The Curious Case Of The Hedge Fund That Made $700 Million On GameStop

While retail was "sticking it to the suits" - the actual suits at hedge fund Senvest Management were about to net a cool $700 million on GameStop's (GME) run higher.

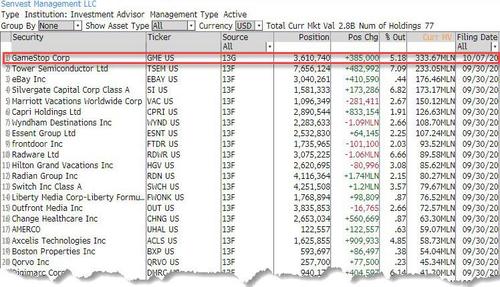

Senvest holding as of Oct 7, an oddity considering many within the hedge fund world at the time viewed it as a potential bankruptcy candidate - hardly a prudent move from a fiduciary standpoint, unless Senvest had a plan... and boy did it have a plan.

But let's back up.

Senvest principles, Richard Mashaal and Brian Gonick, started buying GME stock equity in September, the Wall Street Journal report reveals, just weeks before they had accumulated a massive 3.6 million shares making Gamestop the fund's largest holding. Mashaal told the Journal: “When it started its march, we thought, something’s percolating here. But we had no idea how crazy this thing was going to get.”

In retrospect, he just might have had an idea.

GameStop turned into the firm's most profitable ever investment by dollars earned and IRR. Senvest's fund has ballooned from $1.6 billion to $2.4 billion as a result of GameStop's move and, for the month of January, the fund was up 38.4%. Gamestop is also the reason why Senvest is currently the top performing fund tracked by HSBC's popular Hedge Weekly report.

Thomas Peterffy, chairman of Interactive Brokers, noted what many had suspected: “It is not just little people on the long side here. There are huge players playing both sides of GameStop.”

Richard Mashaal, left, and Brian Gonick made $700 million in GameStop in just three months.

He was right. Senvest says their interest in the name was "piqued by a presentation from the new GameStop chief executive at a consumer investment conference in January 2020." The Journal writes:

But as they spoke with management, sussed out competitors and noted the involvement of activists in the stock, including Chewy Inc. co-founder Ryan Cohen, they eventually started buying. By the end of October, Senvest owned more than 5% of the company, paying under $10 a share for the bulk of the stock.

They thought that if GameStop could hold on until the next generation of videogame consoles came out and stoked demand for games and accessories, the company would get a boost. And they reasoned that if Mr. Cohen could help transform GameStop from a largely bricks-and-mortar operation into an online gaming destination, the company could be worth far more.

Sure there are fundamentals, but we doubt that was the reason for the accelerated accumulation of GME stock by Senvest. Something tells us there were other factors that prompted the urgent buying spree, especially since the original "short burn of the century" article on Reddit which sparked the retail interest in the name, appeared in early September right around the time Senvest started acquiring shares, according to the Journal. One almost wonder if the two aren't linked.

The post reads: "Sup gamblers. Feel bad about missing the gain train on TSLA? Fear not - something much greater and stupider is here. You know Citadel? The MM that took all our money today? Well now we finally won’t be at the mercy of the MMs. Instead, we’re going to temporarily join forces with the Galactic Empire and hijack the death star."

The post then launches into a relatively sophisticated explanation of the hows and whys of orchestrating a short squeeze:

The this turn around is going to make TSLA's short burn look like warm afternoon tea.

Why? Well, most short squeezes are mostly math. This one is special because we have math AND great underlying news.

To be clear, this will happen whether or not we participate. I prefer us idiots to be a part of history. Here’s what’s up:

Short interest:

GME currently has between 85% - 99.8% short interest, depending on what site you use. For context, 20% is already considered high as the moon. TSLA and NFLX were around 30-40% at their peak. But GME’S ACTUAL SHORT INTEREST IS OVER 110%.

Here is a simple way of framing the timeline:

- Senvest made $700MM on GME.

— zerohedge (@zerohedge) February 5, 2021

- "Richard Mashaal and Brian Gonick started buying GameStop Corp. shares in September" - WSJ

- the r/WSB post "Greatest Short Burn of the Century" hit on Sept 8 https://t.co/fKOc2NDeb8https://t.co/HQuZMcoAEG pic.twitter.com/a3yJOiXkUg

Just a few months later, in December the GameStop long thesis got a major boost among both the retail (outside of WSB) as well as C-grade institutional community, when Hedgeye, which sells research to clients, pitched the name.

On Dec. 17, when GME stock closed at $14.83, Hedgeye told its clients that GameStop was one of their "Best Ideas" and held a presentation as to why the equity, then trading at $14.83 could eventually be worth $100. What Hedgeye's clients did not know - according to the WSJ - is that Senvest had pitched the idea to them.

Of course, for Hedgeye it would be a knockout blow if it emerged that the firm wasn't an "independent provider of research" but middle-man and facilitator for hedge funds who had put on trades and then used Hedgeye's client network as an amplification system... similar to what many accuse hedge funds of doing to r/wallstreetbets right now. Which is why the advisory denied that the upgrade was prompted solely by Senvest's whispers (we can only assume that Senvest is also a client): “I respect Senvest a lot. We vetted it independently and we came up with a similar conclusion,” said Hedgeye analyst Brian McGough said.

In any case, by late December - between wallstreetbets and Hedgeye clients, the thesis was already widely spreading among the retail community, a process that would eventually culminate with the explosion of the stock price in late January. Why? Because the prevailing narrative was one where one or more hedge funds would never be able to cover their shorts because there was not enough shorts available in the float to cover, a process the world first encountered with Volkswagen, leading to a huge squeeze that briefly made Volkswagen the world's most valuable company. A squeeze "process" which, incidentally, Senvest was all too familiar with. The WSJ writes:

Messrs. Mashaal and Gonick had been on the wrong end of short squeezes before at Senvest. One case was with opioid maker Insys Therapeutics Inc., though they ultimately made money on their short position. GameStop’s stock could soar if it got caught up in a situation in which its rising price forced bearish investors to start buying back shares to curb their losses, they thought.

They thought... and they were right. All they needed was the critical mass of buyers to ramp an initial buying cascade which would then trigger the squeeze and the rest is history. That's precisely what happened in mid to late January, when the stock price exploded from $20 to over $500.

Unable to believe their eyes (or perhaps knowing precisely how such a massive short squeeze would play out) Senvest was just waiting for the catalyst to dump it all. They got it on on January 26, when Tesla CEO Elon Musk joined the stock-pumping fray and Tweeted out: "GameStonk!!".

“Given what was going on, it was hard to imagine it getting crazier,” Senvest's Mashaal concluded.

And here's who made sure that a hedge fund would make $700MM on GME https://t.co/7ylfMYWF4P pic.twitter.com/CqdSQX8xJZ

— zerohedge (@zerohedge) February 5, 2021

So just a series of very lucky coincidences leading up to a record, $700 million payday, or a masterfully executed plan that was laid out and executed far better than most Hollywood scripts?

We hope to have the answer once Congress holds its Gamestop hearings, although considering that Maxine Waters is in charge we won't be holding our breath.

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more

WOW! It reads like a good action plot, which it seems to be just what happened. A bit of planning and a bit of plotting and then a bit of misleading and the stage was all set. Quite a scheme to make lots of profit.

How much of it was totally legal and how much was NOT is an interesting question.

Thanks for a post that was both educational and exciting.