The Fear Trade Puts Gold In The Limelight

The sharp spike in gold prices is almost entirely explained by an increase in fear-related demand for gold. This is in line with the fall in the 10-year real rates. Fear is the key medium as the short-term driver for gold.

The catalyst for the current rise in ‘fear’ is not only banking and funding stress, to levels last seen in March 2020, but also a sharp rise in the market-implied probability of a US recession in the next year. With bank deposits at smaller regional banks now declining at speed and risks of this capital flight persisting, there is a direct pass-through to the real economy via higher funding costs that is hard to ignore.

The fact that macro markets have become unusually fragile or ‘gappy’ in the recent period, likely driven by policy uncertainty, positioning risk and illiquidity, could further fuel fear-driven demand for gold, suggesting this may be a slow grind higher for gold prices from current levels. In particular, uncertainty over when central banks will eventually pivot in the face of record macro data volatility may prevail, fueling the risk of sharp, hard-to-anticipate and uncharacteristically large moves in asset prices.

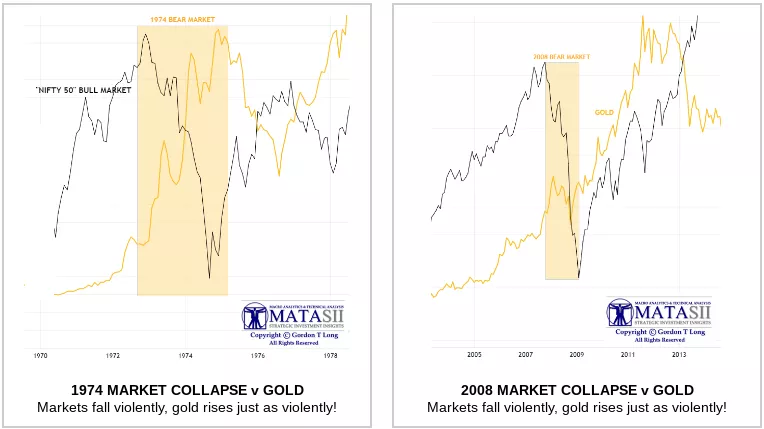

For Gold to continue its dramatic rise from current levels then one or both of the following must occur:

- The Fed must beginning cutting rates as it did in 1974 and 2008

- The Geoeconomic Macro Trade must "kick-in".

1- FED FUND RATE CUTS

2- THE GEOECONOMIC MACRO TRADE

The primary reason for gold prices to sustainably detach from the underlying shorter term variables in gold pricing is if central banks (particularly the Fed) lose control over the monetary environment. Thus, it seems that the gold market is now pricing in a significant risk that the Fed can’t get inflation back under control.

As the long term charts below suggest, gold is nearing overhead resistance. "Fear" can only take gold so far before the issue of out of control inflation and a falling dollar must be the drivers.

READ:

CHART:

The chart below will help you recognize technically when that has occurred versus what the media is reporting and telling you as the currently "accepted" narrative.

.webp)

More By This Author:

All Economic Indicators Don't Lie

Global Economic Problems: China, Japan & EU

What Q2 Earnings Revealed