That Supposed Herbalife Miss

Herbalife results was a miss on volume growth. And first I was disappointed - but as I read the 10-Q carefully I became more and more cheered.

The last post outlines what the range of outcomes on Herbalife is.

On the binary issue of the FTC inquiry we have no explicit news. As stated in the last post (and I think most shorts would agree with me) the earnings power of this company is completely secondary to whether the company is allowed to operate.

The real debate which is about the legality of the business model will continue.

The secondary debate is about the profitability of the company.

Most of this post is about the secondary debate - and the entire stock movement is about the secondary debate.

Slowing growth

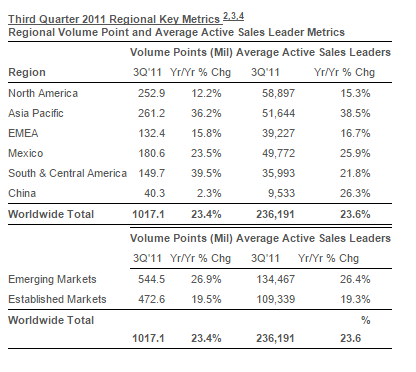

In the third quarter of 2011 (as the last post makes clear) the company had volume growth like this:

This was astounding growth. Normal companies do not grow sales volume at 23.4 percent for long.

In that quarter sales volume (23.4 percent) was very closely correlated to the growth in the number of active sales leaders (23.6 percent). This correlation should be expected.

And whilst the correlation was not perfectly accurate by region - it was pretty close and remained close for a long time.

Over time sales growth slowed. However as recently as the first quarter volume growth was 9 percent (off very big numbers) and sales-leader growth was 11 percent. These are still perfectly adequate numbers.

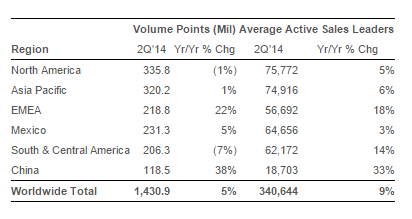

In the second quarter Herbalife had its first miss in recent years. Here were the numbers for sales growth and volume growth:

The 5 percent sales growth number is by far the worst the company had seen. However active sales leaders continued to grow at 9 percent. There was a question as to whether you believed sales leader growth led volume growth - because if it did volumes will rise over time.

More on that later.

Some of this poor volume results in the first quarter was Venezuela - and for reasons explained in the last post declines in Venezuela are good news not bad news. Net of Venezuela sales growth was probably 7 percent - still a very acceptable rate - albeit a definite slowing.

I stated in the last post that the fair value for Herbalife (assuming an FTC clearance which the shorts think is unlikely) depends critically on the volume numbers.

If volume growth resumes as 8% plus (consistent with the number of active sales leaders) then the stock was worth something around $200.

If the volume growth declined from the growth above then assuming FTC clearance a number around $80 was fair value. [And $80 is about the 12 month high - and predates the FTC inquiry. As someone who still held stock at $80 I would be disappointed.]

Alas for the longs the numbers came in and volume growth declined further.

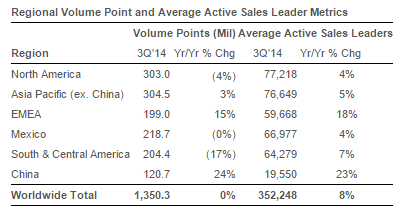

Here they are:

Note volume growth of ZERO.

This was not meant to happen and is a big miss. Net of Venezuela it is not so bad - volume growth of 3%.

The earnings number was awful but that was because of bunch of expected charges. Venezuela has largely gone away (the sales there collapsed and the charge for currency loss has been taken). If the FTC inquiry goes away so do all the remaining charges.

But (assuming FTC clearance) the volume growth is what matters. And that is still clearly slowing.

If that were the end of the story I would be adjusting my target price for the stock below $100.

But I am not - and the reason is explained below. My time-to-target has however unfortunately extended.

Two hypotheses - one bearish, one bullish

The volume point number and the number of sales leaders has diverged sharply. Over time these will converge. That is just the way the world works.

