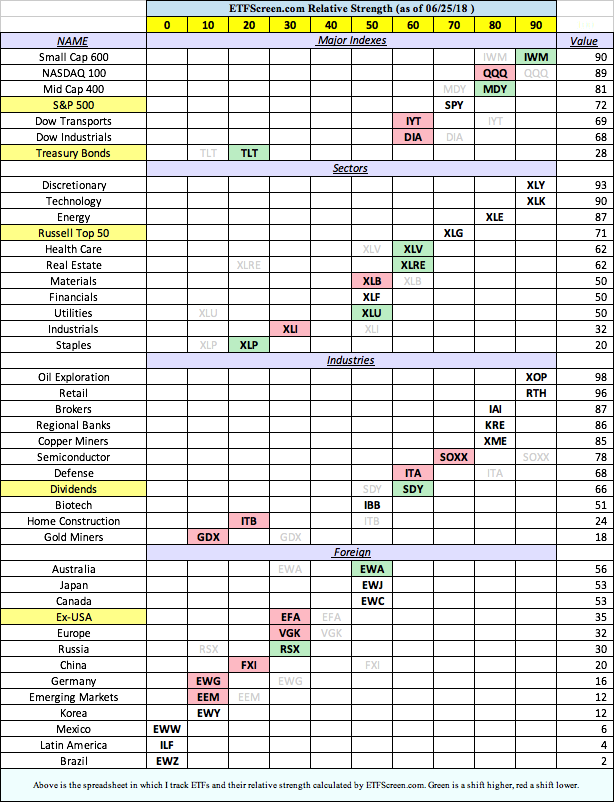

Sector Strength

What is this spreadsheet telling us?

The Small Caps are leaders. Early in a bull market, you want to see small cap leadership, but at this stage, and with global trade tensions, it looks more like a place where investors are hiding out. So I think it reflects as a negative on the strength of the general market.

The sectors are lead by Consumers and Technology. But the market cannot continue to hit new highs with only these two areas showing strength. Another negative for the general market.

The foreign stock ETFs are mostly skewed left which shows weakness. Avoid these ETFs.

(Click on image to enlarge)

Outlook Summary:

The long-term outlook is increasingly cautious. Reduce stock market exposure.

The medium-term trend is up as of May-10.Watching for signs of a peak.

The short-term trend is down as of Jun-19.

The medium-term trend for bond prices is up as of Jun-19 (yields lower, prices higher).

Disclaimer: I am not a registered investment advisor. My comments above reflect my view of the market, and what I am doing with my accounts. The analysis is not a recommendation to buy, ...

more