The “Black Swan” Solution To Our Energy Problems

I firmly believe that simple solutions to our energy problems are in the process of coming out of the blue, and are something no one is thinking about now.

Add up the contributions of many small improvements, and the cumulative change will alter our economic future beyond all recognition. Here are two of them.

General Electric (GE) is now mass-producing their “Smart Energy LED Bulb,” which can screw into a conventional socket and produce the same amount of light as a 60-watt bulb, but consume only nine watts of power.

Some 22% of America’s electric power supply is used for lighting, and this bulb could cut our total consumption by 17.6%.

Other bulb manufacturers are getting into the game, like Philips, Osram, Toshiba, and Panasonic, which are already offering more efficient designs. The downside is that, while they last 25,000 hours, or ten times longer than a conventional incandescent bulb, they will initially cost $15-$25.

Economies of scale are expected to bring costs down dramatically in a few years. The Department of Energy has selected Seattle as the test bed for an all LED (light emitting diode) public lighting system.

Here is another game changer for our energy woes. If you double conventional car engine efficiency, US oil consumption drops by half. This is not so hard to do. The US government has already mandated that US car makers achieve an average fleet mileage of 54.5 miles per gallon by 2025.

They are hoping this will lower the cost of gasoline to $1 a gallon by then. They may get their wish this year instead.

One of the first things you learn in a freshman level physics class is how inefficient an internal combustion engine is, using hundreds of moving parts operating at 500 degrees to convert only 25% of the energy input into to motion.

Tesla’s (TSLA) entire electric drive train has just 11 moving parts, operate at room temperature, and convert 80% of its energy into motion. When they go to the mass market in two years with the $35,000 Tesla 3, it will have a huge impact on our overall energy picture

Add this in with the surging supplies of American shale oil, and the utter collapse of the price of Texas tea (USO) over the past six months is suddenly starts to make incredible sense.

The American Onshoring Trend is Accelerating

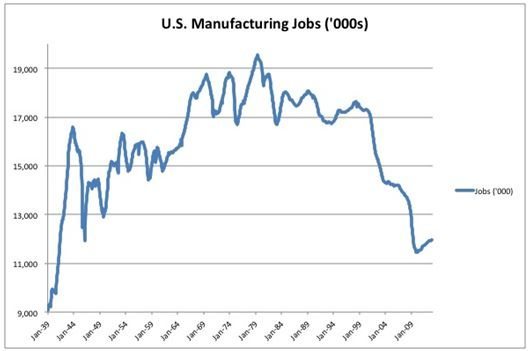

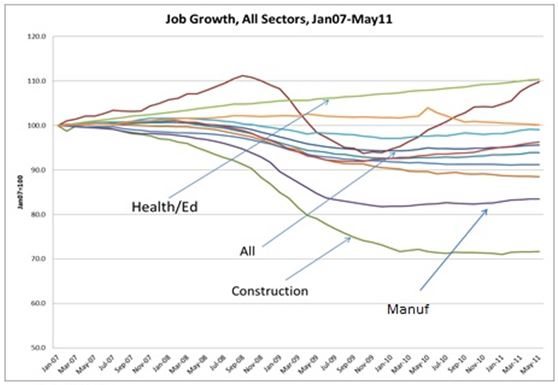

Onshoring, the return of US manufacturing from abroad, is rapidly gathering pace. Get onshoring right and ll of a sudden sector selection and rotation will become a piece of cake.

Of course, it is hard to quantify this assumption with hard data. US government statistics are a deep lagging indicator and are unable to keep up with a rapidly changing, interconnected, fluid world. No doubt, they will tell us this epoch making sea change is underway in ten years.

However, it is possible to track what a single company is accomplishing. In 1973, General Electric (GE) ran the largest home appliance manufacturing facility in the world.

Its Appliance Park in Louisville, Kentucky, employed 23,000 workers packed into six gigantic buildings, each as large as a shopping mall. It was so big, it even earned its own postal zip code (40225).

