The "Fallen Angel" Avalanche Arrives: S&P Downgrading Companies At Fastest Pace On Record

Last week, the rating agencies - which during the financial crisis were accused, and for good reason, of being too slow to respond to the deterioration in credit fundamentals - vowed that they would be much faster in taking the hammer to credits that are due for a downgrade, with Moody's telling Reuters it would review its entire universe of corporate ratings "with a slew of downgrades or downgrade warnings on the cards."

Well, the raters weren't kidding, because around the time Ford (F) became the biggest fallen angel in the current cycle (and second largest ever) when S&P downgraded the auto giant to junk last night ...

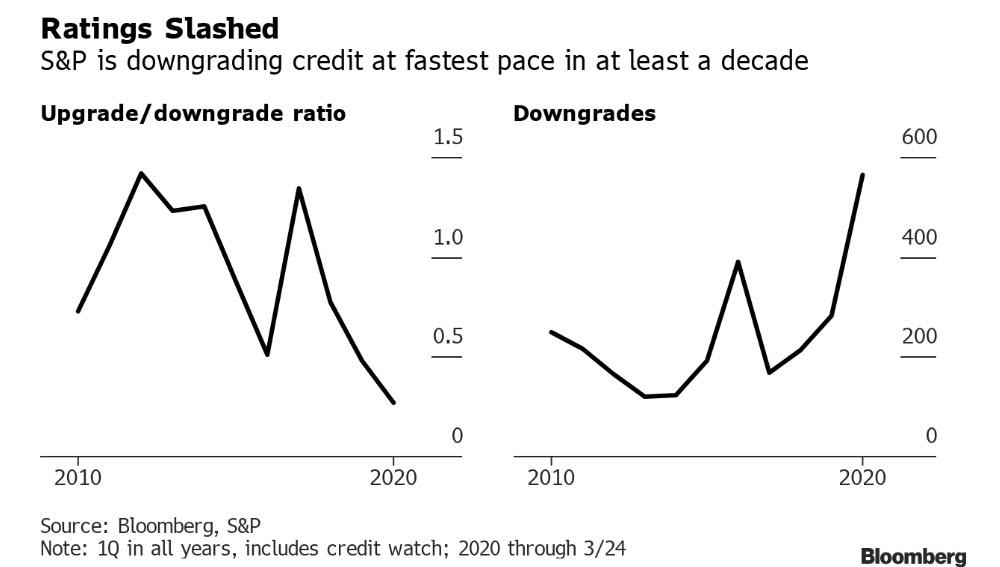

... we learned that - true to its word - S&P was slashing and burning corporate ratings at the fastest pace on record as it struggled to keep up with the cratering US economy and cash flows.

