The Best Stock Tip You’ll Get All Year

How much attention would you pay to an investment theme that had a very good probability of generating 20% to 25% annual total returns for the next half decade or longer. Yes, there are a handful of companies out there that should put those types of returns into your brokerage account, year after year. This is a sub-philosophy of the dividend investing world that I find very few investors know about or understand. Learn and take advantage, as this could be one of the most beneficial tips on investing you might ever receive.

This investment idea starts with a little basic interest rate math. Consider a stock with a 4% dividend yield and the company increases the dividend rate by 6%. For the yield to stay at 4% the share price must mirror the increase and move up by 6%. The combination of yield plus share price growth will give you a 10% total return (actually a little more with the dividend increase) over the course of the year. If the company is well managed and can grow its dividends by 6% every year, you can realize that 10% total annual return compounded over a period of years. As you probably know, the mass psychology of the stock market is neither logical nor linear, so there will be periods of time when the share price lags your growth target, pushing the yield higher and/or the share value gets ahead of the 6% per year growth profile and the yield will drop below 4%. But in the long term, if your yield ends up near the yield in effect when you bought shares, your average annual total return will be very close to the starting yield plus annual dividend growth rate.

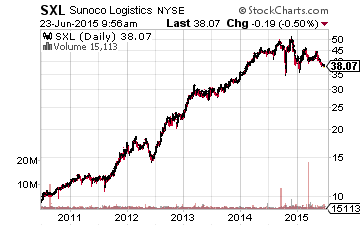

The higher the dividend growth rate, the greater the total return you will realize from a high distribution growth investment. Consider Sunoco Logistics Partners LP (NYSE:SXL). Sunoco Logistics is a midstream master limited partnership (MLP) that owns crude oil and refined products pipelines, energy products storage facilities, and loading/unloading terminals. The best part of the SXL story is the company’s history of increasing its quarterly distribution rate every quarter for 40 consecutive quarters or 10 years. Look at the 5-year chart on the right and see how amazing this little followed growth story could have been for your portfolio.

Over the last four to five years, the increase has been at least 5% every quarter, giving 20%+ per year distribution growth. As I discussed above, with this type of distribution growth the total return should come out to the yield plus growth rate. Over the last 10 years, SXL investors have realized average annual total returns of 26.3%. With compounding, this means $1,000 invested in mid-2005 is now worth over $10,000. The Sunoco Logistics management team expects to continue with 20% annual distribution growth. SXL yields about 4%.

This group of what I call fast growth MLPs has been expanded over the previous few years as large energy companies have used the publicly traded partnership structure as a way to monetize and generate more income out of midstream assets like pipelines, storage facilities and terminals. These energy companies spin off an MLP and then dole out sales of assets over a period of years to almost guarantee a target distribution growth rate. Here are several one to two year old MLPs with strong sponsors and forecast distribution growth rates well above 20% per year.

- Shell Midstream Partners LP (NYSE:SHLX)

- Phillips 66 Partners LP (NYSE:PSXP)

- Valero Energy Partners LP (NYSE:VLP)

- Antero Midstream Partners LP (NYSE:AM)

- Dominion Midstream Partners LP (NYSE:DM)

Yields for these high growth companies are typically around 2%.

I will be focused on covering the specific investment details of these high return potential MLPs along with more mainstream partnership companies in my soon to be launched Tax-Smart Income ...

more

Good article. I think SHLX is the best pick.SHLX is still in its early stages and has the largest parent.