The Cost Of Owning A Home Is Soaring

Image Source: Unsplash

We all know that buying a house is now unaffordable, but owning a house is increasingly unaffordable, too. Gordon Long and I have laid out the sobering explosion of the costs of homeownership, a rise that shows no signs of slowing, much less reversing.

It would be nice to attribute it all to one source or one villain, but alas, it isn't that easy. Costs are rising across the board for many reasons, none of which are reversible by enacting a policy tweak or two.

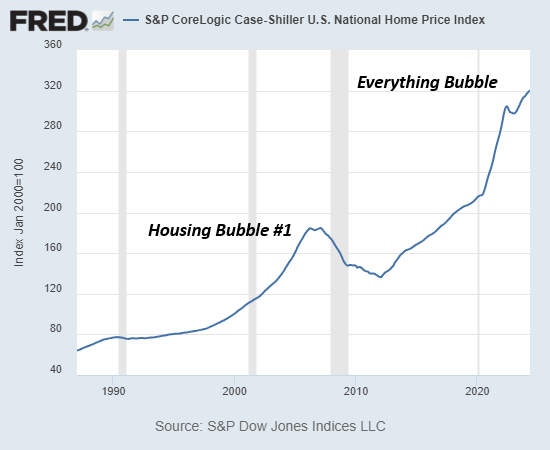

For context, let's start with inflation since 2020 and the cost of buying a house. Truflation pegs the aggregate inflation (a.k.a. loss of the purchasing power of the US dollar in our domestic economy) at 26% since January 2020. All else being equal, we would expect the cost of housing to have risen by about 25%.

But according to the Case-Shiller national housing index, which tracks the purchase prices paid for each house over time, housing costs rose an eye-watering 45% since January 2020, as the index soared from 220 to 320.

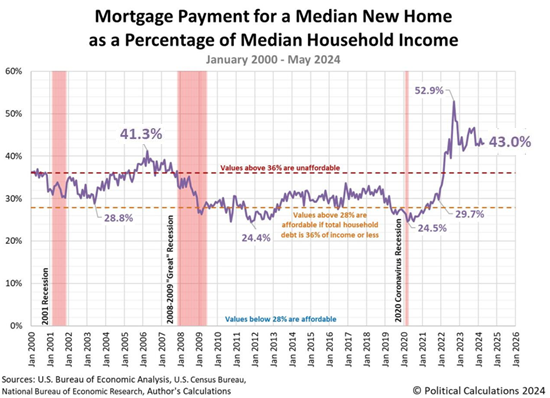

Traditionally, the primary cost of home ownership everyone tracks is the mortgage payment, the famous monthly nut of principal and interest, which of course goes up with the purchase price and the interest rate of the mortgage.

As we all know, both the purchase price and the interest rate have gone up significantly, pushing the mortgage payment as a percentage of median household income up to levels that exceed the previous peak in Housing Bubble #1 circa 2006-08.

If inflationary pressures remain elevated and the bond market isn't buying the "inflation is fading" story, then mortgage rates might not drop even if the Federal Reserve cuts the Fed Funds Rate.

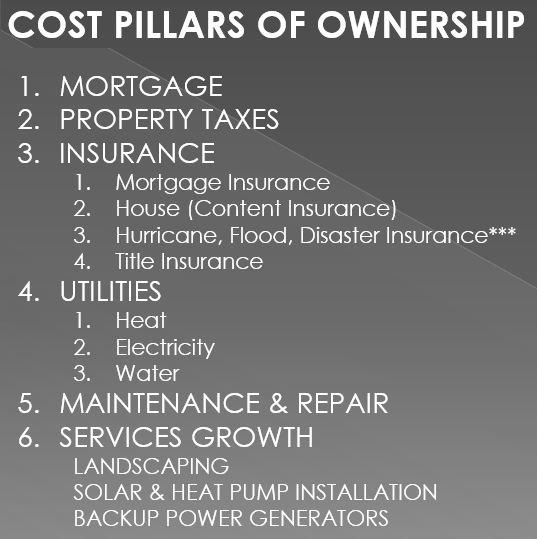

But the mortgage payment isn't the only cost of owning a home. All the other costs that were relatively affordable in decades past are now skyrocketing. Gordon listed the six basic categories of home ownership expenses: mortgage, property taxes, insurance, utilities, maintenance and repair and home-related services.

