The Coronavirus Market Crash – Lessons Learned

Logical Invest in Bearish Mode Since January

At the start of the year, before the CORVID-19 outbreak was known, we updated our strategies to better withstand a possible bear market. You can read the details here.

A Two-Stage Correction

In the first stage, hedges like gold and Treasuries worked well. Although the S&P 500 took a free fall, the 30-year Treasury ETF went parabolic high as the 10-year yield touched 0.6%. Gold also reacted to the upside, although more modestly. Overall, the typical LI portfolio held up well. This stage lasted for more than 12 days, giving a window of safety for investors before the second stage.

In the second stage, as the realization of the magnitude of the coronavirus crisis became apparent, panic selling ensued. The S&P 500 hit limit down. Margin calls started hitting leveraged positions, forcing investors to raise cash from all sources, including gold and Treasuries, to avoid liquidations. When everything sells at the same time, something that we also saw in 2008, cross-asset correlation rises and nothing works but cash (or short positions).

The Logical Invest Top 3 Strategy

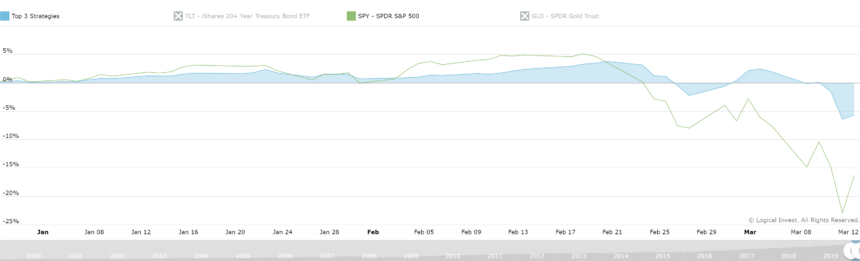

This strategy invests equal-weight in each of the three best performing strategies from the previous look-back period. From the chart you can see that the Top 3 Strategy was flat up until March 10, while the S&P 500 was down almost 15%. It is currently sitting at a -5.7% loss YTD.

Logical-Invest Top 3 Strategy during the coronavirus crash

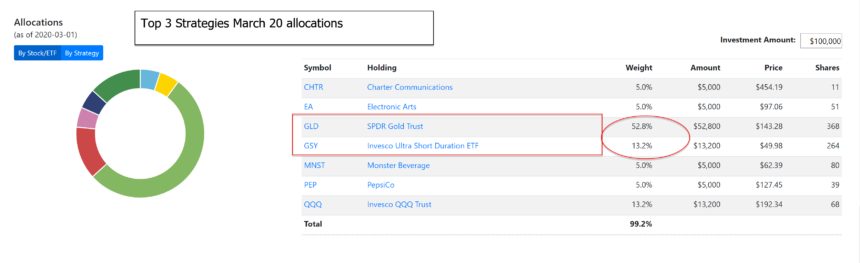

This current portfolio has a 52.8% exposure to gold and 13.2% in short duration bonds (cash).

What to Do During High VIX Levels?

The VIX peaked at 78 and is now sitting at around 55. This has not happened since the 2008 crisis, where VIX touched 95.

At these levels of volatility, it is more gambling than investing. Volatility sensitive investors like ourselves know that these levels are not sustainable, and a reversion to the mean will eventually happen. We prefer to avoid these extreme markets as players become irrational and short-term swings are large enough to damage accounts. There is nothing wrong with waiting in cash until volatility returns to normalcy, VIX (roughly) below 20-25.

Is This a Correction or the Start of a Bear Market?

It would be a lie to say that we know. Lately, corrections have been triggered by various political decisions like tax laws, tariffs, etc. In the past, virus outbreaks have not been long-term negative for markets, but this time is different, as whole cities and countries are put into lockdown. Stepping away from the actual event, one can argue that the markets have been fragile for a number of reasons:

- We have been in a continuous bull market for almost 12 years.

- The Treasury yield curve reversed some time ago, a sign of a pending correction.

- Interest rates are negative in major economies, which limits central banks’ corrective options. The ECB did not cut rates, probably because they could not. How do you cut when rates are already negative at -0.5%?

We are certain there will be worldwide support for the markets as seen in the past. We may even see the S&P 500 index returning to previous levels. Weaknesses in the system is apparent so the risk is asymmetric to the downside.

An Alternative to Holding Equities

It can be dangerous to sell equities at this level because there may be a quick bounce up, but nobody knows when that might happen and if there will be more downside first. An alternative approach is to replace equity positions by selling a 2 month, at-the-money SPY, SPX, or ES put option. Because of the high volatility, these options will pay about 10% of premium in two months if the stock price does not go below this level. If it goes down, then the investor gets their stock position back at a 10% lower price.

However, this assumes the investor is familiar with options and the broker allows shorting options.

What Next?

What is important is for investors to protect profits. We will monitor markets this coming week to see how much central bank, government, and liquidity intervention is able to calm markets. There is no reason to trade aggressively in this environment, and cash is again, king.

Logical-Invest.com is not a registered investment advisor and does not provide professional financial investment advice specific to your life situation. Logical Invest is solely an algorithmic ...

more

The Fed is not taking down the bull. It clearly is pumping the bull. The Fed does not want the cycle to end, at least now.