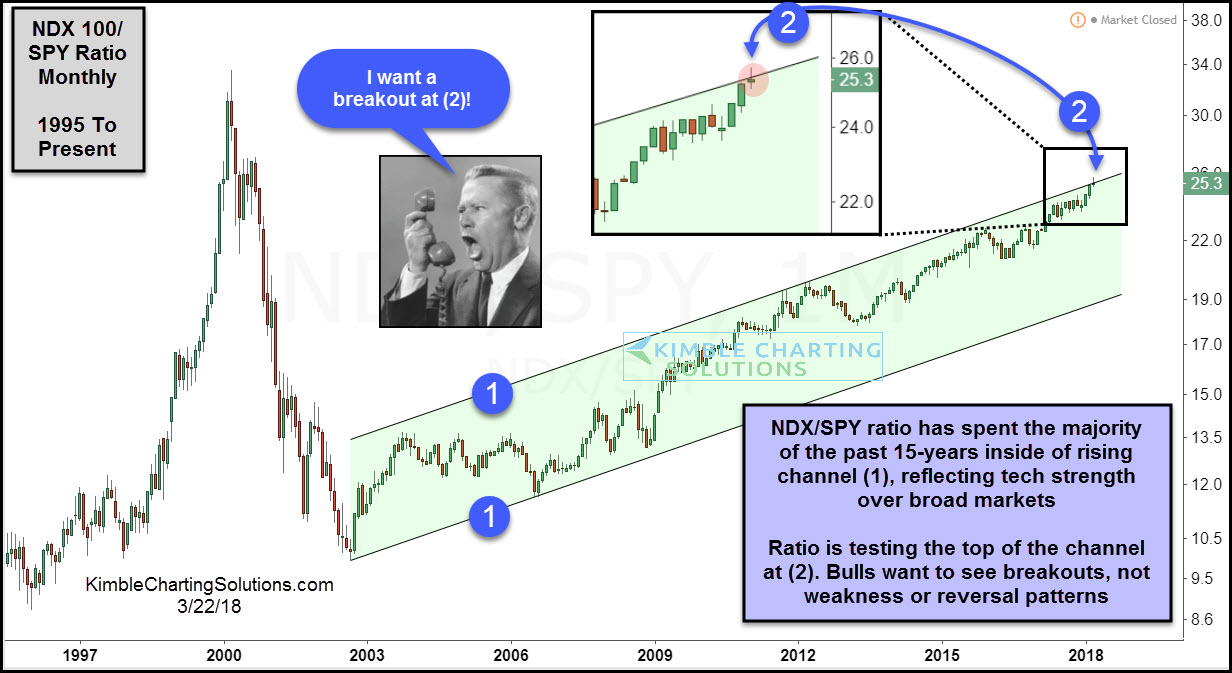

Tech Bulls Beware, You Don’t Want Selling Here

(Click on image to enlarge)

Tech stocks have been on a roll for the past 15-years (long-term bull trend) and nothing of late has changed that! Above looks at the Nasdaq 100/SPY ratio on a monthly basis over the past couple of decades.

Over the past 15-years, the ratio has spent the majority of the time inside of rising channel (1), highlighting that tech has been in a leadership role for years and years. The ratio is now testing the top of this rising channel at (2) this month.

The ratio is now at a price point where it is important to see a breakout. Tech bulls would get a caution message if weakness or a reversal pattern takes place at (2).

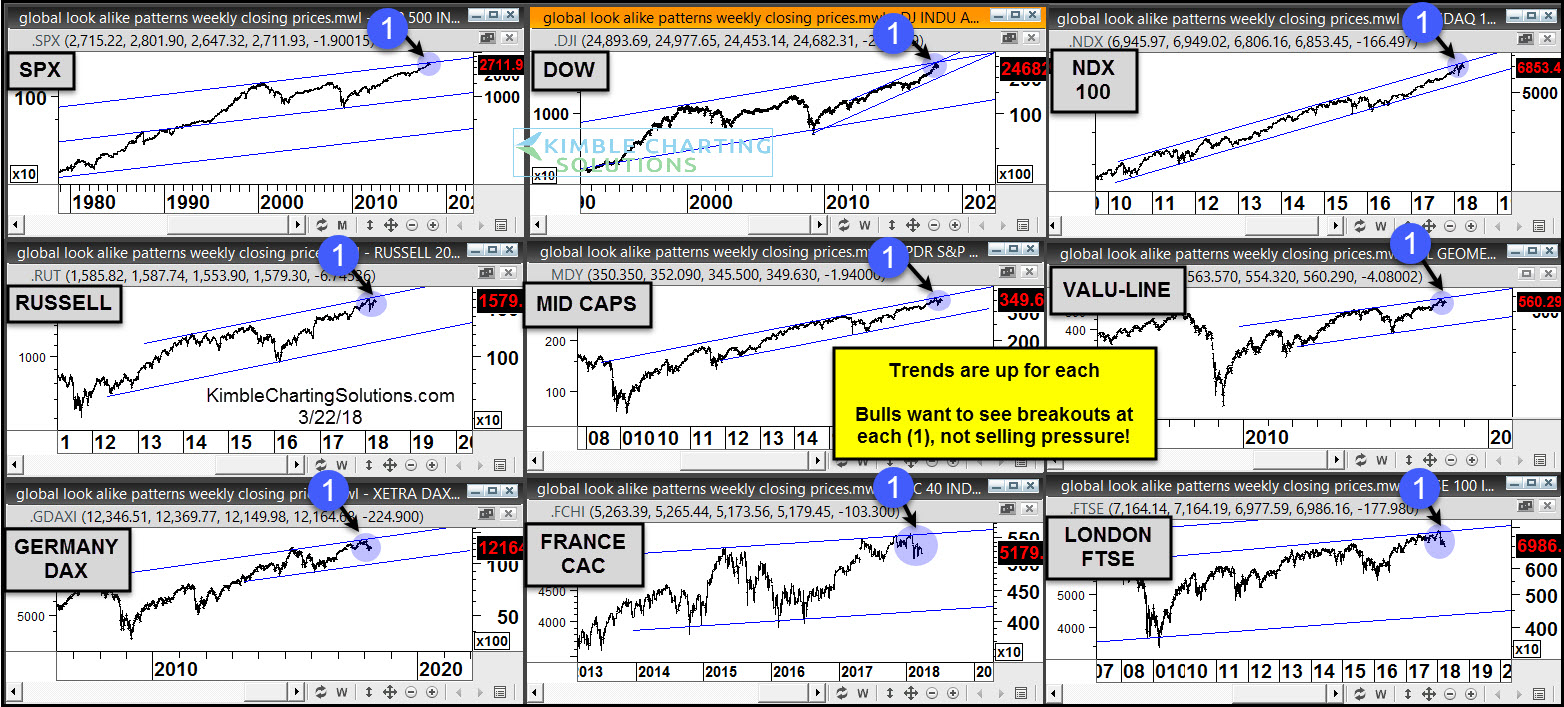

Below looks at key stock indices around the world:

(Click on image to enlarge)

Each of these indices is in solid long-term bull trends and nothing of late has changed that! Each is testing breakouts at each (1).

Similar to the NDX/SPY chart above, these indices want to see breakouts, not selling pressure getting started at each (1)!

Sign up for Chris's Kimble Charting Solutions' email alerts--click here.

Too late. Wall street hates big tech right now, and things look bad. Analysts re iterate price targets today.

Also, please let me win the Amazon Echo Show contest!