The Earnings Picture Refuses To Weaken

Image Source: Unsplash

There is no shortage of market skeptics who see this year’s gains as without a fundamental basis and support.

The skeptics justifiably point to the market’s narrow leadership in the mega-cap Tech players as a major argument why they don’t see the rally having sustainable legs. This is a fair point, though it’s important to note that we are seeing other parts of the market join the leadership team recently.

The bears assign much greater odds to the recession risk, which they see as grossly mispriced in the market. They see the inflation problem as being more ‘sticky’ than the market appreciates and see significant downside risks to current consensus earnings expectations.

Recessions are notoriously hard to predict, and this ‘coming recession’ has proved harder than most.

Without a crystal ball, it is hard to know with certainty what lies ahead in the macroeconomy. But most mainstream economists are lowering their recession odds, though they all see above-average risks of economic trouble. With inflation steadily coming down and the labor market staying fairly strong, many in the market are starting to assign bigger odds to the ‘soft landing’ scenario.

We are seeing some early evidence of this in the real-time earnings estimate revisions data as well.

Regular readers of our earnings commentary know that we have consistently been flagging a favorable turn in the revisions trend since the start of 2023 Q2, with earnings estimates stabilizing in the aggregate after consistently coming down for almost a year and actually starting to go up for some key sectors.

This combination of favorable macroeconomic developments and optimism about the transformational power of artificial intelligence (AI) seems to be driving market optimism.

To get a sense of what is currently expected, take a look at the chart below that shows current earnings and revenue growth expectations for the S&P 500 index for 2023 Q2 and the following three quarters and actual results for the preceding four quarters.

Image Source: Zacks Investment Research

The -9.5% decline in Q2 earnings today is down from -7.2% at the start of the quarter, with estimates for 12 of the 16 Zacks sectors coming down. The biggest cuts to earnings estimates have been for the Energy, Aerospace, and Consumer Discretionary sectors.

On the positive side, Q2 earnings estimates increased for the Transportation, Tech, Construction, and Industrial Products sectors.

Please note that while 2023 Q2 estimates have come down, the magnitude of negative revisions compares favorably to what we saw in the comparable periods of the preceding couple of quarters. In other words, estimates haven’t fallen as much as they did the last few quarters, not only for Q2 but also for the rest of the year.

As noted earlier, we have been pointing out a notable stabilization in the revisions front lately, which roughly coincided with the start of Q2 in April 2023. This was a shift in the overall revisions trend that had been in place for almost a year before that.

Getting back to the 2023 Q2 expectations, embedded in the aforementioned earnings and revenue growth projections, is the expectation of continued margin pressures, which has been a recurring theme in recent quarters.

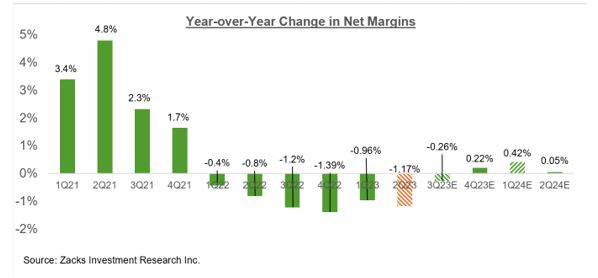

The chart below shows the year-over-year change in net income margins for the S&P 500 index.

Image Source: Zacks Investment Research

As you can see above, 2023 Q2 will be the 6th consecutive quarter of declining margins for the S&P 500 index.

Margins in Q2 are expected to be below the year-earlier level for 11 of the 16 Zacks sectors, with the biggest margin pressure expected to be in the Basic Materials, Construction, Energy, Medical, Conglomerates, Autos, Aerospace, and Tech sectors.

On the positive side, the Finance sector is the only one expected to experience significant margin gains, with the Consumer Discretionary sector as a distant second. Sectors expected to be essentially flat margins relative to 2022 Q2 are Retail, Utilities, and Industrial Products.

The chart below shows the earnings and revenue growth picture on an annual basis.

Image Source: Zacks Investment Research

As noted earlier in the context of discussing the revisions trend of 2023 Q2 estimates, we have been observing a notable stabilization in the revisions trend since the start of April 2023.

This stabilization in 2023 earnings estimates represented a notable reversal in the persistently negative trend that had been in place for almost a year. Current expectations for 2023, as represented by the above chart, are down -13.5% since the April 2022 peak.

Since the start of 2023 Q2 in April, aggregate earnings estimates for 2023 are essentially flat, with 9 of the 16 Zacks sectors enjoying positive estimate revisions in that time period. Sectors enjoying positive estimate revisions since the start of Q2 include Construction, Industrial Products, Autos, Tech, and Retail.

Q2 Earnings Scorecard

The Q2 earnings season will really get going with the July 14th quarterly release from JPMorgan (JPM) and the other big banks. But the Q2 reporting cycle has officially gotten underway already, with results from 18 S&P 500 members already out. All of these 18 index members have fiscal quarters ending in May, which we and other data vendors count as part of the June-quarter tally.

In fact, by the time JPMorgan comes with its quarterly results, we will have seen such Q2 results from almost two dozen S&P 500 members. Nike (NKE - Free Report) is the latest index member that came out with fiscal May-quarter results recently, with Adobe (ADBE - Free Report), FedEx (FDX - Free Report), and others included among the 18 that have reported already.

Total Q2 earnings for these 18 index members are down -21.5% from the same period last year on +0.6% higher revenues, with 83.3% beating EPS estimates and 66.7% beating revenue estimates.

This is too small and unrepresentative of a sample to draw any conclusions from. Still, the comparison charts nevertheless put the Q2 results from these 18 index members with what we had seen from the same group of companies in other recent periods.

Image Source: Zacks Investment Research

More By This Author:

Q2 Earnings: What Can Investors Expect?

Q2 Earnings: An Early Preview

Breaking Down The Big 7 Tech Players' Outsized Roles

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more