The “Excellent Opportunity” In The Energy Sector

Image Source: Unsplash

It’s no secret that artificial intelligence gobbles up energy like the Cookie Monster on a bender shoveling baked goods into his face. It’s also no secret that China and the U.S. are in a race to AI dominance that may make previous conflicts look like child’s play in comparison.

While Eisenhower may have gotten the credit for the Allies’ victory on D-Day, it was the privates scrambling out of the landing craft that got the job done. It’s the same with AI. Chips made by companies like Nvidia (NVDA) get all the glory, while it will be energy that will do the heavy lifting.

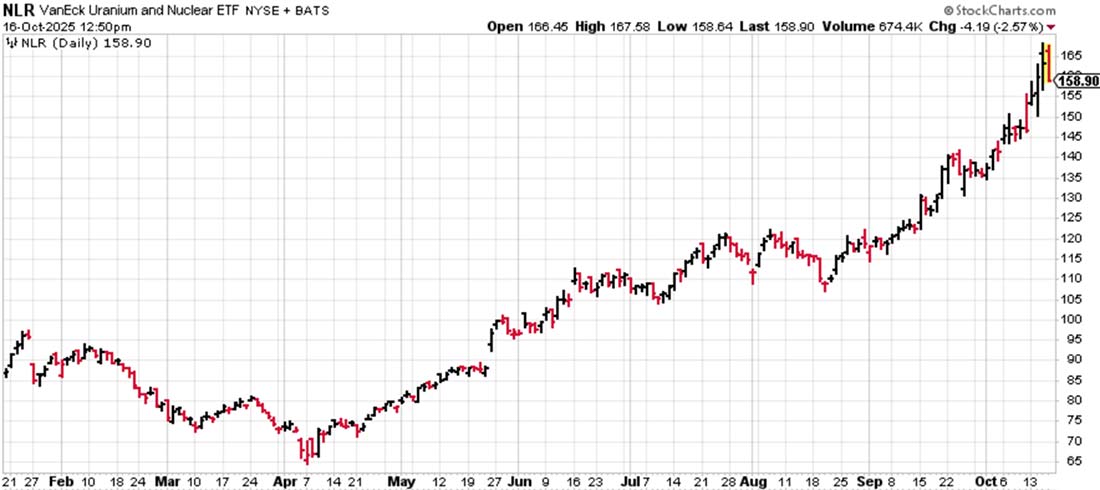

That’s why President Trump is pushing for more development of nuclear energy and encouraging oil companies to drill. As a result, nuclear stocks have gone, well, nuclear.

Even though Trump is trying to squash alternative energy, investors know that AI will require every bit of energy that can be produced, whether it’s from fossil fuels, nuclear, or solar and wind. As a result, solar stocks have also moved up sharply.

Meanwhile, oil and gas stocks have gone nowhere. They’re pretty flat for the year. And that gives us an excellent opportunity.

Over the past 20 years, the price of oil has gyrated back and forth between roughly $20 and $100 per barrel (there were a few outliers, like when oil prices briefly went negative and when they spiked to $147). Lately, it’s barely above $60, which means quality oil stocks are on sale.

Companies like small-cap Precision Drilling (PDS) have been trading at less than six times free cash flow. The company generated $150 million in free cash flow over the past 12 months. Despite Precision’s earnings being projected to grow 298% over the next five years, the stock has been trading at just 11 times forward earnings.

Tidewater (TDW), which provides vessels for offshore oil drilling, also generates plenty of cash flow and has been trading at a big discount at less than nine times free cash flow and 13 times forward earnings.

Lastly, one of my favorite companies, Enterprise Products Partners (EPD), which operates pipelines to transport oil and gas, pays a 7% tax-deferred dividend and is on pace to generate nearly $8 billion in distributable cash flow, which means the stock has been trading at just eight times cash flow.

Whatever trend is hot in the market, I like to dig a little deeper to find the value and the companies that are vital to the new technology. Energy is that sector in the booming AI space.

More By This Author:

Is B&G Foods’ 17% Yield Delicious… Or Dangerous?

MPLX: An Oil And Gas Partnership With A Strong 7.8% Yield

The Right Way To Own Small Cap Stocks