Tesla Shares Hit The Wall After Reliability Report

Tesla Motors, Inc. (TSLA) designs, manufactures, and sells electric vehicles and electric vehicle powertrain components. The Company is headquartered in Palo Alto, California.

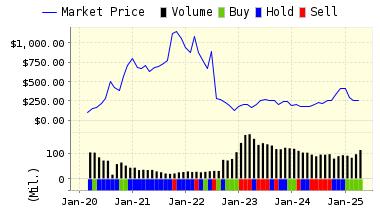

Our models have been down on Tesla for a while now. We put a sell on the stock back in early September. Prior to that the firm had a brief spell as a HOLD from July 6th to September, but it spent the rest of 2015 as a STRONG SELL or SELL.

Today, investors also realized that all was not well at the alternative vehicle manufacturer. Shares took a dive on news that Consumer Reports, the "bible" of car reliability ratings, had found the car to possess worse-than-average predicted reliability. While drivers reported some typical issues for newer vehicles--such as sun roof leaks,squeaks, and body rattles, more significant were issues relating to the car's transmission and battery charging systems.

One wonders how this will effect sales given the fact that up until now the company had such strong demand it could not fill all orders in a timely fashion. Teslas are NOT cheap, and people ready to pay a premium for a vehicle that requires special charging equipment may not be quite so sanguine about laying out that extra money if the vehicle is not as plush or refined as others in its price range.

Below is today's data on TSLA:

Recommendation: We continues with SELL recommendation on Tesla Motors, Inc. for 2015-10-19. Based on the information we have gathered and our resulting research, we feel that Tesla Motors, Inc. has the probability to UNDERPERFORM average market performance for the next year. The company exhibits UNATTRACTIVE Book Market Ratio and Price Sales Ratio.

|

ValuEngine Forecast |

||

|

Target |

Expected |

|

|---|---|---|

|

1-Month |

226.17 | -0.85% |

|

3-Month |

227.99 | -0.05% |

|

6-Month |

233.48 | 2.36% |

|

1-Year |

204.92 | -10.16% |

|

2-Year |

277.71 | 21.75% |

|

3-Year |

282.05 | 23.65% |

|

Valuation & Rankings |

|||

|

Valuation |

35.03% overvalued |

Valuation Rank |

|

|

1-M Forecast Return |

-0.85% |

1-M Forecast Return Rank |

|

|

12-M Return |

-1.03% |

Momentum Rank |

|

|

Sharpe Ratio |

0.91 |

Sharpe Ratio Rank |

|

|

5-Y Avg Annual Return |

49.99% |

5-Y Avg Annual Rtn Rank |

|

|

Volatility |

55.21% |

Volatility Rank |

|

|

Expected EPS Growth |

188.93% |

EPS Growth Rank |

|

|

Market Cap (billions) |

28.60 |

Size Rank |

|

|

Trailing P/E Ratio |

n/a |

Trailing P/E Rank |

|

|

Forward P/E Ratio |

94.65 |

Forward P/E Ratio Rank |

|

|

PEG Ratio |

0.45 |

PEG Ratio Rank |

|

|

Price/Sales |

7.72 |

Price/Sales Rank |

|

|

Market/Book |

39.95 |

Market/Book Rank |

|

|

Beta |

0.85 |

Beta Rank |

|

|

Alpha |

0.05 |

Alpha Rank |

|

Market Overview

|

Summary of VE Stock Universe |

|

|

Stocks Undervalued |

57.62% |

|

Stocks Overvalued |

42.38% |

|

Stocks Undervalued by 20% |

24.03% |

|

Stocks Overvalued by 20% |

13.78% |

Sector Overview

|

Sector |

Change |

MTD |

YTD |

Valuation |

Last 12-MReturn |

P/E Ratio |

|

0.55% |

5.00% |

0.46% |

5.91% overvalued |

3.61% |

23.37 |

|

|

0.64% |

4.96% |

-1.18% |

3.64% overvalued |

4.39% |

24.02 |

|

|

1.16% |

5.53% |

-9.46% |

1.17% overvalued |

-5.76% |

20.29 |

|

|

0.31% |

2.99% |

0.02% |

0.27% overvalued |

1.10% |

16.67 |

|

|

-0.40% |

5.13% |

-5.69% |

0.60% undervalued |

-3.34% |

22.32 |

|

|

0.17% |

5.00% |

2.96% |

1.82% undervalued |

4.03% |

26.32 |

|

|

0.34% |

4.22% |

-2.69% |

2.30% undervalued |

3.88% |

28.77 |

|

|

-0.13% |

4.23% |

-1.49% |

3.75% undervalued |

-3.89% |

17.64 |

|

|

0.83% |

3.17% |

-6.81% |

3.75% undervalued |

4.50% |

22.49 |

|

|

-0.77% |

1.61% |

2.51% |

3.88% undervalued |

6.78% |

29.43 |

|

|

0.98% |

6.95% |

-7.69% |

4.17% undervalued |

-8.14% |

18.10 |

|

|

1.04% |

4.83% |

-0.79% |

5.00% undervalued |

7.95% |

20.82 |

|

|

-0.13% |

13.79% |

-17.32% |

8.34% undervalued |

-37.50% |

26.09 |

|

|

-0.86% |

5.41% |

-12.29% |

8.60% undervalued |

-3.32% |

15.64 |

|

|

-0.58% |

8.47% |

-3.50% |

9.54% undervalued |

4.14% |

15.29 |

|

|

2.67% |

10.78% |

-14.02% |

12.01% undervalued |

-17.51% |

24.20 |

Valuation Watch: Overvalued stocks now make up 42.38% of our stocks assigned a valuation and 13.78% of those equities are calculated to be overvalued by 20% or more. Four sectors are calculated to be overvalued.

Disclosure: None.

Disclaimer: ValuEngine.com is an independent research provider, producing buy/hold/sell recommendations, target price, and valuations on over 7,000 US and Canadian equities ...

more

If they don't get these problems fixed, they will never be able to buy another car again.

This trouble could not happen to a more arrogant guy, Elon Musk, who once advocated the nuking of Mars to warm it up. Hard to know when the guy is serious, but he also once said that manually driven cars would be outlawed. He is trouble, and now he has trouble.

He may be arrogant but he is brilliant. Unfortunately, they tend to go hand in hand. Us common folk just have to deal with it and give credit where credit is due.

NO, I don't give him credit. He has globalist and US government backing for a specific purpose, IMO, and that is to defeat Russia by stopping US reliance on oil. Russia is almost entirely dependent on oil exports. That is a very dangerous policy. I wouldn't have said that was his goal until he said manually driven cars would one day be outlawed.