After that, the offshoring mania kicked in, with the firm motivated by a single factor: hourly wages. You could hire 30 men in China for the cost of one American union worker. The savings were too compelling to pass up, and The Great Hollowing Out of US manufacturing was off to the races.

GE tried to sell the entire operation, but was too late. The 2008 financial crisis decimated the market for Midwest industrial facilities. You could only get the scrap metal value, or three cents on the dollar.

By 2011 employment at Appliance Park had plunged to 1,863 and the region’s new “Rust Belt” sobriquet was well earned.

Then, almost imperceptibly at first, the trend started to reverse. Decades of 20% a year wage increases took the cost of a skilled Chinese worker from $300 a year to $25,000.

The 2011 Japanese tsunami, followed by huge floods in Thailand, caused massive disruptions to the international parts supply network.

A minor strike by the Longshoreman’s Union at the Port of Oakland in California brought the distribution channel to a grinding halt. Business plans that looked great on an Excel spreadsheet turned out to be not so hot in practice.

It gets worse.

When Chinese workers walked across the street to collect bigger pay packages, they often took blue prints, business plans, and proprietary software with them.

Six months later, a local competitor would show up with a similar, although inferior, product at half the cost. Suddenly, globalization was not all it was cracked up to be.

In the meantime, the American labor force, reading the Chinese characters on the wall, evolved. Unions were disbanded. Antiquated work rules were tossed. The unions that were left agreed to two tier wage structures that had entry level employees coming in at $13.50 an hour, a fraction of the original rate.

Then management got smarter. By removing the assembly line from the marketplace, companies lost touch with customers. Designers lost contact with the manufacturing process, creating products that could only be built expensively, or not at all.

Quality plummeted. Innovation suffered. By bringing manufacturing home, firms not only solved these problems, they were able to built better ones for less money.

China turned out to be farther away than people thought. Having middle management jet lagged up to three months a year proved to be very expensive. It takes six weeks to ship an appliance from the Middle Kingdom to the US if the shipping schedules are perfect.

An American plant can truck product to most US stores within two days. That wasn’t a problem when consumer products saw lives that ran into decades. It is a big deal when rapidly accelerating technological improvements require them to be turned over every three years or less, as they are today.

Better American management techniques are giving US based factories an edge. I saw this up close at the Tesla (TSLA) factory in Fremont, California, where workers have the ability to improve the assembly process daily, and are incented to do so.

The place was so clean and quiet, it felt more like a hospital than a factory. It turns out that a drive train with only 11 parts doesn’t require much labor to assemble it, and robots do most of that.

By adopting similar techniques, GE, is building the same number of appliances as it did during the 1960’s peak, about 250,000 a year, with one third of the employees.

Using the new thinking, many companies are finding out that offshoring was a big mistake in the first place, and are bringing production home. Some business analysts estimate that up to a quarter of the companies that offshored lost money doing it.

The fact that GE is onshoring is important. It is considered by many to be the best-run industrial company in the United States, and when it leads, many follow.

On the heels of the GE move, Whirlpool has relocated its mixer assembly from China to Ohio, and Otis has brought home elevator making from Mexico.

Did I mention that because of all of this GE stock is a screaming buy?

Even Wham-O has jumped on board, the maker of Frisbees, Slinkies, and Hula Hoops, and a company that is dear to my heart (I dated the founder’s daughter in high school), moving production from the Middle Kingdom back to Southern California.

If I am right, and onshoring speeds up into the next decade, we may get another opportunity to relive the roaring twenties. By then, a shortage of workers will lead to higher wages, greater consumer spending, and rising standards of living.

The price of everything will rocket, including your stocks and homes. GDP growth will surge to 4%-5% a year. Inflation will, at long last, make its long predicted return.

It will be an economy in which Jay Gatsby will feel right at home.

_635883189691963788.jpg)

Disclosure: None.

Wow, the US will do anything to destroy Russia and start WW3. But bringing jobs home to protect patents makes sense. Interesting article.

Very thought provoking, thanks.