The Everything Bubble Has Burst; Can The Fed Patch It?

Yesterday I asked, just what exactly is terrifying the Fed?

As a brief recap, there are three main issues grabbing their attention.

1) The collapse of German banking giant Deutsche Bank (DB).

2) China’s banking system entering a credit freeze.

3) The bursting of the Everything Bubble.

Of the three, it is the third that is most terrifying for the Fed.

After the 2008 crisis, the Fed attempted to reflate the financial system by creating a bubble in US Government bonds, which are also called Treasuries.

These bonds are the bedrock of the current financial system. And their yields represent the risk-free rate against which all assets, stocks, commodities, mortgages, etc. are valued.

So when the Fed created a bubble in Treasuries, it was actually creating a bubble in EVERYTHING.

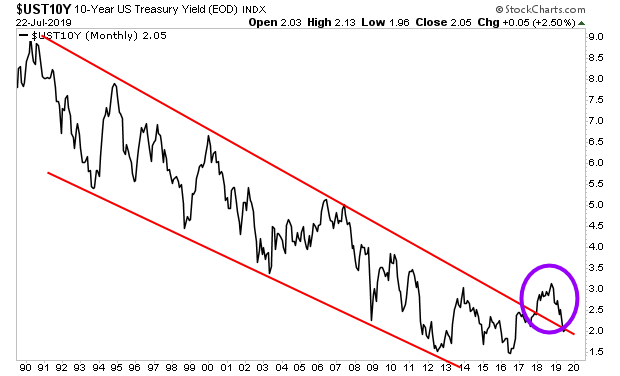

And last year, it BURST, when the yield on the 10-Year US Treasury broke its 30+ year downtrend (purple circle in the chart below).

This is what panicked the Fed.

Why?

Because if the Everything Bubble blows up, so does the entire financial system.

- We’re talking a stock market crash worse than 2008.

- Oil falling to $10-$20 per barrel.

- Real estate prices falling 30%+

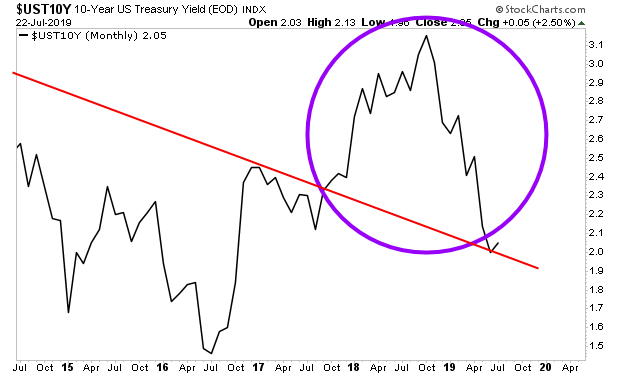

This is the situation the Fed is now desperately trying to stop. As you can see in the below chart, the Fed’s efforts are working… for now.

The yield on the 10-Year Treasury fell to retest its long-term trendline last month. But it has YET to break below this line.

And that’s why the Fed is panicking… talking about cutting rates an incredible 50% next week.

For more market insights and investment ideas, swing by our FREE daily e-letter at www.gainspainscapital.com.

The Fed wants two things, high asset prices and low wages. Low wages are threatened by isolationism. But so far, Trump is afraid to totally isolate the USA. He should be afraid.