Syndax Pharmaceuticals IPO: Supported By A Strong Syndicate

Syndax Pharmaceuticals Inc. (Pending:SNDX) expects to raise net proceeds of $58.6 million in its upcoming IPO. Based in Waltham, Massachusetts, SNDX is a late-stage biopharmaceutical company that is developing therapeutics for cancer.

SNDX will offer 4.4 million shares at an expected price range of $14 to $16.

SNDX filed for the IPO on January 4, 2016.

Lead Underwriters: Citigroup Global Markets and Morgan Stanley

Underwriters: JMP Securities and Oppenheimer & Co.

Business Summary: Biopharmaceutical Company Developing Treatments for Cancer

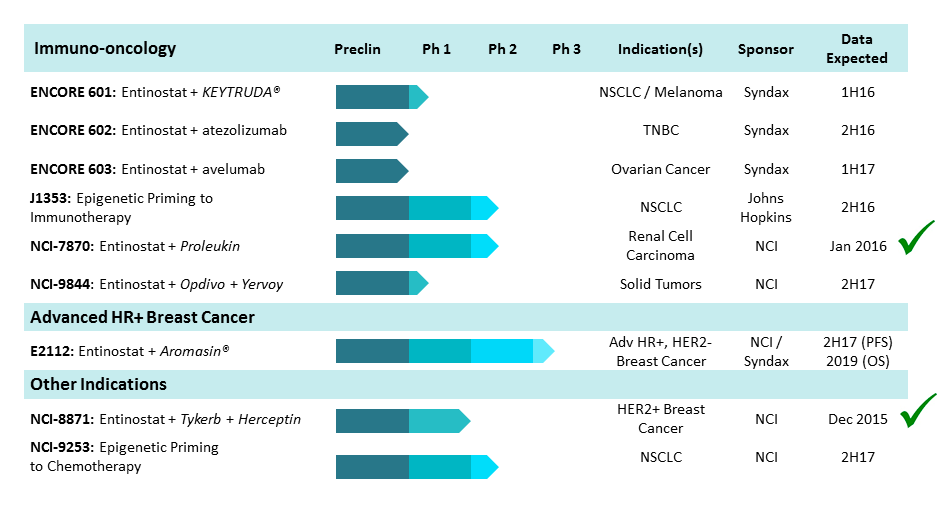

Syndax Pharmaceuticals is a late-stage biopharmaceutical company that is developing therapeutics to treat cancer. Its lead product candidate is entinostat, which is an epigenetic, oral, small molecule drug for treatment-resistant cancers, including lung cancer, breast cancer, solid tumors and hematological malignancies. As an oral histone deacetylase inhibitor, entinostat targets growth in cancer cells and resistance pathways that constrain the efficacy of other cancer treatments.

(Click on image to enlarge)

(Source)

Syndax Pharmaceuticals is also developing entinostat as a combination treatment for other oncologic indications with an initial concentration on tumors that have demonstrated sensitivity to immunotherapy, including melanoma, lung cancer, ovarian cancer and triple negative breast cancer.

Entinostat directly affects immune regulatory cells and cancer cells, which has the potential to improve the body's immune response to tumors. The treatment has a favorable safety profile that has been demonstrated in clinical trials on over 900 patients.

Syndax Pharmaceuticals is currently evaluating entinostat in combination with Keytruda in a Phase 1b/2 clinical trials for lung cancer and melanoma, and they intend to begin Phase 1b/2 clinical trial for entinostat in combination with atexolizumab for triple negative breast cancer. SNDX will also begin similar trials for the drug in combination with avelumab for ovarian cancer.

The company has entered into a collaborative research and development agreement with the National Cancer Institute and Genentech. In addition, they have entered into collaboration with Ares Trading, a subsidiary of Merck, and Pfizer to evaluate the safety, tolerability and efficacy of entinostat used in combination with an investigational monoclonal antibody to treat ovarian cancer.

Executive Management Highlights

CEO and Director Dr. Briggs Morrison, M.D. also serves as Managing Director at MPM Capital. He has been CEO of Syndax since June 2015. He has held positions at AstraZeneca, Pfizer, and Merck Research Laboratories.Dr. Morrison received a B.S. in Biology from Georgetown University and holds an M.D. from the University of Connecticut School of Medicine. He completed his internship and residency in Internal Medicine at the Massachusetts General Hospital, a fellowship in Medical Oncology at the Dana-Farber Cancer Institute and a post-doctoral research fellowship in Genetics at Harvard Medical School.

President and COO Michael Metzger has served in his positions since May 2015. He has held previous positions at Regado Biosciences, Mersana Therapeutics, Radius Health, and Forest Laboratories. Mr. Metzger holds an MBA in Finance from New York University Stern School of Business and a BA degree in Political Science from The George Washington University.

Potential Competition: Pfizer, Eli Lilly and Novartis

Syndax Pharmaceuticals expects to face competition if its drug candidate, entinostat, is approved for use in comination with Aromasin for the treatment of advanced breast cancer. Competition would come from Ibrance developed by Pfizer (NYSE:PFE), Afinitor developed by Novartis (NYSE:NVS), and abemaciclib developed by Eli Lilly (NYSE:LLY). Other companies developing treatments for cancer include Roche, Amgen (NASDAQ:AMGN), Celgene (NASDAQ:CELG), Johnson & Johnson (NYSE:JNJ), and Bristol Myer Squibb.

Financial Overview: Early Stage Losses Noted

Syndax Pharmaceuticals provided the following figures from its financial documents for the year ended December 31:

|

2015 |

2014 |

|

|

Revenue (License Fees) |

$627,000 |

N/A |

|

Net Income |

($24,119,000) |

($19,828,000) |

As of December 31, 2015:

|

Assets |

$89,903,000 |

|

Total Liabilities |

$23,205,000 |

|

Stockholders' Equity |

($252,415,000) |

Conclusion: Consider Buying In

Healthcare deals EDIT and BGNE performed well in February (albeit supported by heavy insider buying).

The US market is beginning to show signs of a turnaround from a terrible start in 2016; we are cautiously optimistic on this cancer-focused firm with a strong syndicate.

Additional risks include having just one strong product candidate and reliance on a clinically untested process.

We suggest investors consider buying into SNDX.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. more