The 5 Best Dow Stocks

Today I used Barchart to sort the stocks of the Dow Industrials to find the 5 with the best technical buy signals.

Today's list includes:

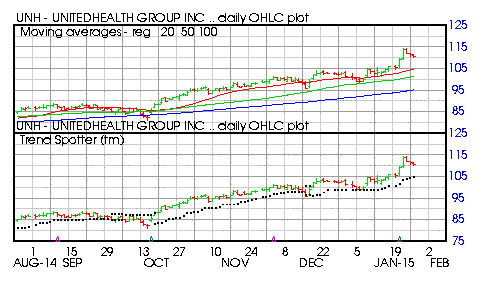

Unitedhealth Group (NYSE:UNH),

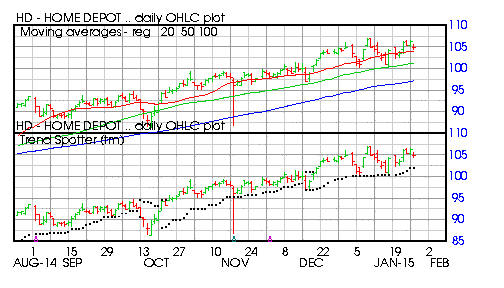

Home Depot(NYSE:HD),

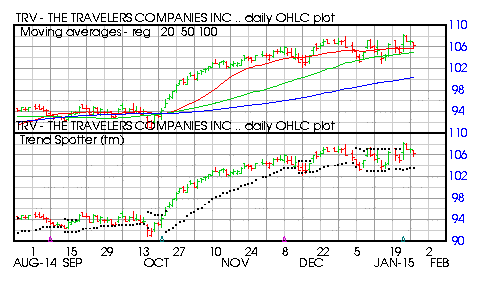

The Traveler's(NYSE:TRV):

Barchart technical indicators:

- 96% Barchart technical buy signals

- Trend Spotter buy signal

- Above ts 20, 50 and 100 day moving averages

- Only 3.25% off its recent high

- Relative Strength Index 66.34%

- Barchart computes a technical support level at 110.22

- Recently traded at 110.68 with a 50 day moving average of 101.41

Home Depot (HD)

Barchart technical indicators:

- 80% Barchart technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- Only 1.82% off its recent high

- Relative Strength Index 55.42%

- Barchart computes a technical support level at 104.53

- Recently traded at 105.26 with a 50 day moving average of 101.28

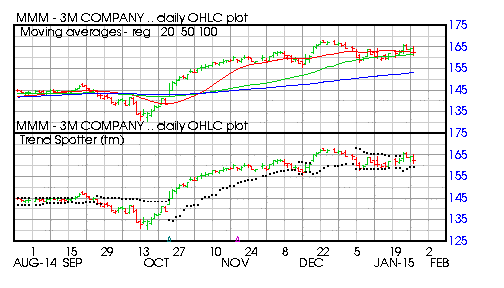

Barchart technical indicators;

- 72% Barchart technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- Only 3.36% off its recent high

- Relative Strength Index 51.50%

- Barchart computes a technical support level at 160.96

- Recently traded at 163.02 with a 50 day moving average of 161.52

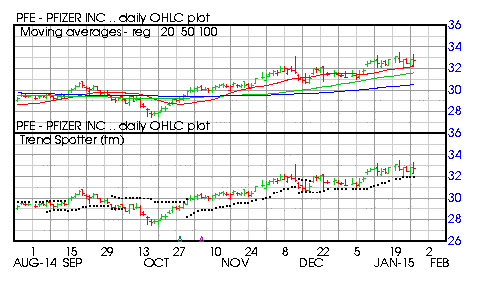

Barchart technical indicators:

- 72% Barchart technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- Only 2.33% off its recent high

- Relative Strength Index 58.67%

- Barchart computes a technical support level at 31.93

- Recently traded at 32.78 with a 50 day moving average of 31.60

Barchart technical indicators:

- 72% Barchart technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- Only 1.90% off its recent high

- Relative Strength Index 52.47%

- Barchart computes a technical support level at 106.08

- Recently traded at 106.37 with 50 day moving average of 104.97

Disclosure: None.

In addition to having one of the sector's leading market caps, PFE has a decent yield of 3.5%. The stock is up 3.7% YTD.