The Fed’s Actions Appear To Be Working…. Or Are They? What Could Be Their Next Moves?

There was an abundance of news this past week, including the Government’s release of CPI, PPI as well as the Federal Reserve minutes that shed light on their thinking and potential future “game plan.”

Let’s dive into these.

CPI (Consumer Price Index):

March CPI showed inflation at 5.0%. This was below the expected rate of 5.2% on an annual basis. Core CPI showed core inflation at 5.6% which was in-line with expectations of 5.6%.

Inflation for the month fell by 100 basis points from 6.0% to 5.0% in March . This is the biggest drop over the course of one month since April 2021. However, we have seen 23 consecutive months with inflation above 5%.

This is the cost of “free” and 0% interest rates.

PPI (Producer Price Index):

March PPI inflation hit 2.7%, below expectations of 3.0%. Core PPI inflation came in at 3.4%, in-line with expectations of 3.4%. PPI inflation fell from 4.9% to 2.7% or 220 basis points, in one month.

This is the largest monthly drop since inflation peaked in 2022. However, February PPI inflation was revised higher from 4.6% to 4.9%. Will March’s be revised upward as well?

The overall PPI inflation rate has fallen from 11.3% to 2.7% since June 2022, less than 1 year ago.

The Federal Reserve minutes:

The Fed also released the minutes from their March meetings which resulted in an additional hike of 0.25% (25 basis points). Here is the summary of those minutes:

- Fed officials lowered target interest rates due to the banking crisis.

- Several Fed officials considered pausing rates in March.

- Fed projects a “mild recession” starting in 2023.

- All officials backed 25 bps hike in March.

- The US Government ran a $378 billion deficit in March.

(In March 2022, the deficit was $193 billion, now up 95%. The YTD deficit is at $1.1 trillion, up 65% since last year. Meanwhile, the debt ceiling has still not been raised. If it is not raised by July, the US will begin to default?

The Federal Reserve was late in raising rates. Here is a reminder of what they said in 2021:

January 2021: Inflation is transitory, recession won’t happen.

May 2021: Recession is unlikely.

December 2021: inflation is not transitory, but recession won’t happen.

May 2022: Recession may be needed to lower inflation.

December 2022: Disinflation started, no recession.

NOW: “Mild recession” to begin in 2023

Is “mild recession the new inflation is transitory?

Guess what? The Fed has been successfully attacking inflation. However, I think they realize that they may have broken “something.” The deficits are exorbitant, and they are now predicting a “mild recession,” which may mean anything from a soft to a very hard landing. (See our recent Market Outlook, “Can The Fed Engineer A Soft Landing?”

Weaknesses are making themselves apparent:

There is a wide cadre of areas of the economy that show weakness. These include regional banking issues, manufacturing, housing, commercial real estate, layoffs (this his past week McDonalds joined the trend of many big tech companies by starting to lay off a huge number of staff). Additionally, retail sales continue to decline y/o/y. To one degree or another, the Fed’s actions have precipitated a significant slowdown.

Clearly, the Fed’s historical, rapid, and unprecedented rise of interest rates is creating the Fed’s desired outcome. Or will the damage be too much for the economy?

Let’s look at just two of these areas reported this past week. Retail sales and commercial real estate:

Retail sales are falling but this is a trend that started with the first Federal Reserve interest rate hikes in late 2021 and early 2022. See chart below:

Commercial Real Estate:

$1.5+ trillion in commercial real estate debt will mature by 2025 while interest rates have skyrocketed. However, there is a much more immediate problem, office vacancies just hit a record high. Many of our biggest cities are sitting on huge office vacancies and companies are now turning to subleasing space at significantly reduced rates just so it does not sit vacant. This is a drag on companies’ operating costs as they sit with millions of square feet of office space.

In San Francisco alone (as one example) there are 13 companies that account for 3.5 million square feet of vacant office space available for sublease. Right now, there is 9.6 million square feet of office space available for sublease in SF. There is also 30 million square feet of vacant space in the city. This is but one example of major commercial real estate problems in the U.S. To put this in perspective, check out the below chart:

Rangebound Markets

The other by product of the Fed’s attack on inflation is the effect it has had on the major financial markets. Both the stock and bond markets have experienced long periods of enhanced volatility and rangebound markets.

We have basically moved sideways for the past year. This trendless market looks like a tug of war between the bulls and the bears. Remember that many retirees are depending on growth of their financial assets for their retirement, and large pension funds need growth to meet their ongoing financial liabilities. As a result, sideways markets eventually take a toll on consumer spending.

See charts below on the S&P 500 and the 20-year Treasury Bonds. Both have stayed in a narrow range for quite some time.

1 year range for S&P 500 Index

Year-to-date 2023 for the S&P 500:

The 20-year Treasury Bonds have also been consolidating in 2023. See chart below. However, if we go into a recession or the Fed lowers rates later this year, as some expect, look for TLTs to break out of this consolidation:

Should We Be Bullish or Bearish?

There are reasons to be bullish and/or bearish. Here are just a few of the overriding principles affecting the markets:

Positive/Bullish:

- Seasonality (April is a good month to be invested…see more below)

- TNA-for investors with a risk appetite, there is really There is No Alternative

- Massive amounts of cash sitting on the sideline. The big up days are FOMO (Fear of Missing Out) where people begin to put some of that money to work.

- Big short positions by large hedge funds and commercial traders. When positive news hits some of their algo based programs begin to close out their shorts and/or go positive

- Inflation is coming down. Any belief that the Fed may be done hiking or that they could lower rates in the future is perceived by the markets to be a positive.

- Earnings expectations (and actual reporting) comes in better than expected

- Pre-election years are almost always positive, dating back to the early 1900s.

