The Fed Cannot Allow Another Lost Decade

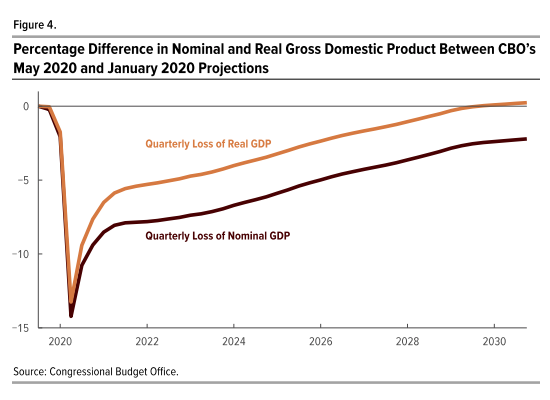

The CBO has a new report where they update their forecasts for real and nominal GDP growth during the 2020s:

Of course this is just one projection, but it’s in line with what I see elsewhere, both among forecasters and in the financial markets. The Fed should not allow this to happen.

You might argue that there’s nothing the Fed can do to prevent a big drop in RGDP. I agree, but the decline in NGDP, especially in the out years, is totally unacceptable. And this will make the fall in RGDP even worse than it needs to be.

It looks to me like they’ve lowered their forecast for 2030 prices by roughly 2.5%. There’s no reason why the Fed should allow the current pandemic to reduce inflation by 0.25%/year for the next 10 years. Yes, almost all of that shortfall is expected to occur in 2020 and 2021, but in that case the Fed needs to make up the shortfall with above 2% inflation in future years. The CBO does not expect this, nor do private forecasters (AFAIK), nor do the TIPS markets, nor do I.

I was appalled when in 2008 and 2009 the economics profession as a whole seemed complacent about Fed policy. It was obvious that NGDP would remained depressed for many years, and very few people were calling for a much more expansionary Fed policy. That’s why I got into blogging.

Now it’s widely expected that the Fed will again allow a lost decade, and I see no sense of urgency in the Fed, in the economics profession, in the government, in the media, or anywhere else to do anything about it. Where are the calls for level targeting?

Where’s the outrage?

If the financial economy had strength, we could tolerate rising interest rates. But the Fed is happy with the new normal. As long as deflation doesn't take over they are happy with slow growth and little economic opportunity down on mainstreet.

The Fed may be happy with this slow growth. I'm not.

It is mostly about protecting the collateral.