The Actual Problem: Monetary Policy Ex-US

The global media seems endlessly fascinated by the question of whether monetary policy in the US is too easy or too tight, even as the Fed comes amazingly close to hitting its targets. I suppose this interest can be partly justified by the size and influence of the US, which David Beckworth calls a “monetary superpower”. Nonetheless, there should be more discussion of the fact that monetary policy in the Eurozone and Japan is way off course, and that these policy mistakes are a danger to the global economy.

Core inflation in the Eurozone is 1.0%, far below the ECB’s roughly 1.9% target:

And growth in the Eurozone is slowing as we go into 2019.

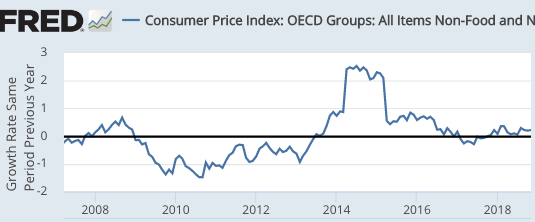

Core inflation in Japan is even further below the BOJ’s 2% target:

And growth in Japan is also slowing.

My suggestion is that both central banks consider switching to level targeting and adopt a “whatever it takes” approach to hit their targets. These changes might require legislation, and I’m not an expert on the political barriers to getting this done, which I presume are formidable. Fortunately, these two changes might well be enough; I doubt they’d need to take any additional “concrete steps”.

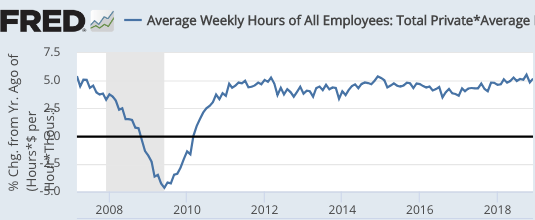

PS. Commenter LK Beland constructed a monthly series of wage income for the US, by multiplying average hourly earnings, average hours per week and payroll employment. In some respects, this data is superior to NGDP as an indicator of the appropriateness of monetary policy. Interestingly, the graph shows even greater stability than NGDP growth, mostly hovering around 4% to 5%:

This is what I’ve been advocating as a long run policy ever since I started blogging in early 2009. However, I would have liked to have seen faster “catch-up” growth in the early years of the recovery. Even so, this is a good sign. If they can keep roughly 4% growth going forward then . . . . we win.

It does appear that what is still accommodative here at home is too tight for the EM's and the Eurodollar reserve currency market worldwide. China growth should tell us going forward.