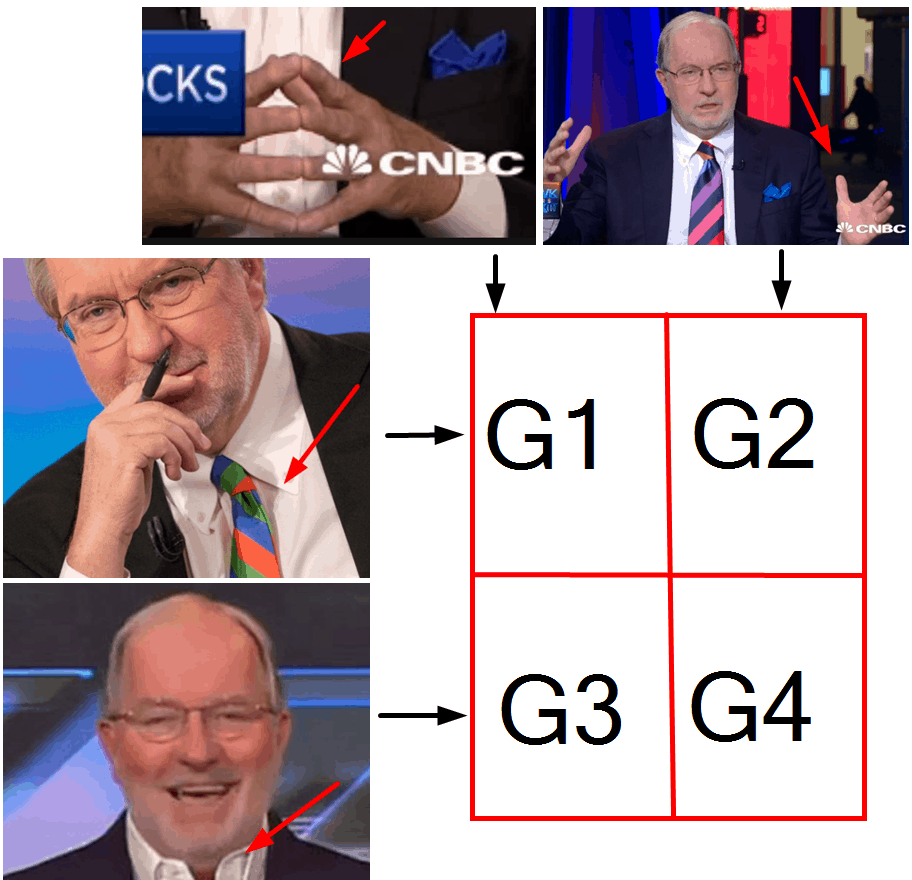

The Gartman Grid

I see that Dennis Gartman is front-and-center on ZeroHedge this morning, so I thought I’d offer up these thoughts: we all have opinions on the stock market. However, very few of us have daughters who are Senior Line Producers (whatever that means) on CNBC, thus we cannot share our musings with the rest of the world. Happily, there is one Dennis Gartman who is blessed with just such a situation, and he appears on CNBC with more frequency than even the great Janet Yellen (plus he hasn’t fainted on camera yet, not even once).

Mr. Gartman’s pontifications, however, can at times be opaque and thus hard to interpret, so I would like to offer this easy-to-use grid to help you tease out precisely where the man stands. The quadrant is comprised of two simple binary facts:

Horrible Colorful Tie or Open Collar? – Dennis likes to mix up the wardrobe. Sometimes he goes footloose and fancy-free, doffing the tie and leaving the top shirt button joyously undone. At other times, he steps up his game and goes for the All Business look, donning a tie which contains colors rarely found in the natural world.

Fingertip Prayer or Devil-May-Care? – More often than not, the D-Man has all ten fingers engaged in a tip-to-tip prayer to the market gods. This, I suppose, is engaged so as to evoke an air of intellect and quiet thoughtfulness. There are other times, though, in which passion trumps reason, and the hands fly loosely, in the manner of two dazed starlings, desperately seeking the rest of their flock.

It only takes a moment for the observant viewer to ascertain the state of each of these two realities. There is no Schrodinger’s Cat in Dennis’ world. Thus we pull out our handy grid:

Based on the result you determine, you may refer to his point-of-view as follows:

- G1: Energy Chart is Moving From the Upper Left to the Lower Right

- G2: It’s Good to Be Seen

- G3: Be Gently Short of Stocks in Yen Terms

- G4: I’m Confused But Focused on the Contango Structure

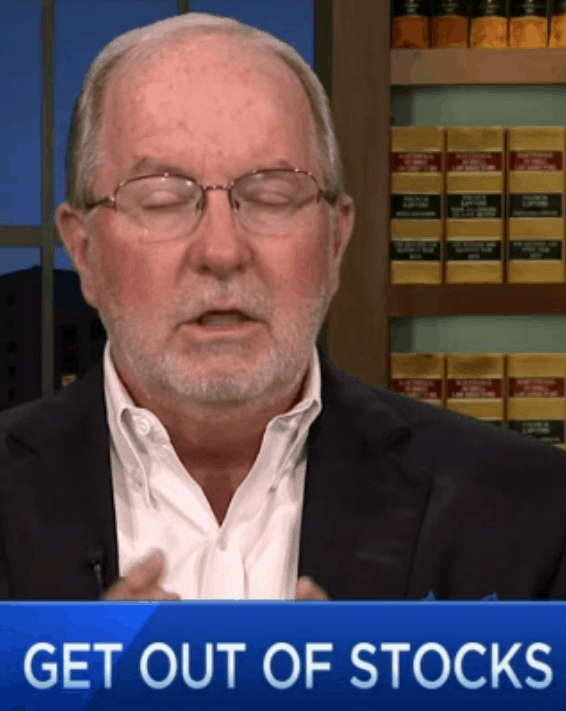

I hope you find this guide to be constructive in your trading for 2016. I will close by agreeing with one statement our televised friend has declared on occasion, which I think will be a crucial credo for the year ahead, once we get this bounce out of the way:

This blog is not, and has never been, investment advice. It is a place that allows me to express my own views on the market and specific securities – as well as make whatever cultural ...

more