The AD Surge Is 100% Monetary Policy

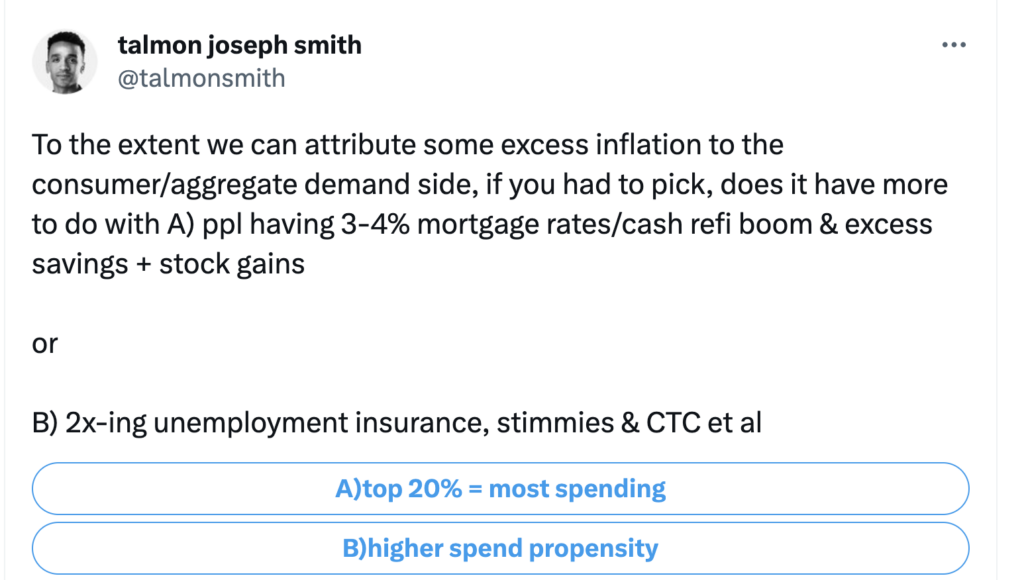

David Beckworth directed me to this tweet:

I’d put a weight of 0% on A and 0% on B. I’d put a 100% weight on monetary policy. In 2021, the Fed should have set their Fed funds target at a level that would return NGDP to the pre-recession trend line. In fact, they set rates well below their equilibrium level, and hence NGDP rose about 8% above trend. Thus 100% of the excess demand was caused by the Fed not doing its job.

BTW, I’m not sure what “consumption/aggregate demand” means. Consumption and aggregate demand are very different concepts.

PS. I’m almost ready to take a victory lap on this post from late 2022, where I expressed skepticism about the Fed’s forecast that the unemployment rate would rise to 4.6% by the end of 2023, despite positive RGDP growth of 0.5%.I suggested that conditional on positive GDP growth, the unemployment rate would not rise very much.

Here’s Yahoo:

Fed officials see inflation finishing the year close to 4% now, compared with 3.6% prior. Unemployment is only seen rising to 4.1% from 4.5% previously. Officials now see stronger economic growth this year of 1% verses 0.4% previously.

More By This Author:

A Rising Tide Lifts Yachts And RowboatsThe Wolf Is Getting Closer

A Target Band For Inflation?