The Financial Noose Tightens

The US Senior Loan Officer Opinion Survey on Bank Lending Practices (SLOOS) is used by monetary policymakers to gauge credit conditions.

Over the past year, banks have reported tighter lending standards on commercial loans to small, large and middle-market firms (blue bars below since 1990, courtesy of The Daily Shot). This indicator has traditionally led US corporate defaults by three months (light blue below) and suggests rising payment defaults from here.

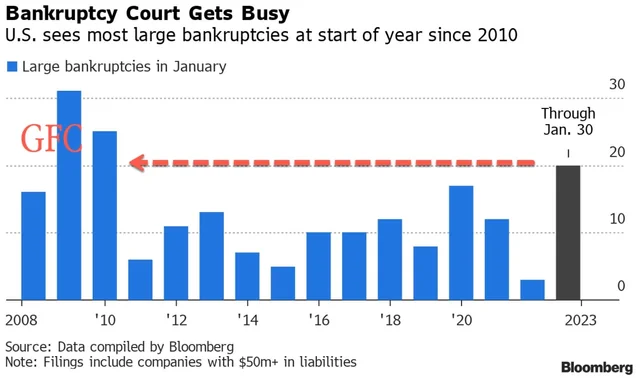

Already (as shown below) through the end of January, large corporate bankruptcies (companies with more than $50 million in debt) have spiked the most since the 2008 financial crisis.

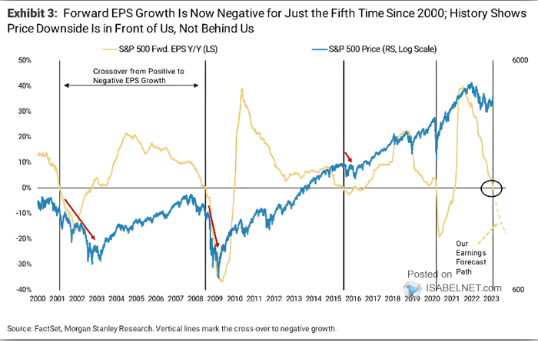

Coming into 2023, forward S&P 500 earnings per share (EPS) growth has turned negative for the fifth time since 2000 (shown below in yellow, courtesy of ISABELNET.com), and the downtrend is forecast to continue (dotted line). Stock prices have always followed EPS lower (S&P 500 in blue), with the bulk of bear market losses happening after the earnings trend crosses from positive to negative (black lines below).

For all the people talking about low unemployment rates being bullish for economic growth and equity markets, the truth is that the unemployment rate (lower line below since 1950) is the most lagging of indicators and has always been lowest at the start of recessions (grey bars below, aka the end of each economic expansion phase). Stock valuations (S&P 500 price-to-earnings ratio is the top line below) typically tumble during recessions as the unemployment rate spikes.

Today, the most historically reliable leading indicators suggest a near certainty of recession within the next 12 months (US 3m-10-year curve is at 100%, far right bar below). The riskiest assets, meanwhile, like junk bonds (HY credit circled below), most commodities (copper below) and stocks, remain in denial, still broadly over-valued.

Highly leveraged financial markets have been trained to hang hope on endless bailouts from central banks. But the economy is the big dog that wags the tail of spending, capital investment, jobs, revenue, and ultimately earnings, not central banks. Moreover, today the US Fed is still tightening financial conditions with monthly QT and possibly more rate hikes. When they move to loosen credit conditions again, it will take many months for the easing efforts to disseminate. A lot of distressed selling is due to occur before then.

More By This Author:

Equity And Corporate Bond Prices Still Screaming Cycle TopBullish Dreams Should Be Tempered By History

Irrationally Exuberant January Comes To A Close