However it is not clear whether the volume points converges on the number of sales leaders (ie volume growth converges to about 8 percent) or whether the number of sales leaders converges on volume growth (something nearer 3 percent and declining).

In other words it is not clear whether volume leads sales leaders or sales leaders lead volume. My instinct is the latter - but it is not obvious.

Lets start with the bearish hypothesis

The bearish hypothesis is simple. The product is increasingly harder to sell. It is saturated. The demand for a "business opportunity" however is substantial (especially when labour markets are not good) and so people are "signing up" to be distributors at the old rate but they are selling less and less.

This obviously is not sustainable - and the sales leaders will sell less and less and will be discouraged from being sales leaders.

Over time sales leader growth (now 8 percent) drops back to volume growth (3 percent and falling).

This is the thesis of several Twitter shorts who talk about saturation all the time.

The bullish hypothesis

The company implemented many changes in business practice in response to Bill Ackman. One of these was a limit on first-time orders (which discourages inventory loading). If the change simply defers purchase then you will find sales leaders continue to grow but for a few quarters sales volume lags badly.

Then you anniversary the business change and the sales volume growth (now 3 percent) converges on the sales leader number growth (now 8 percent).

Now here is the cheeriest thing in the whole Herbalife results.

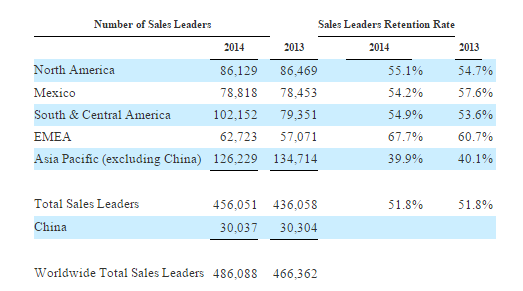

We can distinguish between these two hypotheses. In the bear case the distributors are getting discouraged (by lack of sales) and hence the sales leader retention rate should be falling.

In the bull hypothesis the sales leaders take longer to qualify but they are selling through at an adequate rate - and hence will stick around.

Here is the point: in every market in the world where Herbalife publishes the sales-leader retention rate retention is rising. Rising retention on rising numbers of sales leaders almost guarantees rising sales in the future.

This is still a growth stock (and deserving of way over $100 per share after FTC clearance) but alas the business practice changes have deferred growth. Its a growth deferred stock.

I am going to make a lot of money. Its just going to be slower. But hey - I will take it.

Oh - and here is the table from the 10-Q of retention:

The good news on the FTC

There was no specific news on the FTC front - but what could be gleaned from the report was fantastic. Yes rip-snorting bullish. Eye-wateringly bullish.

The expenses related to the FTC inquiry were $2.7 million in the second quarter down from $3.0 million the prior quarter.

If legal bills are any guide (and common sense says that they are a guide) then the FTC inquiry is not being very problematic. [The shorts have not noticed this. Generally they are lacking in common sense.]

The bad news

The company had lots of one-off expenses and the cash flow net of these expenses was not wonderful. If (when) the FTC inquiry sorts itself out this will go away - but for the moment it limits financial flexibility.

Nonetheless, the bad cash flow this quarter mattered. The company stopped buying back shares. This quarter it bought back no shares and paid no divided. It distributed nothing to shareholders - and as a shareholder I am not thrilled by that.

But that is more than offset by the good FTC news (as described above) and the increasing number of sales leaders. Growth deferred - but growth nonetheless.

--

Summary: As a bull I am unhappy with the lack of volume growth and the lack of buybacks. This might have curtained the upside of the stock.

But the growth in sales leaders (at higher levels of retention) absolutely puts paid to this. This is a growth stock - just not this year. But we will lap the sales practice changes and this will be an blisteringly good growth stock.

And the evidence in the accounts is that the FTC inquiry is not pressing is overwhelmingly positive.

I was disappointed when I read the results - but hey - I am thrilled now.

Hope they get to buy back some stock in the 40s. That will just be the icing.

John

Disclosure: The content contained in this blog represents the opinions of Mr. Hempton. Mr. Hempton may hold either long or short positions in securities of various companies discussed in the blog ...

more