- Consumers continue to spend, albeit more slowly and with some restraint.

Negative/Bearish:

- Huge amount of U.S. Debt and a pending debt crisis if not soon resolved.

- Interest rates on short duration bonds (2 years) are attractive and could pull $ away from the market.

- Insurance products with little to no risk are attracting $ away from risk-oriented stock and bond markets.

- Liability driven large institutional funds are decreasing their near-term obligations by investing in risk-free or lower risk capital markets.

- A more cautious investor who has been burned in the last 10 years does not want to take on additional risk.

- We are going through a credit crunch, and it is keeping investors much more conservative.

- The stock market still seems overpriced given earnings levels in relation to price-earnings ratios.

- Recession concerns could take stocks down another notch.

Tech Stocks have been the best place to be so far in 2023:

There are a few reasons that Tech has been the darling so far in 2023. For one, they were the most “beat up” last year and were probably selling at more attractive multiples at the end of 2022 than most other sectors. These growth stocks took a backseat to value stocks (and energy) during 2022 so they had the best potential to “bounce back”.

Secondly, the balance sheets of these companies are more pristine and cash flow positive than a large swath of other companies that could be more affected by rising interest rates. Also, given the weakness exhibited among regional banks and the financials (another ill effect of the Fed’s policy and one of the things they broke), money rotated out of Bank stocks and into world class, multinational mega tech companies (Nvidia, Google, Microsoft, Apple, and others).

However, for the past two weeks tech has been in a stalemate, and it too is now in a rangebound market. See chart below:

What’s Working? Fast cars and burgers:

Ferrari and McDonalds are doing just fine. The wealthy are buying expensive cars and consumers are looking for food at value pricing. See chart below:

What does the remainder of April hold?

As we have pointed out on other occasions, April is a bullish month to be invested in the stock markets but most of its strength is typically felt in the 2-3 weeks leading up to earnings, which began in earnest last Friday (major banks reported on Friday).

April has gained ground 52 of 73 years since 1950, more than any other month except December. April’s annualized return since 1950 is 18.08% and ranks 3rd among all calendar months in terms of annualized return.

Here is a breakdown of the annualized performance of the S&P (since 1950) during the month of April by weeks.

April 1-18 +31.47%

April 19-24 -8.53%

April 25-30 +10.02%

A follow-up on Gold:

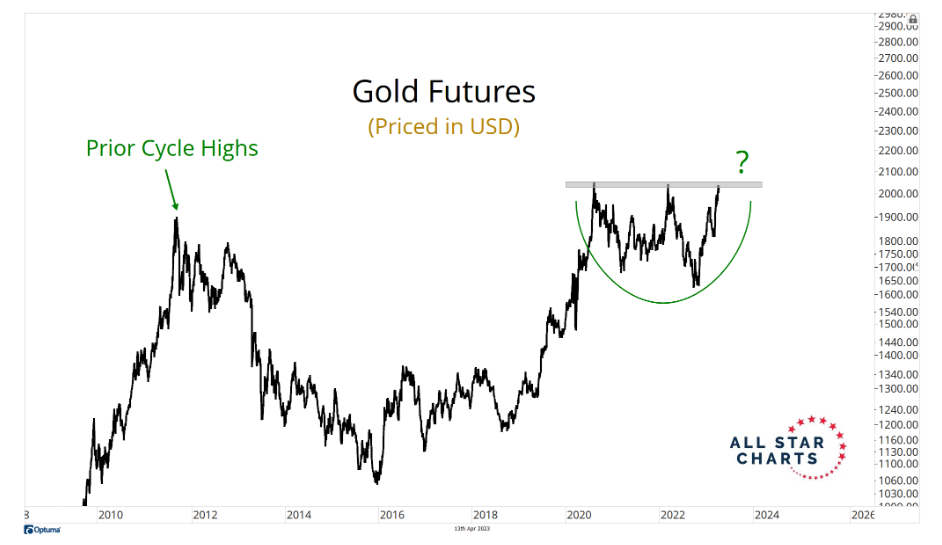

Last week we shared with you a detailed look on the abandonment of the U.S. Dollar and how that could benefit Gold, Silver, and other metal prices (as well as commodities). Gold continued its rise this past week (until Friday when it hit resistance). Will it break out? Will it rise above its prior highs established many years ago? See charts below:

Friday’s move was expected:

You might be surprised to learn that in other countries currencies, Gold has surpassed the old highs, has broken out and is at historical new highs. See chart below:

You might also be surprised to learn that the last time Gold broke out to new highs in the U.S. it outperformed the S&P 500 for 11 years. Are we about to see this again? See chart below:

Speaking of other commodities, you might also be surprised to learn the fate of Coffee and Sugar which recently hit new highs. Mish often comments that as food becomes more costly, many people turn to lower costing options or “junk” and that shows up in sugar futures contracts continuing to rise. See chart below:

Wrapping it up:

We are in an unusual period where it is difficult to predict what the next market moves might be. Given the financial uncertainty plaguing the U.S. right now, an outcome for the next 6-12 months is very difficult to predict.

We have not even factored in the geopolitical unrest and what could occur if there was a larger military incursion. (We have learned this week that we are much more involved in the Ukraine War then this administration led us to believe).

These are times when you need to rely on strict investment discipline.

More By This Author:

Is The World Ditching The U.S. Dollar? What Investments May Benefit The Most?

Can The Fed Engineer A Soft Landing? The One Key To Your Investment Success!

It’s A Confusing Economic Picture. What To Do Next?

Disclaimer: The information provided by us is for educational and informational purposes. This information is based on our trading experience and beliefs. The information on this website is not ...

more