The Bottom Of The Barrel

Checking in today from Buenos Aires, Argentina...

Inflation, goes the old joke, is when you pay fifteen dollars for the ten-dollar haircut you used to get for five dollars when you still had hair.

Here in Argentina’s capital, we remember paying 100 pesos for a haircut, which included a straight razor shave and a whisky. Old school-style. At the time, 100 pesos was worth about $5. But that was back in... what was it, 2013, 2014? Today (yesterday, actually), that same cut, shave and tipple, cost us $7... which is currently equal to ~2,000 pesos.

A 40% increase in dollar terms, in other words... but a 2,000% increase in pesos. Once again, when it comes to the race to the fin del mundo, Argentina leads the way!

Back in the northern hemisphere, meanwhile, the Bureau of Labor Statistics told us this week what every American who pays rent, buys gas, eats food, etc. probably already knows... which is to say, inflation is anything but “transitory.”

Wednesday’s BLS report showed the Consumer Price Index running at an 8.2% year-over-year increase, while the Core Index (for those of you who do not eat or use energy), came in at 6.6%, the largest year-on-year increase in forty years (going back to August, 1982).

Moreover, at 0.4%, the monthly CPI increase was double what “experts” had forecast. The Core Index, sans food and fuel, was up 0.6%.

The difference between CPI and Core reading represents the drop in energy prices over the month (fuel oil was down -2.7%; gasoline -4.9%).

Killer Crossover

Essentially, it’s a nice break, while you get it... but with the energy crunch only worsening over in Europe (even as winter is still more than two months away), and OPEC+ yanking 2 million bpd from the global supply, one wonders how much longer falling energy prices will exert downward pressure on inflation in the US.

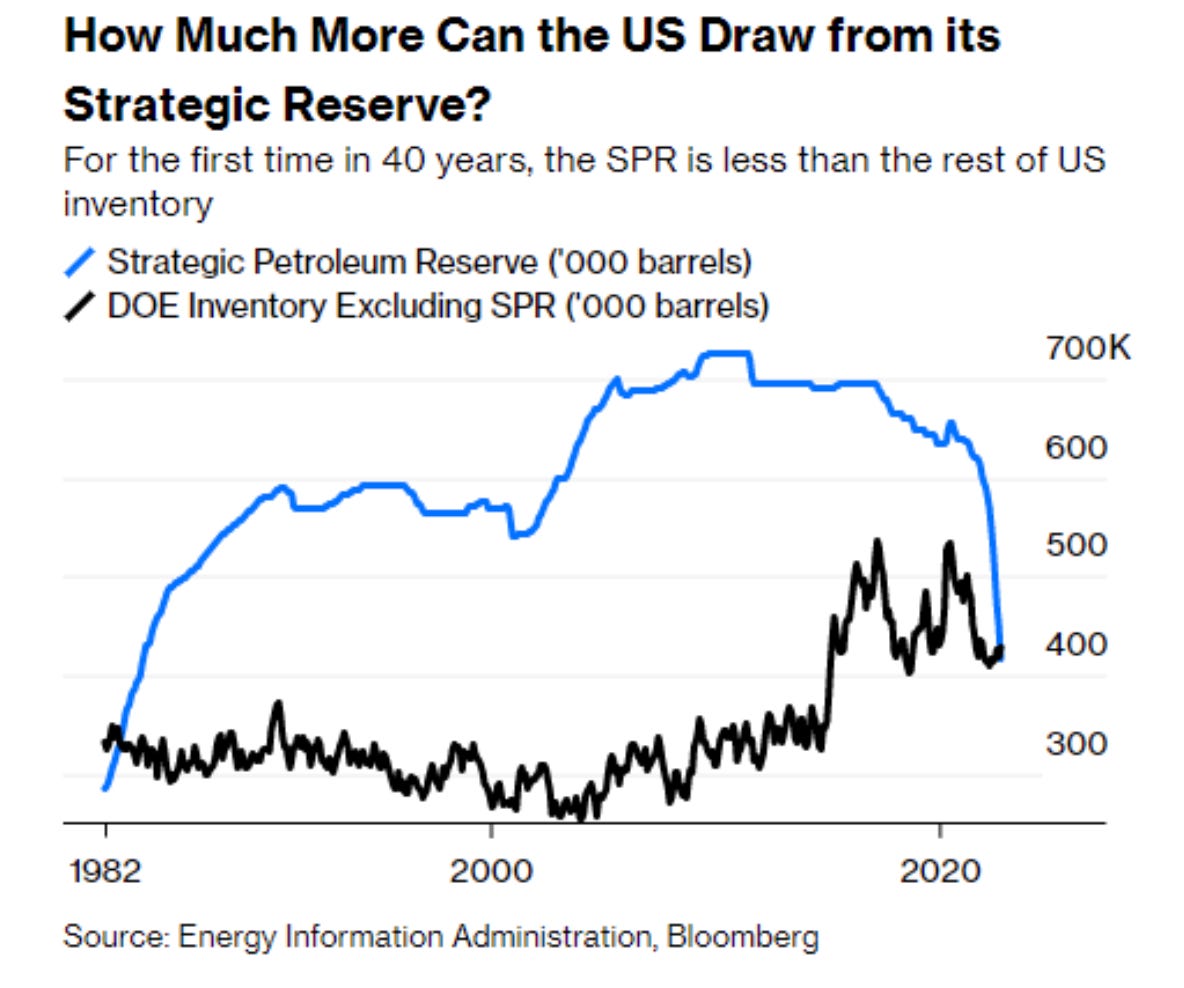

Recall that the Biden administration has been draining the Strategic Petroleum Reserve, in a conspicuous attempt to bring relief at the pump (this national asset will have to be refilled sometime in the future, mind you, presumably at much higher prices), but as the chart below shows, this is hardly a long term solution… (colleague Dan Denning sent this one over earlier in the week with the title “Killer Crossover.” Indeed!)

