Tech Sector Strength Drives S&P 500, Nasdaq To More Records

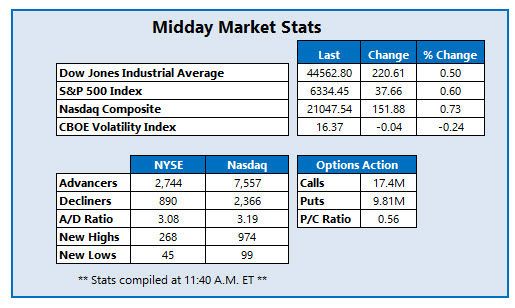

The Dow Jones Industrial Average (DJI) was last seen up triple digits, while the S&P 500 Index (SPX) and Nasdaq Composite (IXIC) nabbed more record highs as the tech sector continued to strengthen. Wall Street is eyeing trade updates, after Commerce Secretary Howard Lutnick reiterated the Aug. 1 tariff deadline over the weekend, but noted the U.S would remain open to negotiations after the date.

Navitas Semiconductor Corp (Nasdaq: NVTS) stock is getting blasted in the options pits, with 161,000 calls and 29,000 puts exchanged so far today, or 13 times the volumetypically seen at this point. Most popular is the August 10 call, where positions are being bought to open. NVTS is up 33.2% to trade at $9.04, and earlier marked a nearly two-week high of $9.48. The shares are extending a bouncing off the $6 region, with support at the 40-day moving average also guiding them higher. In the last three months, NVTS added a whopping 401%.

Chocolate maker Hershey Co (NYSE: HSY) stock is near the top of the SPX today, last seen up 4.5% to trade at $179.04, as it paces for its seventh gain over the last eight sessions. The equity is also trading at its highest level since March as is tests resistance at $180 level, which has kept a tight lid on price on price action over the last few months. HSY now sports a 5.1% year-to-date lead.

EQT Corp (NYSE: EQT) stock is at the bottom of the SPX today, down 6.6% to trade at $55.30 at last check as natural gas futures slide. This pullback precedes the company's second-quarter earnings report, which is due out after tomorrow's close. Despite today's drop, shares still sport a 53.3% year-over-year lead, with familiar support at $54 ready to contain additional losses.

More By This Author:

Nasdaq, S&P 500 Buck Records As Indexes See Weekly DropsDow, Nasdaq Set To Snap Weekly Win Streaks On Tariff Fatigue

Stocks Steady As S&P 500, Nasdaq Log Record Closes