The Big Mac Index Proves It: Inflation Is Getting Better

Image Source: Pixabay

The Fed recently cut its policy rate for the first time since the early days of COVID-19. The pre-pandemic normal feels just within reach -- except for those high prices. I have bad news: Your daily life may never be cheaper than it is right now, but it’s becoming more affordable. And I’ll prove it to you with America’s favorite fast-food order: the Big Mac, writes Callie Cox, chief market strategist at Ritholtz Wealth Management.

The Big Mac is a bastion of American culture. It’s the crown jewel of one of the most successful fast-food chains ever — McDonald’s Corp. (MCD) — and its double patty, three bun, special sauce extravagance represents everything that is both delicious and unholy about the American palate.

Big Macs have been around since 1968, so you, your parents, and your grandparents have likely had at least one memorable experience enjoying those burgers. We all know and love a Big Mac -- especially Wall Street. The Economist has tracked the price of a Big Mac for almost 30 years to measure purchasing power parity – the gap between productivity and living standards between countries. Economics, but with burgers.

In the US, the price of a Big Mac has climbed 18% since January 2020, about in line with the 21% climb we’ve seen in the Consumer Price Index. Before the emergence of COVID-19, you could buy a Big Mac for $4.82 – or a crisp $5 bill with change to spare. Today, you’re paying $5.69, according to the Economist’s index.

That’s about the extent of the inflation complaints we hear these days: Five years ago, that burger — or iced latte, lipstick, haircut, airplane ticket, etc. — cost so much less than it does today. You’re right, that is technically inflation.

But inflation isn’t just prices. It’s how many Big Macs you can afford. Let’s look at the price of a Big Mac in the context of wages. At the beginning of 2020, an average worker could afford about five Big Macs with an hour’s pay. While the price of Big Mac gradually climbed, worker pay climbed as well. At one point in 2022, one hour of work could buy you 5.4 Big Macs – an improvement from just two years before.

Inflation was a massive problem at that point, though. Prices – as measured by CPI – were increasing at a 8.4% clip, much faster than the 6.5% growth we were seeing in average hourly earnings. This is why the Fed started hiking rates – to bring price and wage growth back in line with each other.

In the months ahead, Big Macs became slightly less affordable. The average Big Mac budget per hour of work slipped to 5.2. Our grocery budgets didn’t stretch as far as they once did. Inflation started to bite, and Americans noticed.

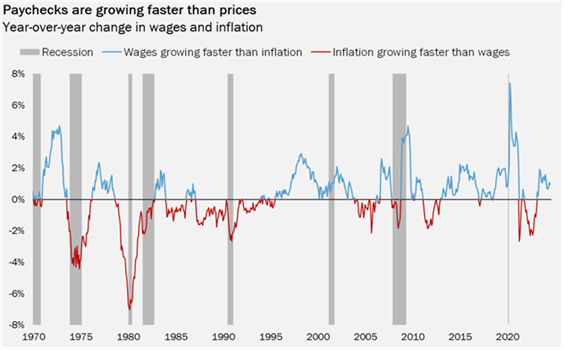

But the tide changed sometime early last year. Paychecks started catching up to prices. In March 2023, the growth in wages officially overtook the pace of inflation. Since then, the average American’s hourly pay has increased 5.9%, while prices have jumped just 4.1%. Our burger-flation gauge has moved up ever so slightly over that time, from 5.2 to 5.3.

Burger-flation is not a precise science, and there are plenty of reasons why the Big Mac’s price has changed over time. Still, it’s a great example of how the economy is slowly healing from the inflation crisis through the lens of routine purchases.

Things gradually may become more affordable even if they’re not necessarily cheaper. Suddenly, your spontaneous Big Mac cravings don’t break the bank like they used to. Maybe you get can fries with that.

Americans and businesses thrive best when pay grows faster than prices. We’ve seen it time and time again throughout history. Since 1965 (when worker pay data was first published), wage growth has exceeded inflation in about 60% of months.

Source: Callie Cox Media LLC, BLS, NBER

So, sure, high prices sting. I still curse under my breath when I check out at the grocery store. But burger-flation is a message of hope, not despair.

The US economy is moving forward, and you hold some power in this process. Corporate profits are growing again, and paychecks are increasing at a 4.1% rate. If yours isn’t, maybe it’s time to ask your boss for a raise. Or, you know, invest that hard-earned money in something that generates a return that outpaces inflation.

About the Author

Callie Cox is the chief market strategist at Ritholtz Wealth Management and the author of OptimistiCallie, a newsletter of Wall Street-quality research for everyday investors. She’s passionate about teaching everyday investors the power of investing for their wallets and their lives.

Prior to joining Ritholtz, Callie worked at eToro, Ally Invest, LPL Financial, TABB Group, and Bloomberg. Her work has been featured on CNBC, Bloomberg, the Financial Times, Yahoo Finance, and Barron's, among other publications. She frequently shares market analysis on Twitter at @callieabost.

More By This Author:

LEU: A Nuclear Power Play In A Market Set To Prosper From Fed CutsKVYO: A Promising E-Commerce Tech Play Whose Shares Are On The Move

Silver: What Elliott Wave Analysis Says About the Next Big Move

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more