The Fed Is WAAAAY Behind The Curve On Inflation

Inflation is ROARING.

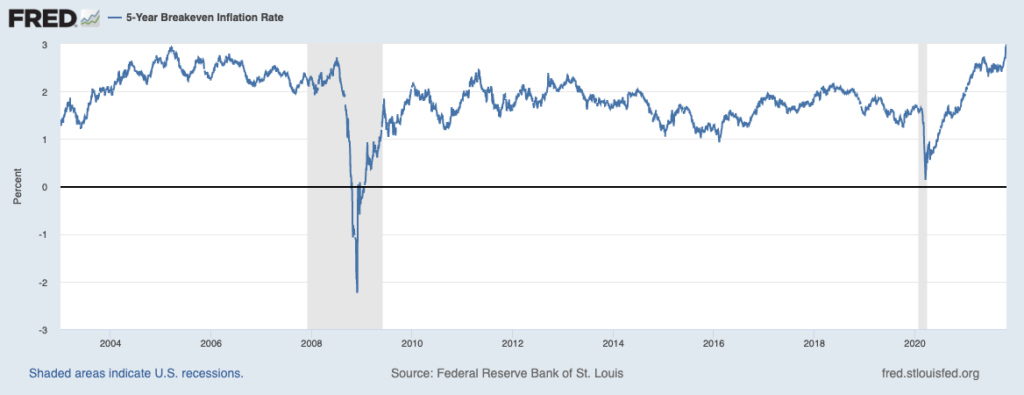

Five year breakevens, which is a key inflation measure, just hit a new all-time high of 3.0% (started in 2002). Inflation expectations running out to five years are now higher than at any point in the last ~20 years.

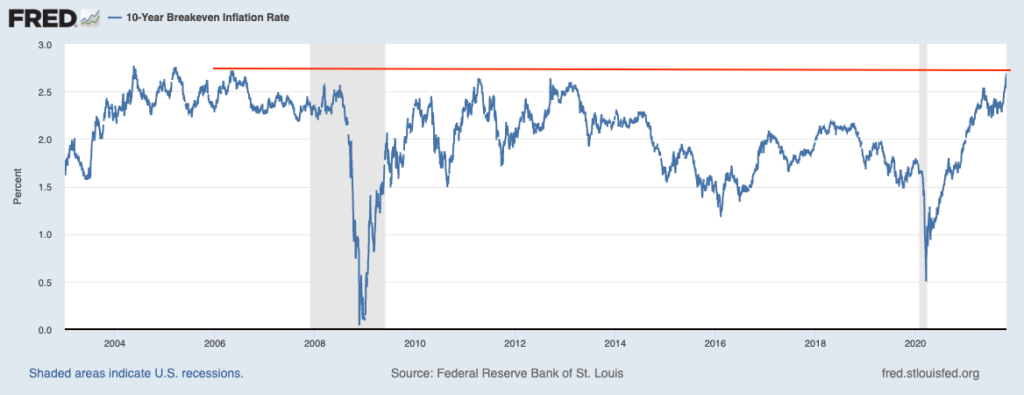

Unfortunately, that’s not even the end of the bad news. The 10-year breakeven rate (inflation expectations 10 years out) hit 2.7044% this week.

This is noteworthy first and foremost in that it is higher than the previous peaks experienced in 2011, 2012, and 2013. Indeed, the last time 10-year breakevens hit 2.7% was in 2006.

At that time the Fed was actively hiking rates: Fed Funds rates were 4.75%, on their way to 5.25%.

Today, Fed funds rates are at zero and the Fed is running a $120 billion Quantitative Easing (QE) program: the single largest monthly QE program in the Fed’s history. Even more incredibly, the Fed has been staging a public debate as to whether it needs to taper this program… for months.

Put simply, there is NO signal that the Fed is going to stop inflation from roaring.

For more market insights and investment ideas, swing by our FREE daily e-letter at www.gainspainscapital.com.