(Source: EIA, Bloomberg)

The Biden administration pledged to draw another 10 million barrels from the SPR back in early October... just enough to tide voters over until after the mid-term elections... but there’s only so many left barrels in the “oil for votes” reserve. Already at a 40yr low, the nation’s “oil piggy bank” is fast running dry.

What happens if (or when) energy tilts in a positive direction again? If, even as the Fed is hiking rates (further) into a recession, inflation proves too fleet to overtake? What then?

“The bottom line,” Dan broke it down for members in his Friday market note, “is that the financial world cannot take a much stronger dollar and higher US interest rates while the real world cannot take sustained inflation of near 10%. Something has to give. But what?”

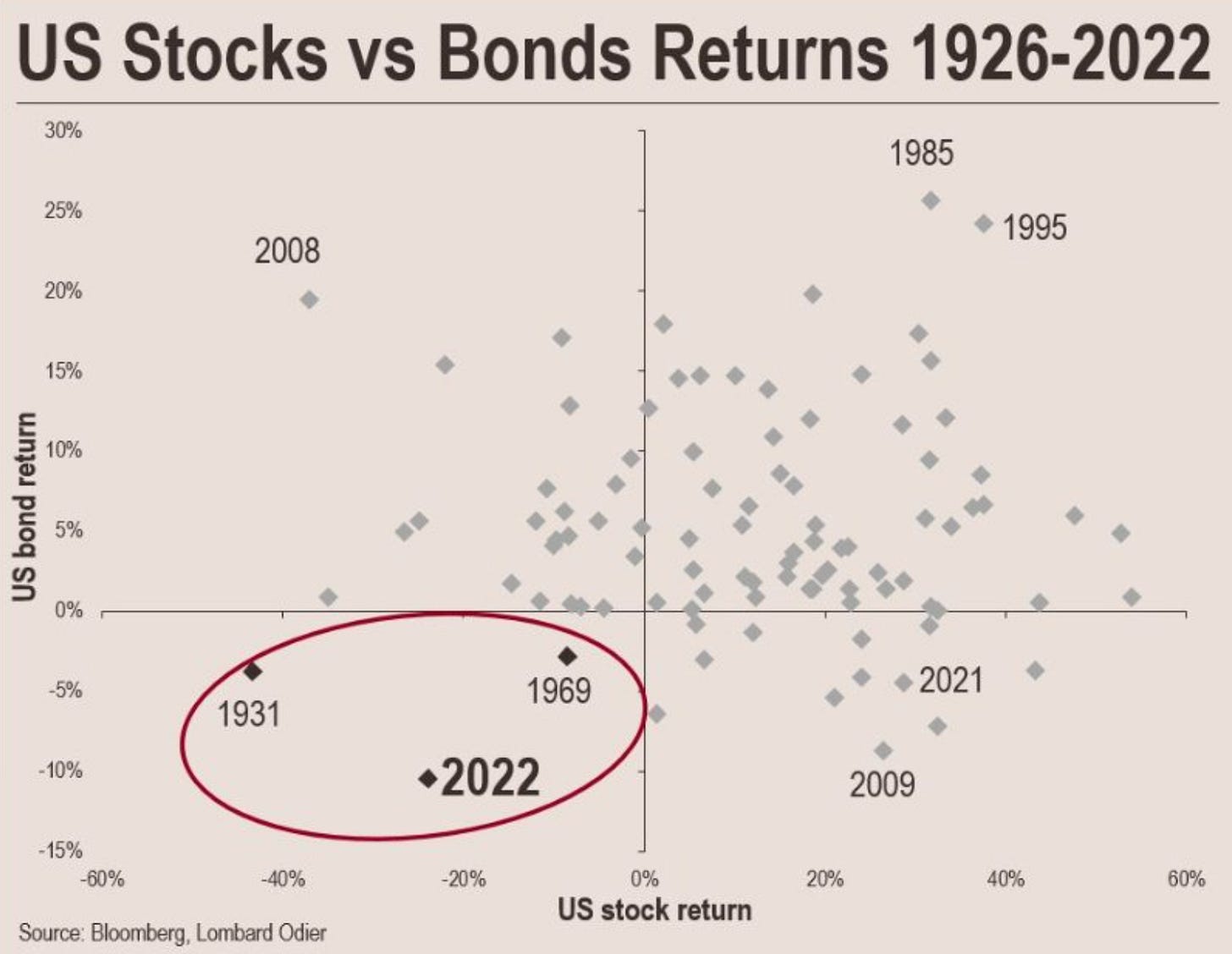

Earlier in the week we showed you this graph, plotting the return of both US stock and bond markets going back almost a century, to the Jazz Age.

(Source: Bloomberg, Lombard Odier)

As you can see, 2022 is keeping some pretty miserable company down there in the lower left-hand quadrant (1931 and 1967). When things get this extreme, it’s worth looking at the other side of the prevailing trend… In other words, could the worst be behind us? Stay tuned.

More By This Author:

"A Very Slight Recession"A Multi-Stage Disaster

Gilty Finking

Follow me on Twitter @harrydentjr