The Day The Dollar Crushed Everything

The way markets usually work is that on any given day (or in any given year) some asset classes are up while others are down. Investors and money managers, as a result, are always torn between the impulse to pile into the best looking sector (greed) and to guard against the unexpected by diversifying (fear).

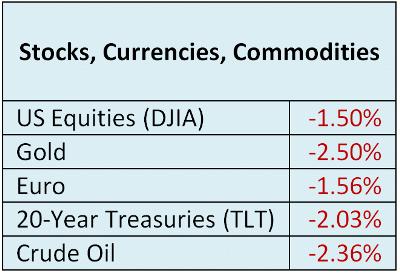

But sometimes it doesn’t matter what you invest in because the only safe asset is cash under the mattress. Friday, March 6 is looking like one of those days. Some major asset classes as of noon:

These are really big moves for stock indexes, currencies and commodities, but the real carnage is in related stocks and bonds, where losses of 5%-10% are common.

What does this mean? That depends on whether today is just a blip in the long, generally-positive trends that have dominated the financial markets for the past few years, or whether it’s a sign that US interest rates are finally ready to go up, ending the era of preternaturally easy money for governments and corporations. If the latter then there are some serious air pockets under a whole range of stocks and bonds.

Then the question becomes: How bad does it have to get before the US backs off and rejoins the currency war? Probably not too bad. Another few days like this should be all it takes for the “rising interest rates in June” meme to be walked back.

So the “good news is bad news” attitude of the markets could easily give way to its opposite, where the worse the day, the closer we come to the next round of QE and falling interest rates. The perversity of the whole thing feels overwhelming at times. But like most disruptions in the natural order, it’s temporary. A system with this much debt can’t tolerate normal interest rates. But it also can’t tolerate steadily rising leverage. So this too (whatever it is) shall pass.

Disclosure: None.

That about sums it up and with Fed increasing rates in the not so distant horizon we may see a Trilogy.