SVMK Could Swing Lower When Lockup Period Expires

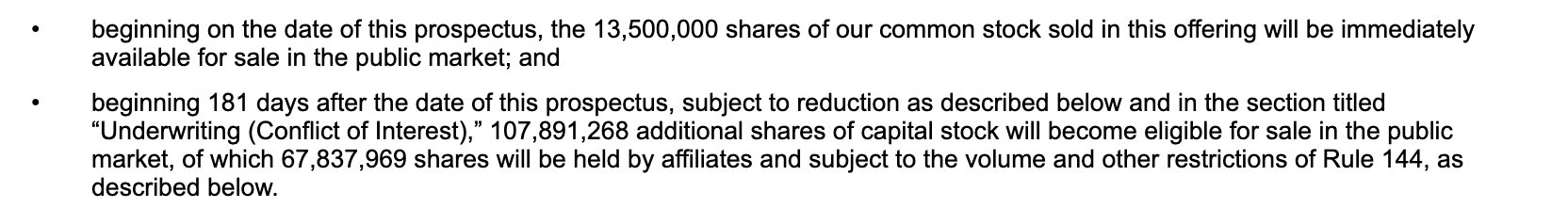

March 25, 2019, concludes the 180-day lockup period of SVMK Inc.

When the lockup period ends for SVMK Inc. (SVMK), its pre-IPO shareholders will have the opportunity to sell more than 100 million shares currently subject to lockup restrictions. This will be a huge increase over the 15 million shares offered in the IPO.

(Click on image to enlarge)

The potential for a large, sudden increase in stock traded on the secondary market could negatively impact the share price of SVMK in the short term when the lockup expires.

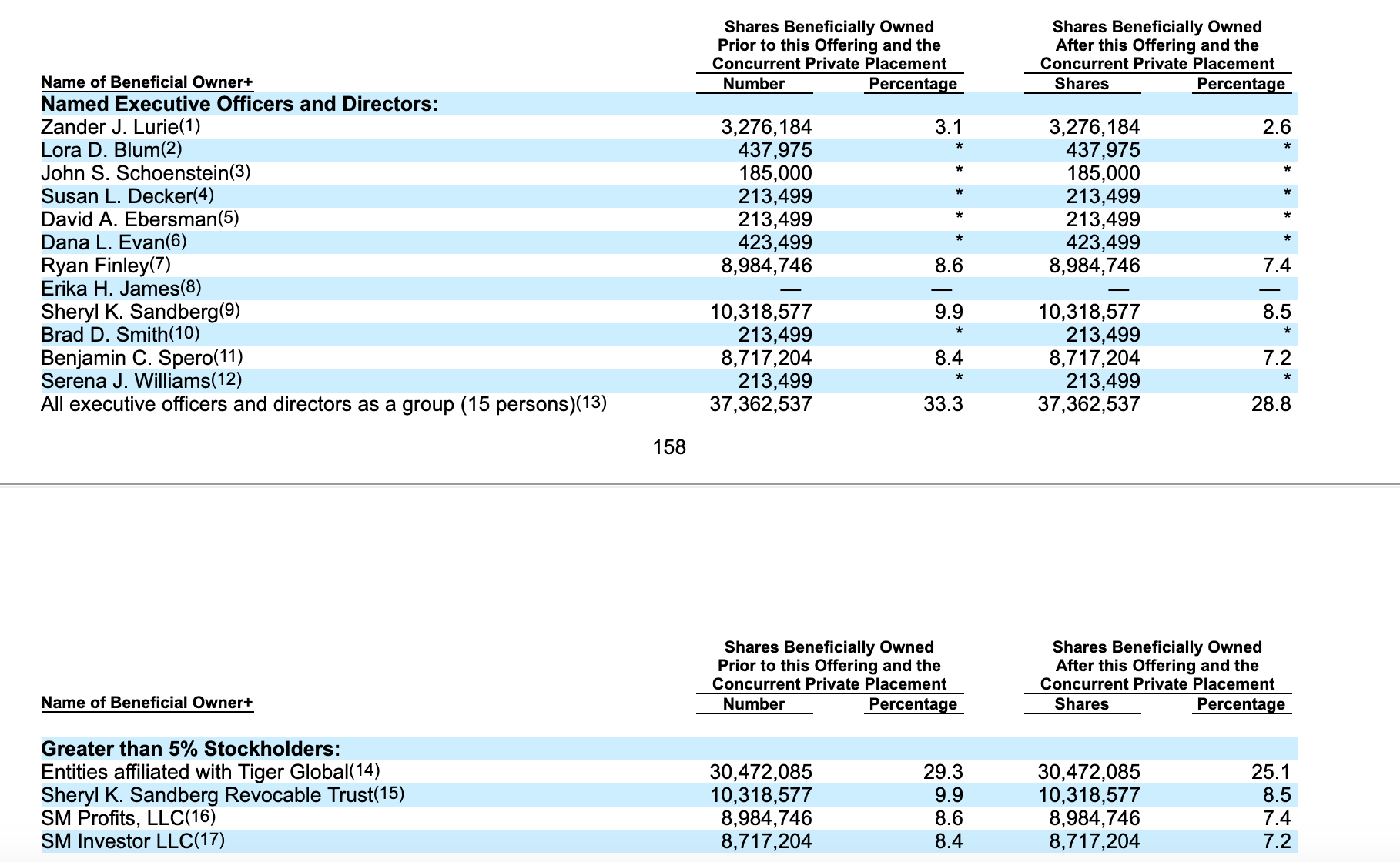

This group of pre-IPO shareholders and company insiders includes eleven individuals and four corporate entities.

