The Coronavirus Panic Proves Once Again The Danger Of Holding Stocks In A Downtrend

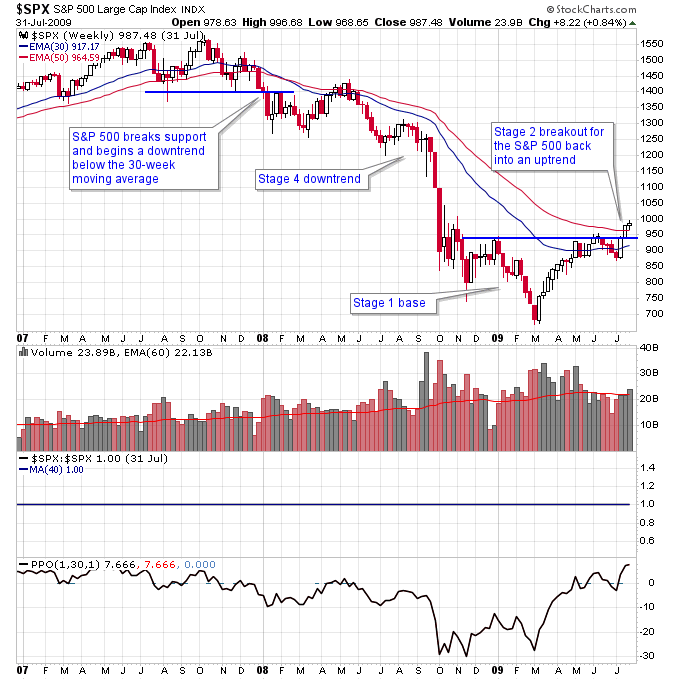

Stan Weinstein says that if you only do one thing from reading his book, which is refuse to buy or hold stocks that are in a Stage 4 downtrend, your results will improve dramatically. If you look at the 2008 bear market in the S&P 500, using Stage Analysis the exit signal was around 1400 in early 2008 well before the fall of 2008 where the rout began and the S&P 500 got crushed. After the breakdown in early 2008 the 30-week moving average became resistance which is what happens in a down-trending market and it was simple to stay out of the market by using the price action below a falling 30-week moving average as your guide to be out of the market.

Of course you’d be down 10% from the top if you waited until 1400 to get out, but that’s a much more recoverable loss than being down 50% at the end of this bear market.

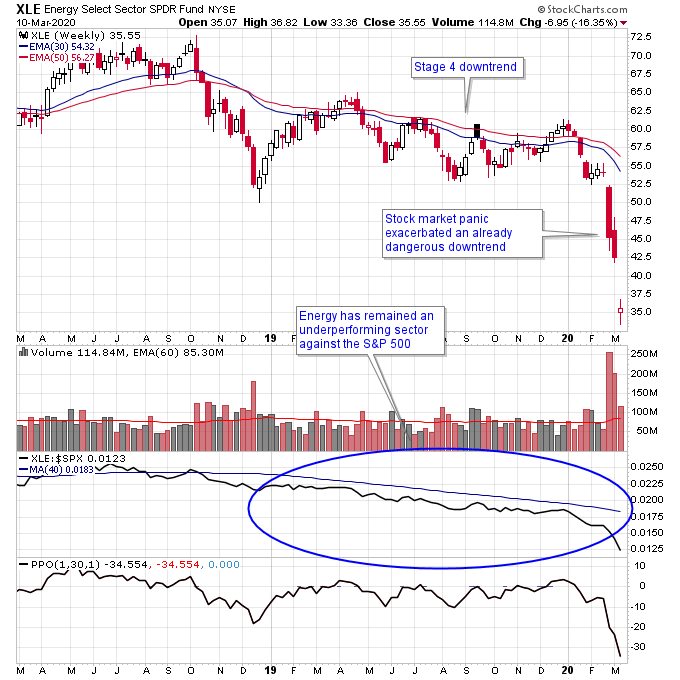

Oil and gas stocks are one of the worst performing sectors so far in 2020 with XLE down over -40%. If you notice what was going on before the recent sharp move downward was a Stage 4 downtrend and under-performance against the S&P 500. This bad situation was exacerbated by the recent stock market panic and also a price war on the price of oil.

Even though energy stocks may have appeared to be a bargain heading into 2020 we can see that with Stage 4 downtrends the eventual bottom can occur much further down than one can imagine.

Disclaimer: The views and opinions expressed are for educational and informational purposes only, and should not be considered as investment advice. The author of this website is not a licensed ...

more