Survey Of Salient Risks To Financial Stability

Image Source: Pexels

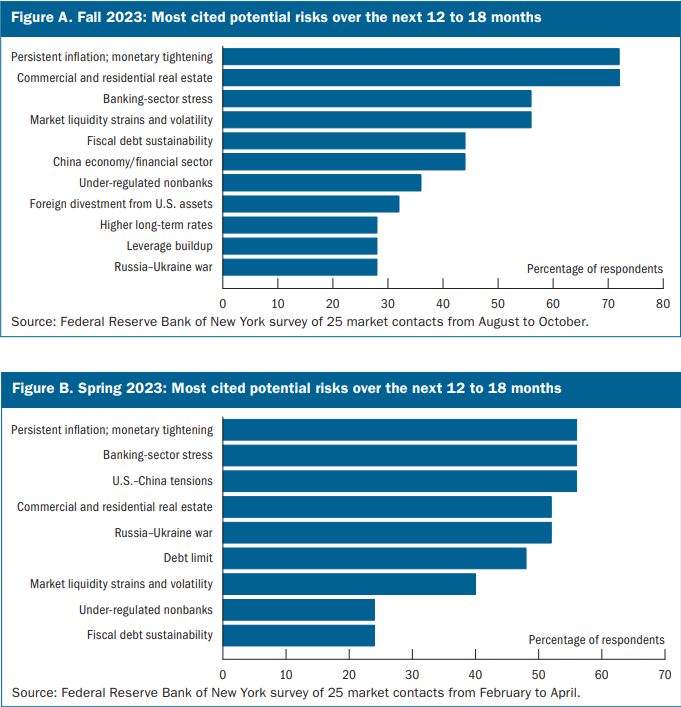

Here is a brief summary of what is of concern to domestic and international policymakers, academics, community groups, and others. We might call these “known risks.”

Persistent inflation and monetary tightening

- Persistent or reaccelerating inflationary pressures

- Resilient economic outlook leading to further monetary policy tightening

- Volatile market conditions

- Entrenched expectations of higher inflation leading to higher realized inflation leading to even more restrictive monetary policy

- Induces and even exacerbates recession

Commercial real estate

- Potential trigger for systemic stress

- Higher interest rates

- Declining property prices

- Structural shifts in demand for office space may prompt large realized losses

- Small and regional domestic bank vulnerability

- Tighter bank lending conditions

Reemergence of banking-sector stress

- Renewed deposit outflows

- Uninsured deposits

- Losses on CRE exposures

- Market liquidity strains and volatility

- Vulnerabilities among highly levered NBFIs

Weakness in the Chinese economy and financial sector

- Capital flight

- Stronger U.S. dollar

- Downward pressure on Chinese assets and other Asian markets

- Alongside weakness in Europe, increased likelihood of a global recession

- Increased foreign exchange market volatility

- Implementation of capital controls

Fiscal debt sustainability

- Treasury market volatility

- Treasury market liquidity strain

- Higher long-term interest rates and bond term premia

- Increases in sovereign bond issuance

More By This Author:

Fed Financial Stability Report – October 2023 – SummaryMacro: Initial Unemployment Claims

Macro: Housing Starts

Disclaimer: This information is presented for informational purposes only and does not constitute an offer to sell, or the solicitation of an offer to buy any investment products. None of the ...

moreComments

Please wait...

Comment posted successfully

No Thumbs up yet!