(Click on image to enlarge)

SVMK had a first-day return of 43.7%, and shares have a return of 28.8% from IPO.

Business Overview: Provider of Survey Software aka SurveyMonkey

SVMK creates and markets survey software and other solutions that enable companies to engage with their employees, customers, and markets they serve around the world. Its cloud-based SaaS platform allows organizations and individuals to create and disseminate surveys. Currently, users respond to around 20 million questions daily in approximately 190 countries. The company's product portfolio includes SurveyMonkey CX, which is a net promoter solution that takes survey scores and interprets them into actionable insights; SurveyMonkey Engage, which is an employee-targeted solution; and TechValidate, which is a market content automation product.

(Click on image to enlarge)

(Source: SurveyMonkey.com)

SVMK also offers SurveyMonkey Audience. This solution helps organizations capture real-time actionable data from specific participants. SurveyMonkey Apply is a solution used primarily by educational organizations and non-profits to allocate grants and scholarships, and Wufoo is a form builder that enables users to quickly design Web and mobile forms, receive online payments, and collect file uploads.

The company's user base includes users in 98% of the Fortune 500. Of those, 71 have organization-level agreements with SVMK. Through June 2018, 12% of its revenue came from clients with organization-level agreements. In addition, SVMK estimates that 80% of its clients use their survey solutions for business purposes, including multinational corporations, SMEs, government agencies, educational institutions, and non-profits.

SVMK Inc. was formerly called SurveyMonkey Inc. It was founded in 1999, has approximately 770 employees, and keeps its headquarters in San Mateo, California.

SurveyMonkey company information sourced from the firm's S-1/A and website.

Financial Highlights

SVMK Inc. reported the following financial highlights for the fourth quarter ending December 31, 2018:

- Revenue reached $67.9 million, for an increase of 19% year over year.

- Users totaled 646,727 versus 606,077 in the same period for 2017.

- Average revenue per user was $425 versus $375 in the fourth quarter of 2017.

- GAAP operating margin was (29%) and non-GAAP operating margin was 2%.

- GAAP net loss was ($25.2) million and Adjusted EBITDA was $12.6 million.

- GAAP basic and diluted net loss per share was ($0.20). Non-GAAP basic and diluted net loss per share was ($0.03).

- Cash and cash equivalents were $153.8 million, and total debt totaled $217.4 million for net debt of $63.6 million.

Financial information sourced from the company's website.

Management Team

CEO Alexander Lurie has served in his position since January 2016. He is also Chair of the Board of Directors. His previous experience includes positions at GoPro, Guggenheim Digital Media, CBS, CNET Networks, and J.P. Morgan. He holds a J.D. and M.B.A. from Emory University.

SVP Lora Blum has served as General Counsel and Secretary since 2017. She brings with her 6 years of experience at LinkedIn and positions at Jones Day. Ms. Blum holds a J.D. from UCLA.

Management information sourced from the company's website.

Competition: Google (Nasdaq: GOOG) (Nasdaq: GOOGL), Medallia, and Qualtrics

Most of SVMK's competition comes from other online survey platforms, although the company notes that pen-and-paper surveys, email surveys, and phone surveys still have a place in the market. The top online survey platforms are Qualtrics, SoGoSurvey, SnapSurvey Software, Typeform, AskNicely NPS Software, Key Survey, Hyphen, Nextiva Survey, Survey Sparrow, and Glint.

Early Market Performance

The underwriters priced the IPO at $12 per share, above its expected price range of $9 to $11. The stock closed its first day at $17.24 for an increase of 43.7%. The stock reached a low of $10.30 on October 30. Share prices recovered to reach $14.54 on November 22. Currently, the stock trades around $15.50, a 28.8% return from IPO.

Conclusion: Short Shares of SurveyMonkey ahead of March 25th Lockup Expiration

When the SVMK IPO lockup expires on March 25th, pre-IPO shareholders and company insiders will be able to sell large blocks of currently-restricted stock for the first time. With more than 100 million shares of SVMK subject to lockup restrictions - and just 13.5 million shares trading subject to the IPO - there is a potential for the secondary market to get flooded when the lockup expires. This influx of shares could cause a sharp, short-term downturn in share price.

Aggressive, risk-tolerant investors should consider shorting shares of SVMK ahead of the March 25th lockup expiration. Interested investors should cover shares of SVMK either late in the trading day on March 25th or over the course of the trading day on March 26th.

Disclosure: Disclosure: I am/we are short SVMK

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business ...

more