Tesla Motors Inc. Receives $500 Million Credit Line: Analyst Weighs In

On Friday June 12 after market close, Tesla Motors Inc. (NASDAQ: TSLA) announced it will receive $500 million in revolving credit. This excited the market as investors have been concerned about Tesla’s working capital for expansion this year.

Tesla entered into a five-year senior secured asset-based revolving credit agreement with Deutsche Bank, Bank of America, Goldman Sachs, JPMorgan Chase, Morgan Stanley, Wells Fargo, and Credit Suisse. In terms of the deal, Tesla has the option to increase its credit line by an additional $250 million, potentially totaling $750 million. The agreement will end on June 10, 2020.

In its most recent quarterly report, Tesla’s revenue growth greatly exceeded the industry average of 7.3%. Since the same quarter one year prior, revenues jumped by 51.5%. Looking where the stock is today compared to one year ago, it is clear that it is not only higher, but has also beat the S&P benchmark despite weak earnings results. Furthermore, working capital has significantly decreased to (-$131.79) million, or 317.33%, when compared to the same quarter last year.

The announcement of the asset-based credit line offers a valuable safety net for the Tesla as the company continues to invest in new endeavors. Such investments include factory expansion in California, the Gigafactory in Nevada, Powerwall, and cell manufacturing. This liquidity cushion will help protect against any missteps or inefficiencies.

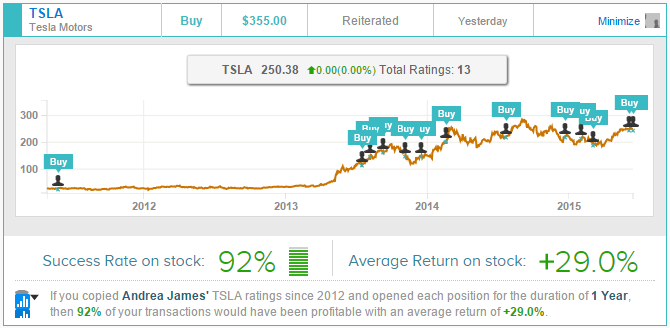

Andrea James, an analyst at Dougherty, rated Tesla a Buy with a price target of $355 on June 15. James sees the credit line “as a positive development given some street concerns about Tesla’s use of cash this year as it invests in factory expansions in California and the Gigafactory battery pack and cell manufacturing plant in Nevada.”

Andrea James currently has a total average return of 9% with an overall success rate of 63% recommending stocks. She has rated Tesla 13 times since May 2011, earning a 92% success rate recommending the stock and a +29% average return per TSLA recommendation.

Click on picture to enlarge

Tesla’s consensus target price stands at 274.38, marking a 9.5% potential upside from where the stock is currently trading.

On average, the top analyst consensus for Tesla on TipRanks is Moderate Buy.

Disclosure: To see more visit more

Great news!