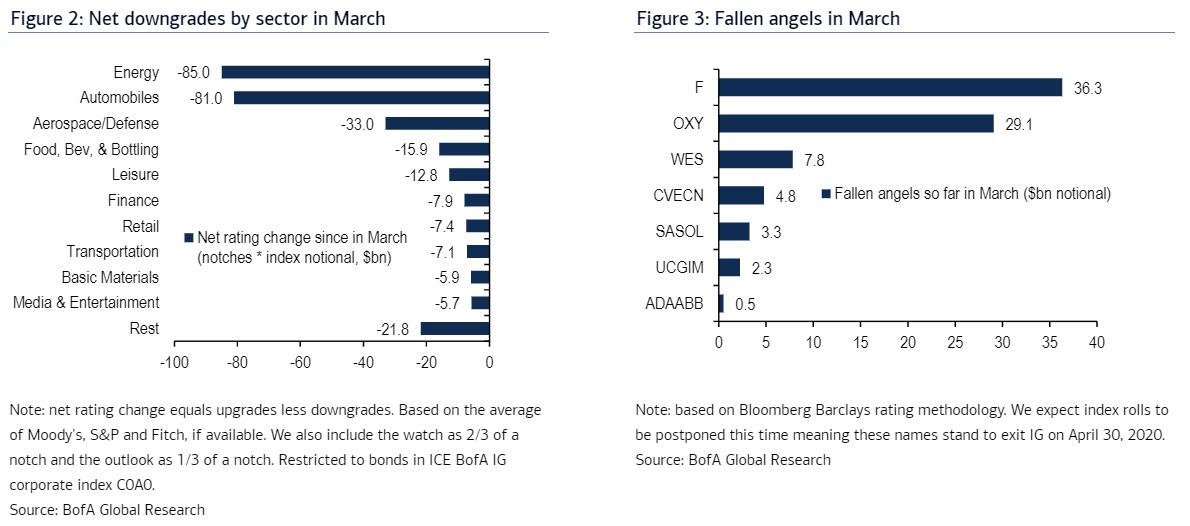

As BofA (BAC) calculates, net downgrades (downgrades less upgrades) so far in March have totaled $284BN, with the Energy sector leading ($85bn, or 30% of the total), followed by Autos following Wednesday's downgrade by both Moody's and S&P ($81bn) and Aerospace/Defense ($33bn).

In terms of actual rating events, S&P has already done 565 downgrades this quarter, up from 351 in 4Q and 281 in 1Q last year, per Bloomberg. That’s the most since records began in 2010 and far exceeds the prior quarterly peak of 390 in 1Q 2016. Its ratio of upgrades to downgrades fell to 0.27, the lowest on record. Moody’s is running a bit slow with "only" 342 cuts, which is still the most for a quarter since 2016. Fitch has done 192 downgrades this quarter, its most since 2012.