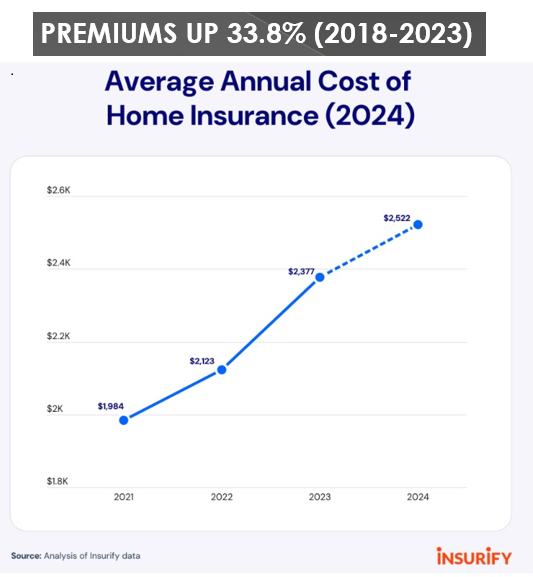

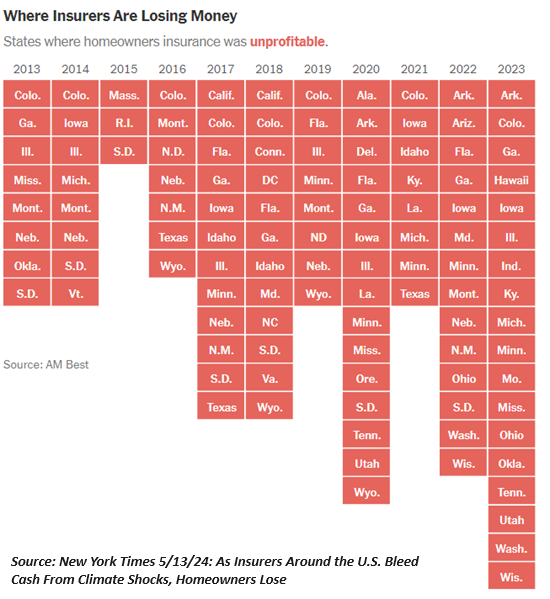

Anecdotally, we're hearing accounts of basic home insurance jumping from $3,000 to $13,000 annually in high-risk regions. We're also hearing of insurers abandoning high-risk areas and entire states, leaving homeowners with few options for insurance. In response, some homeowners are "self-insuring," i.e. they have dropped insurance coverage.

The problem with this option is that should the worst-case scenario come to pass, as a general rule the federal disaster relief agencies will pony up a maximum of $40,000 to the uninsured--far from enough to rebuild or repair a severely damaged house.

Insurers are not in the charity business. Once their losses run into the billions of dollars, they jack up rates to restore profitability. Recall that insurance is a global enterprise, and so the cost of our insurance is partly based on the cost of the reinsurance the big carriers purchase globally. If reinsurance rates rise, everyone's rates rise accordingly.

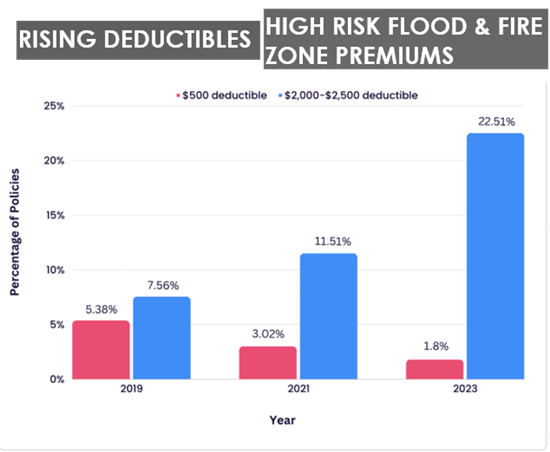

Unsurprisingly, homeowners are responding by raising the deductibles in their policy to lower the annual cost. This is a hybrid of "self-insurance," as homeowners with high deductibles have to have the cash in hand to fund the cost of repairs up to the deductible ceiling.

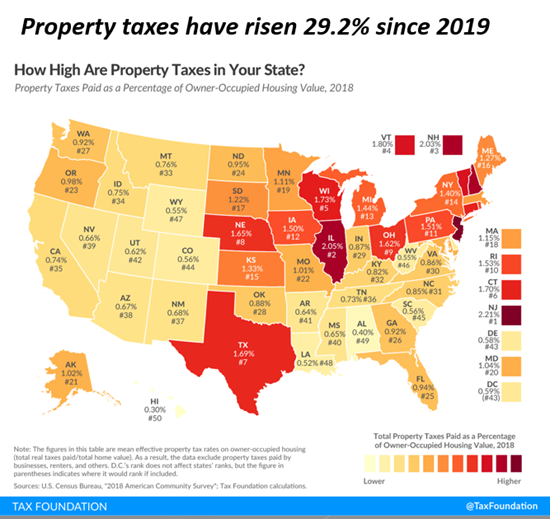

If you think the rise in the price of groceries is eye-popping, check out property tax increases, which are pushing 30% nationally. Since local governments depend on property taxes for a significant percentage of their revenues, we can expect these taxes to remain "sticky" even if housing valuations decline.

The costs of maintenance and repair are soaring as well as the costs of construction materials and labor have increased, along with the other costs of doing business. Just as the cost of a sandwich or burger seems to be about $15 everywhere, the cost of any home project other than fixing a leaky faucet seems to be $10,000 or more now: tree pruning: $10K, roof repair, $10K, and so on.

The soaring costs of home ownership are changing the metrics of unaffordability in important ways. It's not just the initial purchase price that defines what's affordable and what isn't; so too do the costs of owning the house after our name is on the property tax rolls.

More By This Author:

Unaffordable Housing and Homeless Encampments: How Did It Get This Bad?

17 Indicators Of Global Recession Are Clanging

Can We Rein In The Excesses Of Financialization Without Crashing The Economy?

Disclosures: None.