The Consumption Conundrum

Image Source: Pexels

GDP, released last week, showed that the economy grew by a larger-than-expected 4.3%.

Powering the strong economic growth was personal consumption, which rose by 3.5%.

Consumers are spending!... What’s unusual about that statement is that consumer sentiment remains historically weak.

Typically, there is a strong correlation between personal consumption and consumer sentiment.

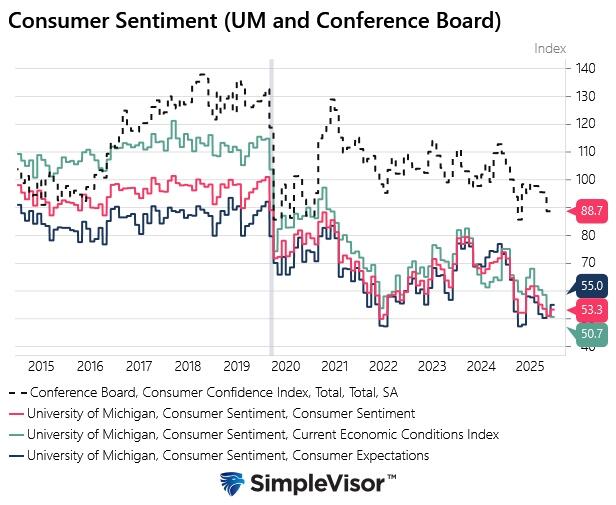

As RealInvestmentAdvice.com shares below, the University of Michigan and the Conference Board consumer sentiment indexes are at or near 10-year lows.

Moreover, they are generally worsening, yet personal consumption continues to grow strongly.

Can such a divergence continue?

To help answer that, consider the five bullet points below, which explain why personal consumption has been strong.

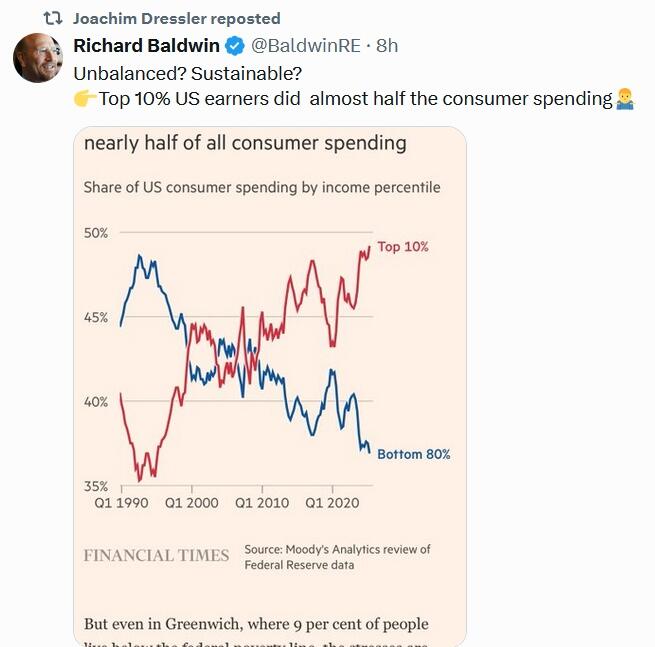

- Wealth Effect: U.S. stock markets will post their third 20%+ increase in a row.

- Non-discretionary Spending: The mix of spending is leaning towards non-discretionary items. For instance, spending on housing, healthcare, insurance, and travel is increasing as a share of total spending. Many of these expenditures are unavoidable, not confidence-driven impulse purchases. For example, healthcare spending accounted for nearly 20% of consumption.

- Credit: Rising use of credit cards, buy-now-pay-later, and home equity loans boosts spending in the short term.

- Savings: Real personal income was flat, thus consumers are using savings, which fell to a historically low 4.7% rate, or credit to meet their needs. Neither is sustainable over the longer run.

- Inflation: Even if the inflation rate is normalizing, the higher prices of goods and services weigh on consumers’ psyche, in turn making sentiment worse. However, its impact on consumption is not as significant.

But here's the real deciding factor...

More By This Author:

US Pending Home Sales Jump To Highest In 33 MonthsThe $16 Billion Question Haunting Mark Zuckerberg

Amid Nike's Worst Drawdown Since Late 70s, UBS Flags Emerging Bullish Signals

Disclosure: Copyright ©2009-2025 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more