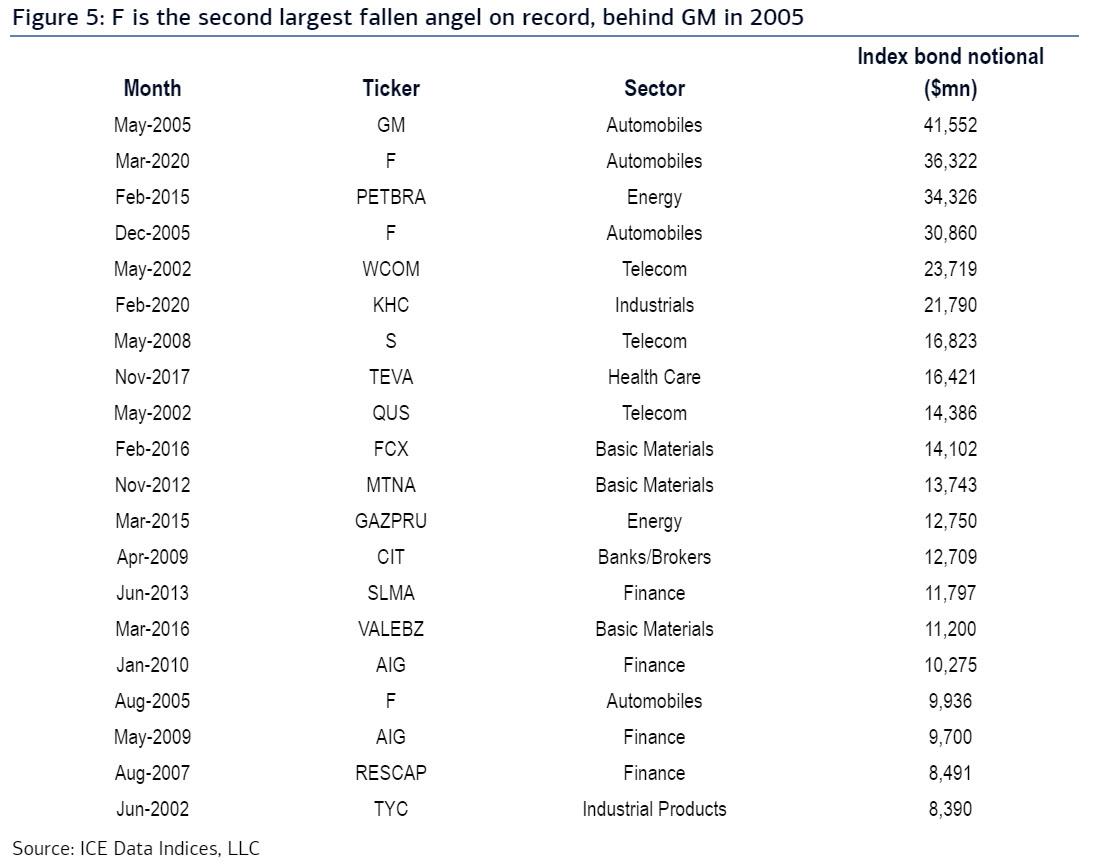

Meanwhile, the "fallen angel" avalanche we have been predicting for years is finally coming true, and has totaled $84bn in March (based on Bloomberg Barclays rating methodology), led by F today ($36bn), OXY ($29bn) and WES ($8bn).

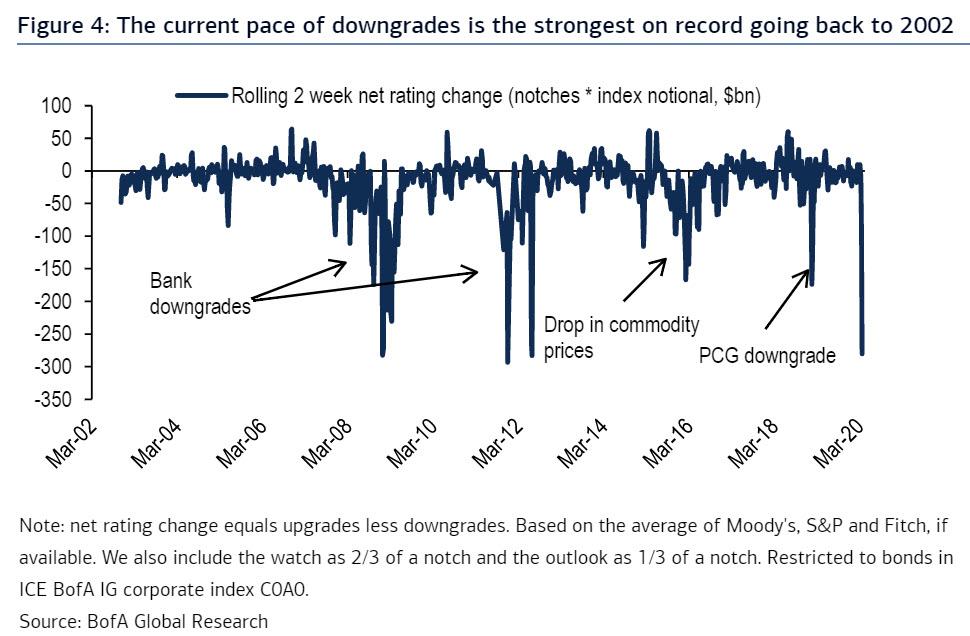

As a result the current two-week pace of downgrades is approaching the fastest on record going back to 2002...

... and as Bloomberg notes, "expect a lot more corporate downgrades and fallen angels"as the economic damage spreads, as the impact of plunging earnings and spiraling funding costs are tallied. The silver lining is that the credit market may be overshooting on illiquidity and panic selling, which means discerning investors could probably make some good money especially with the Fed backstopping IG, although as BBG concludes, "a lot of bonds are still trading at levels suggesting there’s another big wave of downgrades to come."

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more

When I bought $LVS it was under $2 in March 2009. A bit different time then but in essence same song and dance.

The only way I would touch casinos now is if they get more heavily discounted. I like casinos though. They are full of cash and print money during boom times. Time to buy them is in down turns.