The Bond Market's Latest Turn Offers Us Double-Digit Upside

According to the Securities Industry and Financial Markets Association (SIFMA), in September 2016, an average of $722.6 billion in bonds traded every single day in the United States alone.

Nationally and globally, the bond market absolutely towers over the stock market – by nearly 35% worldwide, and more than double in the United States.

Tens of millions of investors – especially retirement savers – own bonds, and conventional wisdom tells them to park between 50% and 60% of their wealth in those bonds.

But… according to a survey by Wells Fargo and Gallup, a measly 22% of investors really understand how bonds work.

That's shocking, and I aim to do something about it. That way everyone will be able to participate in the bond-market profit play I'll show you…

The Most Important Thing to Understand About Bonds

It just so happens that bonds' most critical feature is one of their simplest, too: They move inversely to interest rates.

It's that simple. If interest rates go up, bond values go down, and vice versa.

Now, here's why.

If interest rates go up, then an existing bond becomes less valuable to investors because a new, equivalent bond – in other words, of the same same quality and maturity – will pay more.

If instead interest rates go down, as they mainly have been since peaking in September 1981, then existing bonds become more valuable. That's because they were issued paying higher interest rates than new bonds offer.

If you want to buy one of those bonds today, you have to pay a premium to receive the higher rate.

OK, so now you understand how bonds work. But that's only looking in the rear-view mirror.

Here's where I think we're heading…

What We Can Expect from the Bond Markets Now

In September I told you that, thanks to failed central bank policies of zero and negative interest rates, as well as massive QE programs, governments are about to grab the inflation baton and run with it.

Large infrastructure projects and spending are rapidly becoming the preferred method of kick-starting the inflation leaders are desperate for.

And now markets, especially the bond market, are beginning to sense this and price it in.

Remember, inflation means things will cost more, including the price to borrow money. Translation: interest rates are starting to rise, and the 35-year secular trend of declining interest rates looks increasingly like it's coming to an end.

Even though the Fed's been holding short-term rates historically "lower for longer," long-term rates can rise if the market expects inflation. By discounting those bonds, the market's essentially saying: rates need to be higher.

And now another, very specific, short-term lending market is saying the very same thing.

This Gives Us Confirmation on Interest Rates

When the world's leading banks lend to each other on a short-term basis, the rate charged is called the London Interbank Offered Rate (LIBOR).

LIBOR is the most commonly used reference rate. It's a benchmark, which helps to set rates for all sorts of debt, like sovereign bonds, corporate bonds, personal and student loans, and even mortgages. All in all, some $7 trillion of debt is priced based on LIBOR.

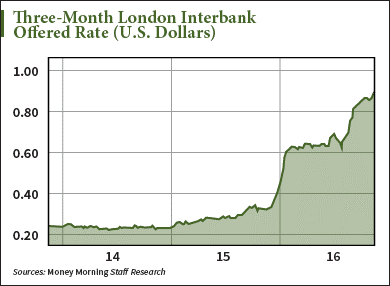

Here's how the three-month U.S. dollar LIBOR has been acting over the last three years.

It's more than tripled since early 2015, and now trades at its highest since 2008. Clearly, banks have become a lot more uneasy about lending to each other, even if it's just overnight.

To be fair, a good portion of this move can be credited to new rules requiring prime money market funds to improve their liquidity reserves and implement floating net asset values, rather than the standard fixed, $1-per-unit price. Such funds had been a vital source of short-term funding for banks.

But the new rules have money seeking the relative safety of funds invested in only short-term U.S. government debt. Since this source of funding has been drying up, banks are relying more on interbank loans. And that's meant higher borrowing rates reflected in LIBOR.

What's more, two influential G7 central bankers have recently provided good reason to expect higher inflation.

Mark Carney, governor of the Bank of England, said his institution would tolerate "overshooting" its targeted inflation. And the U.S. Federal Reserve's Janet Yellen, on the same day, no less, said essentially the same thing, where a "high-pressure economy" may be acceptable for a time as inflation surpasses its 2% target, bolstering growth.

All of this is pointing to higher long-term rates, even if the Fed and its central banking cohorts around the world keep short-term rates artificially low.

And the simplest way for investors to profit from rising long-term rates is to short the corresponding bonds.

Now, it's hard – almost impossible – to sell bonds short, but fortunately, there's a really easy way to make money as bonds tank.

This Play Is Getting Better and Better

Back in late September I suggested it was time to do exactly this, and that the ideal vehicle would be the Proshares Short 20+ Year Treasury ETF (NYSE Arca: TBF).

Since then, TBF retreated to establish a higher low, then climbed back up to set a higher high.

That's textbook bullish chart action that reflects weakening bonds prices. TBF is already up about 2% since then, and up 7% since July's low. Which, by the way, could well be an ultimate secular low.

Buy TBF and use a hard stop at the July 8 closing low of $20.30. I think within 12 months we could see TBF regain the $25 level, providing a tidy 15% gain from current prices.

Only time will tell us that for certain. Meanwhile, TBF is a great way for you to play the likely new secular bear market in bonds to your advantage.

Disclosure: None.